ESAF Small Finance Bank Faces Technical Challenges Amid Market Volatility

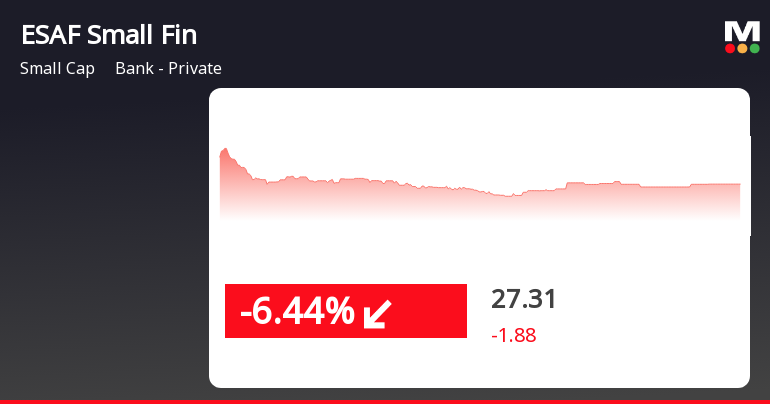

2025-04-02 08:10:32ESAF Small Finance Bank, a player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 26.03, showing a notable increase from the previous close of 24.58. Over the past year, the stock has experienced significant volatility, with a 52-week high of 64.45 and a low of 24.35. In terms of technical indicators, the weekly MACD remains bearish, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, while the Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Other indicators, such as KST and Dow Theory, also suggest a lack of definitive trends. When comparing the performance of ESAF Small Finance Bank to the Sensex, the stock has faced challenges. Over the past week, it recorded a return of -2...

Read More

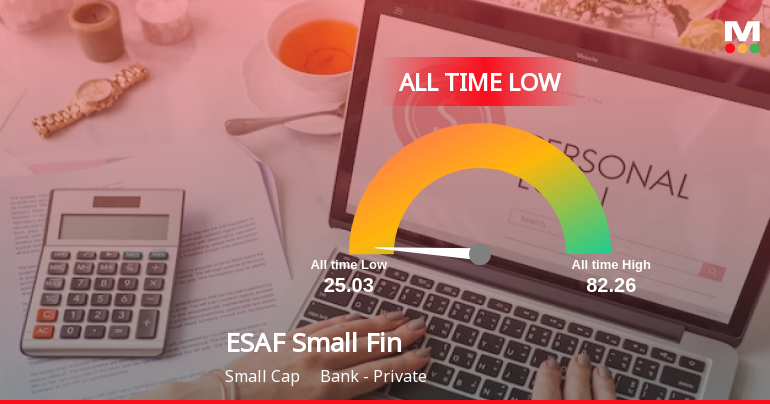

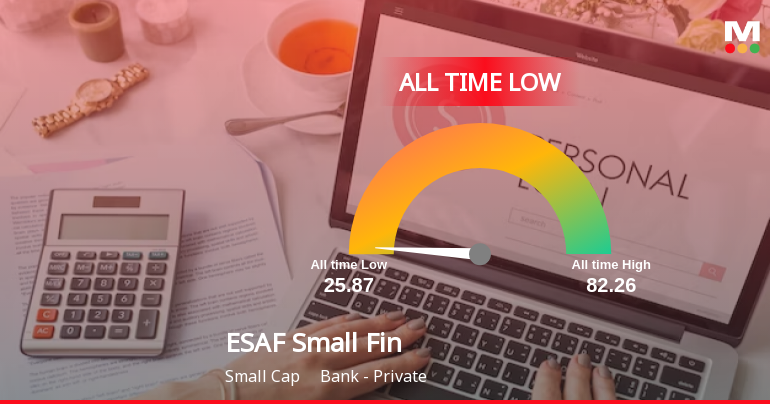

ESAF Small Finance Bank Hits All-Time Low Amidst Financial Struggles and Declining Investor Confidence

2025-03-27 09:34:39ESAF Small Finance Bank has faced notable volatility, hitting an all-time low and underperforming its sector. Key financial metrics reveal a concerning capital adequacy ratio of 0% and a high cost-to-income ratio. The bank has reported negative earnings and a significant decline in institutional investor stakes over the past quarter.

