Ester Industries Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-21 08:02:34Ester Industries, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 133.40, showing a notable increase from the previous close of 127.20. Over the past year, Ester Industries has demonstrated a strong performance with a return of 52.11%, significantly outpacing the Sensex, which returned 5.89% in the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly metrics show a bullish trend. The Bollinger Bands indicate a mildly bearish stance on a weekly basis, contrasting with a bullish outlook on a monthly scale. The daily moving averages also reflect bearish sentiment, suggesting a mixed technical landscape. Ester Industries has shown resilience over longer periods, with a remarkable 344.67% return over the past five years compared t...

Read More

Ester Industries Faces Market Sentiment Shift Amid Mixed Financial Performance Indicators

2025-03-21 08:02:04Ester Industries has experienced a recent evaluation adjustment, indicating a shift in market sentiment. Despite a strong annual return, the company faces challenges such as declining operating profits and a high Debt to EBITDA ratio, raising concerns about its long-term financial health and profitability.

Read MoreEster Industries Navigates Market Challenges Amidst Strong Long-Term Growth Potential

2025-03-20 18:00:40Ester Industries Ltd., a small-cap player in the plastic products industry, has shown significant activity in the market today, with a notable increase of 4.87%. This performance stands in contrast to the Sensex, which rose by 1.19%. Over the past year, Ester Industries has outperformed the Sensex, delivering a remarkable return of 52.11% compared to the index's 5.89%. Despite its strong yearly performance, the stock has faced challenges in the short term, with a decline of 9.37% over the past month and a year-to-date drop of 12.47%. However, the company has demonstrated resilience over a longer horizon, boasting a five-year growth of 344.67%, significantly surpassing the Sensex's 155.21% increase during the same period. Ester Industries currently holds a market capitalization of Rs 1,239.00 crore, with a price-to-earnings ratio of -104.72, contrasting sharply with the industry average of 39.60. Technical...

Read More

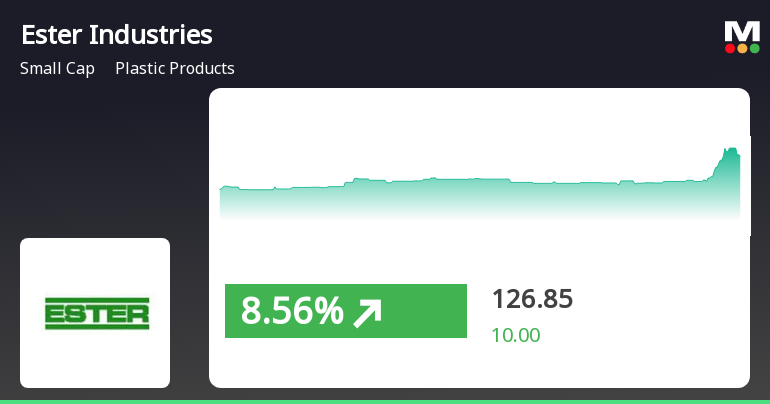

Ester Industries Outperforms Sector Amid Broader Market Gains and Resilience Trends

2025-03-18 15:15:57Ester Industries experienced significant trading activity, gaining 10.31% on March 18, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, reaching an intraday high of Rs 125.75. The broader market also saw positive movement, with the Sensex rising sharply.

Read More

Ester Industries Reports Significant Profit Growth Amid Long-Term Financial Concerns

2025-03-18 08:13:38Ester Industries has recently adjusted its evaluation based on impressive financial performance, reporting a significant net profit growth of 721.85% for the quarter ending December 2024. Despite strong quarterly results and operational efficiency, the company faces long-term challenges, including declining operating profit growth and high debt levels.

Read MoreEster Industries Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-18 08:03:25Ester Industries, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 116.85, showing a slight increase from the previous close of 115.50. Over the past year, Ester Industries has demonstrated a notable return of 30.63%, significantly outperforming the Sensex, which recorded a return of 2.10% in the same period. In terms of technical indicators, the company presents a mixed picture. The MACD shows a bearish trend on a weekly basis while indicating bullish momentum monthly. The moving averages suggest a mildly bullish stance on a daily basis, contrasting with the weekly Bollinger Bands, which lean mildly bearish. The KST reflects a similar divergence, being bearish weekly but bullish monthly. Ester Industries has experienced varied performance over different time frames. While the stock h...

Read More

Ester Industries Reports Significant Profit Growth Amid Long-Term Financial Challenges

2025-03-13 08:05:45Ester Industries has recently adjusted its evaluation following a strong third-quarter performance, with a notable increase in net profit and sales. However, challenges persist, including a declining trend in operating profits and concerns regarding debt servicing, despite a solid stock return over the past year.

Read MoreEster Industries Faces Mixed Technical Signals Amid Market Volatility

2025-03-13 08:02:05Ester Industries, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 117.00, down from a previous close of 121.65, with a notable 52-week high of 177.60 and a low of 84.75. Today's trading saw a high of 124.50 and a low of 114.75, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis while remaining bullish on a monthly scale. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly assessments. Bollinger Bands and KST indicate bearish trends on a weekly basis, while the monthly outlook for KST remains bullish. Moving averages suggest a mildly bullish stance on a daily basis, contrasting with the bearish signals from the weekly Dow Theory and On-Balance Volume (OBV...

Read MoreEster Industries Faces Mixed Technical Signals Amid Market Volatility

2025-03-13 08:02:05Ester Industries, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 117.00, down from a previous close of 121.65, with a notable 52-week high of 177.60 and a low of 84.75. Today's trading saw a high of 124.50 and a low of 114.75, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis while remaining bullish on a monthly scale. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly assessments. Bollinger Bands and KST indicate bearish trends on a weekly basis, while the monthly outlook for KST remains bullish. Moving averages suggest a mildly bullish stance on a daily basis, contrasting with the bearish signals from the weekly Dow Theory and On-Balance Volume (OBV...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEDetails of Dematerialised shares during the month of March 2025

Announcement under Regulation 30 (LODR)-Change in Management

31-Mar-2025 | Source : BSECompletion of tenure of Independent Director

Closure of Trading Window

26-Mar-2025 | Source : BSEIn compliance with the SEBI (Prohibition of Insider Trading) Regulations 2015 the Trading Window for dealing in shares of the Company will be closed from 1st April 2025 till the end of 48 hours after declaration of the financial results for the quarter and year ending on 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Ester Industries Ltd has declared 10% dividend, ex-date: 20 Sep 23

No Splits history available

No Bonus history available

No Rights history available