Eris Lifesciences Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-04-02 08:09:03Eris Lifesciences, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1382.55, having seen fluctuations with a previous close of 1411.10. Over the past year, Eris Lifesciences has demonstrated a notable performance, with a return of 62.64%, significantly outpacing the Sensex's return of 2.72% during the same period. In terms of technical indicators, the company's weekly MACD remains bullish, while the monthly MACD also reflects a bullish stance. The Bollinger Bands indicate a mildly bullish trend on both weekly and monthly charts. However, the KST presents a mixed picture, showing bearish weekly signals against a bullish monthly outlook. The stock's moving averages are bullish on a daily basis, suggesting a generally positive sentiment in the short term. Eris Lifesciences has shown re...

Read MoreEris Lifesciences Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-28 08:03:42Eris Lifesciences, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1374.40, showing a notable increase from the previous close of 1316.70. Over the past year, Eris Lifesciences has demonstrated impressive performance, with a return of 63.41%, significantly outpacing the Sensex's 6.32% during the same period. The company's technical indicators present a mixed picture. The MACD shows a mildly bearish trend on a weekly basis while indicating bullish momentum on a monthly scale. The Bollinger Bands suggest a bullish stance monthly, while the daily moving averages also reflect a bullish trend. However, the KST indicates bearishness weekly, contrasting with its monthly bullish outlook. In terms of stock performance, Eris Lifesciences has shown resilience, particularly over longer time ...

Read More

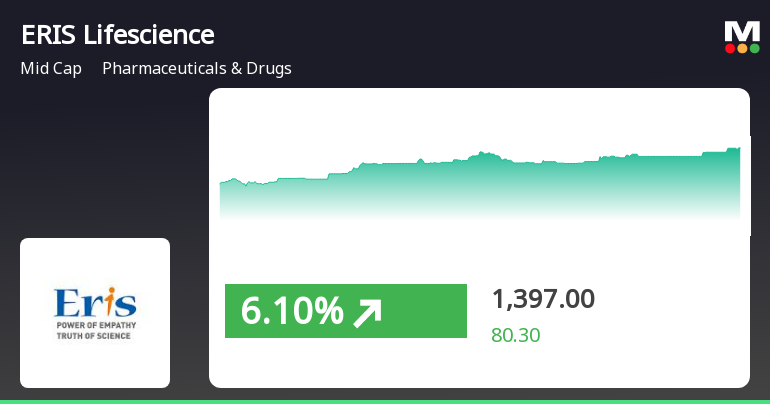

ERIS Lifesciences Shows Strong Rebound Amid Broader Market Recovery Trends

2025-03-27 14:50:25ERIS Lifesciences has experienced a notable rebound after three days of decline, gaining 5.21% on March 27, 2025. The stock reached an intraday high of Rs 1392.15 and is currently trading above all major moving averages, reflecting strong upward momentum amid a broader market recovery.

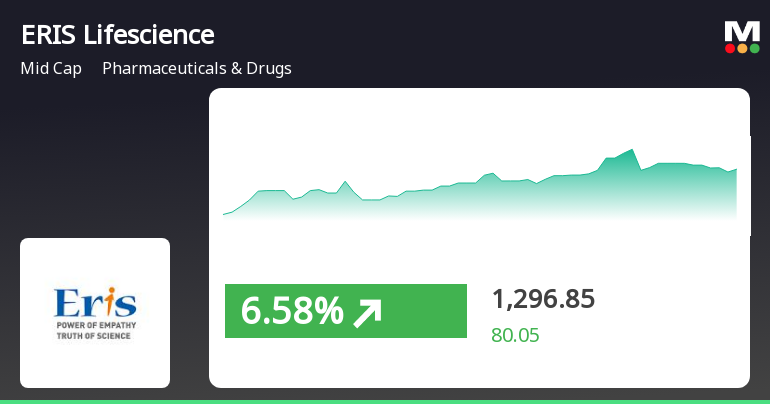

Read MoreEris Lifesciences Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-27 08:03:35Eris Lifesciences, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1316.70, having closed at 1344.90 previously. Over the past year, Eris Lifesciences has shown a notable return of 56.37%, significantly outperforming the Sensex, which returned 6.65% in the same period. In terms of technical indicators, the company displays a mixed picture. The MACD shows a mildly bearish trend on a weekly basis, while the monthly outlook remains bullish. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly periods, suggesting a neutral momentum. Bollinger Bands reflect a bearish stance weekly but are bullish monthly, indicating volatility in the short term. Daily moving averages are bullish, while the KST shows a bearish trend weekly and bullish monthly. Eris Lifescien...