Read More

ESAF Small Finance Bank Faces Severe Challenges Amidst Declining Performance Metrics

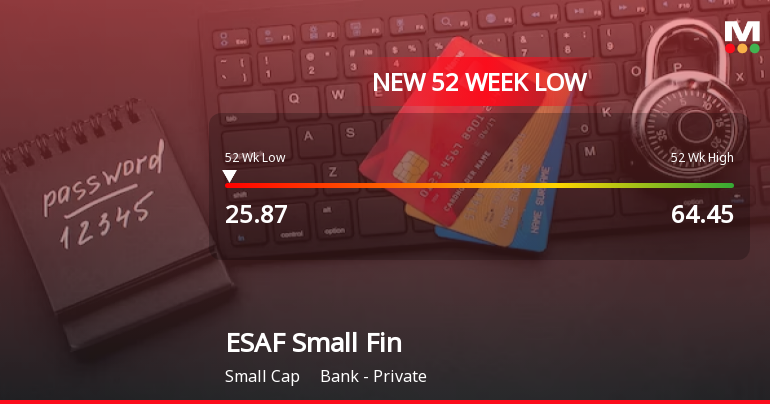

2025-03-26 11:37:39ESAF Small Finance Bank has hit a new 52-week low, continuing a downward trend with significant losses over the past three days and the last year. Key financial metrics indicate challenges, including a 0% Capital Adequacy Ratio and a high Cost to Income ratio, alongside declining institutional investor participation.

Read More

ESAF Small Finance Bank Stock Hits All-Time Low Amid Financial Concerns

2025-03-26 11:32:21ESAF Small Finance Bank's stock has faced significant volatility, recently reaching an all-time low and trading near its 52-week low. Financial metrics reveal concerns, including a 0% capital adequacy ratio and a high cost-to-income ratio. The latest quarterly results show a drastic decline in earnings and reduced institutional investor stakes.

Read MoreESAF Small Finance Bank Adjusts Valuation Amidst Profitability Challenges and Asset Quality Concerns

2025-03-24 08:01:16ESAF Small Finance Bank has recently undergone a valuation adjustment, reflecting its current financial standing within the private banking sector. The bank's price-to-earnings ratio stands at -6.17, indicating challenges in profitability. Additionally, its price-to-book value is recorded at 0.63, suggesting a potential undervaluation relative to its assets. The bank's dividend yield is at 2.47%, which may appeal to income-focused investors, although its return on equity (ROE) is notably negative at -10.15%. The return on assets (ROA) also reflects a negative trend at -0.97%. Furthermore, the net non-performing assets (NPA) to book value ratio is high at 22.31%, indicating significant asset quality concerns. In comparison to its peers, ESAF Small Finance Bank's valuation metrics reveal a more challenging position. While some competitors exhibit attractive valuations and stronger performance indicators, ES...

Read More

ESAF Small Finance Bank Hits All-Time Low Amid Financial Health Concerns

2025-03-18 09:33:11ESAF Small Finance Bank has faced significant stock volatility, hitting an all-time low and experiencing a substantial decline over the past year. Concerns about its financial health are evident, with a capital adequacy ratio of 0% and a high cost-to-income ratio. Recent quarterly results have also shown a dramatic drop in earnings.

Read More

ESAF Small Finance Bank Faces Financial Challenges Amid Declining Performance Metrics

2025-03-05 12:36:05ESAF Small Finance Bank has reached a new 52-week low, despite recent gains. The bank's financial health is concerning, with a 0% Capital Adequacy Ratio and a high Cost to Income ratio of 69.81%. Additionally, earnings per share have plummeted significantly over the past year, indicating ongoing challenges.

Read More

ESAF Small Finance Bank Faces Significant Decline Amidst Market Challenges

2025-03-03 11:35:33ESAF Small Finance Bank's stock has reached a new 52-week low, reflecting ongoing challenges in the market. Over the past month, it has declined significantly compared to the broader market. The stock is currently trading below key moving averages, indicating persistent struggles within the private banking sector.

Read More

ESAF Small Finance Bank Hits 52-Week Low Amid Sustained Decline and Sector Underperformance

2025-03-03 09:38:00ESAF Small Finance Bank has reached a new 52-week low, reflecting a significant decline and underperformance compared to its sector. The stock has consistently fallen over the past week and has experienced a substantial drop over the past year, indicating ongoing challenges in a competitive market environment.

Read MoreCompliances-Reg. 57 (1) - Certificate of interest payment/Principal in case of NCD

04-Apr-2025 | Source : BSECertificate of Interest payment under Regulation 57 of SEBI (LODR) Regulations 2015

Compliances-Half Yearly Report (SEBI Circular No. CIR/IMD/DF-1/67/2017)

03-Apr-2025 | Source : BSEHalf Yearly Report On Listed Privately Placed NCDs as on March 31 2025.

Key Business Updates For The Year Ended March 31 2025.

02-Apr-2025 | Source : BSEKey Business Updates for the year ended March 31 2025.

Corporate Actions

No Upcoming Board Meetings

ESAF Small Finance Bank Ltd has declared 7% dividend, ex-date: 07 Aug 24

No Splits history available

No Bonus history available

No Rights history available