Read More

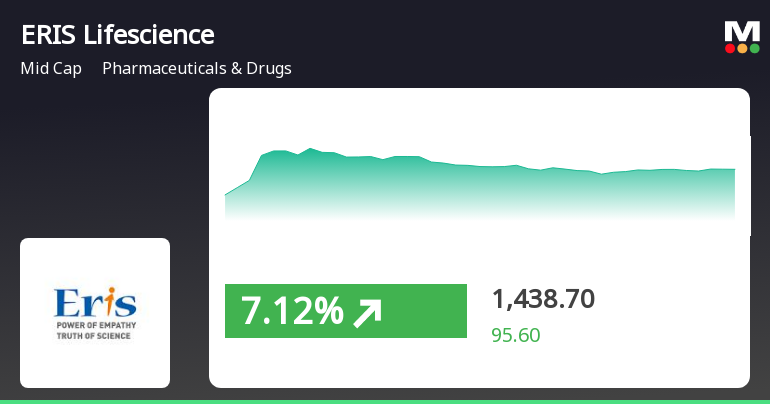

ERIS Lifesciences Shows Strong Performance Amid Positive Market Trends in Pharmaceuticals Sector

2025-03-20 09:35:26ERIS Lifesciences has experienced notable stock performance, gaining 9.05% on March 20, 2025, and outperforming its sector. The stock has shown consistent gains over four days, with a total return of 17.36%. It is trading above key moving averages, reflecting a strong upward trend.

Read MoreEris Lifesciences Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-20 08:03:34Eris Lifesciences, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,343.10, showing a notable increase from the previous close of 1,289.50. Over the past week, the stock reached a high of 1,379.35 and a low of 1,284.55, indicating some volatility. In terms of technical indicators, the stock displays a mixed picture. The Moving Averages signal a bullish trend on a daily basis, while the MACD shows a mildly bearish stance weekly but bullish monthly. Bollinger Bands are consistently bullish on both weekly and monthly charts, suggesting a positive momentum. However, the KST indicates a bearish trend weekly, contrasting with its bullish monthly outlook. Eris Lifesciences has demonstrated strong performance compared to the Sensex over various periods. In the past year, the stock has ret...

Read More

ERIS Lifesciences Shows Strong Performance Amid Broader Market Volatility

2025-03-06 09:50:24ERIS Lifesciences has demonstrated notable performance in the Pharmaceuticals & Drugs sector, achieving consecutive gains over three days and outperforming its sector. The stock opened higher and reached an intraday peak, while the broader market showed mixed signals, with small-cap stocks leading despite a decline in the Sensex.

Read MoreEris Lifesciences Adjusts Valuation Amid Strong Long-Term Performance and Competitive Positioning

2025-03-01 08:00:11Eris Lifesciences, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 1180.05, reflecting a notable shift from its previous close of 1204.15. Over the past year, Eris Lifesciences has demonstrated a return of 35%, significantly outperforming the Sensex, which recorded a mere 1.24% during the same period. Key financial metrics for Eris Lifesciences include a PE ratio of 48.77 and an EV to EBITDA ratio of 20.32. The company's return on capital employed (ROCE) is reported at 11.06%, while its return on equity (ROE) stands at 12.57%. In comparison to its peers, Eris Lifesciences presents a more favorable valuation profile, particularly when contrasted with companies like Emcure Pharma and Pfizer, which are positioned at higher valuation levels. Despite recent fluctuations in stock price, Eris Lifesciences has shown resili...

Read More

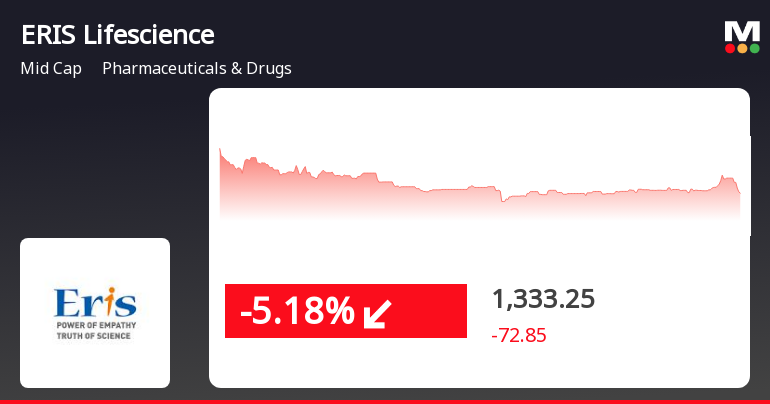

ERIS Lifesciences Faces Significant Stock Decline Amid Broader Market Volatility

2025-02-11 12:35:26ERIS Lifesciences, a midcap pharmaceutical company, has seen its stock decline significantly today, underperforming against its sector. Despite recent losses, the stock has shown some resilience over the past month. Its current positioning relative to various moving averages indicates volatility amid broader market trends.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Corporate Guarantee

31-Mar-2025 | Source : BSECorporate Guarantee

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

ERIS Lifesciences Ltd has declared 735% dividend, ex-date: 13 Feb 25

No Splits history available

No Bonus history available

No Rights history available