Eureka Forbes Faces Mixed Technical Trends Amidst Market Evaluation Revision

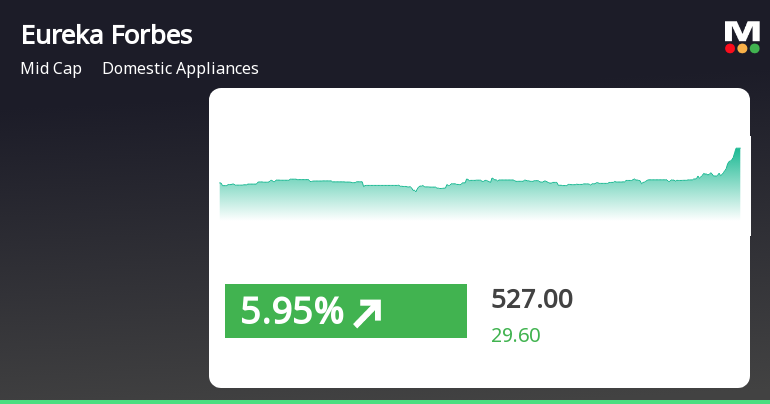

2025-03-26 08:05:03Eureka Forbes, a midcap player in the domestic appliances industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 526.00, showing a slight increase from the previous close of 524.00. Over the past year, the stock has reached a high of 648.40 and a low of 397.15, indicating a notable range of performance. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a bearish trend weekly, contrasting with a bullish stance monthly. Daily moving averages reflect a mildly bearish sentiment, while the On-Balance Volume (OBV) is mildly bearish on a monthly basis. When comparing the stock's performance to the Sensex, Eureka Forbes has shown var...

Read MoreEureka Forbes Faces Technical Trend Shifts Amid Mixed Market Sentiment

2025-03-25 08:06:21Eureka Forbes, a midcap player in the domestic appliances sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 524.00, down from a previous close of 536.30, with a 52-week high of 648.40 and a low of 397.15. Today's trading saw a high of 545.35 and a low of 522.90. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands present a mixed picture, with a bearish outlook on the weekly scale and a bullish stance monthly. The On-Balance Volume (OBV) reflects a mildly bearish trend over the monthly period, suggesting some underlying selling pressure. In terms of performance, Eureka Forbes has shown varied returns compared to the Sensex. Over the past year, the stock has returned 16.52%, significantly outperforming the Sensex's ...

Read More

Eureka Forbes Reports Strong Profit Growth Amid Management Efficiency Concerns

2025-03-19 08:12:30Eureka Forbes has recently adjusted its evaluation, reflecting a nuanced view of its financial standing. The company reported a 75.78% increase in operating profit for Q3 FY24-25 and a 64.98% rise in profit after tax. However, challenges remain in management efficiency and pledged promoter shares.

Read MoreEureka Forbes Faces Mixed Technical Trends Amid Strong Yearly Performance

2025-03-19 08:05:09Eureka Forbes, a midcap player in the domestic appliances industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 532.00, showing a slight increase from the previous close of 519.50. Over the past year, Eureka Forbes has demonstrated a stock return of 18.75%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis and mildly bearish on a monthly basis. The Bollinger Bands present a mildly bearish trend weekly, while monthly indicators suggest a bullish stance. Moving averages also reflect a mildly bearish trend on a daily basis, indicating some short-term challenges. In terms of performance, Eureka Forbes has shown resilience over various time frames, particularly in the one-week and one-month ...

Read MoreEureka Forbes Outperforms Sensex Amid Mixed Technical Indicators and Market Trends

2025-03-18 18:00:45Eureka Forbes, a mid-cap player in the domestic appliances industry, has shown significant activity in the stock market today, with a 2.41% increase in its share price, outperforming the Sensex, which rose by 1.53%. The company's market capitalization stands at Rs 9,854.00 crore, and it currently has a price-to-earnings (P/E) ratio of 69.84, notably higher than the industry average of 44.41. Over the past year, Eureka Forbes has delivered an 18.75% return, significantly surpassing the Sensex's 3.51% performance. In the short term, the stock has also shown resilience, with a 5.66% gain over the past week and a 13.14% increase in the last month, while the Sensex has experienced a decline of 0.88% during the same period. However, the stock's performance over the last three months has been challenging, with a decline of 7.25%, although this is slightly better than the Sensex's drop of 6.09%. Year-to-date, Eur...

Read More

Eureka Forbes Reports Strong Profit Growth Amidst Market Challenges and Valuation Adjustments

2025-03-17 10:37:44Eureka Forbes has recently adjusted its evaluation, reflecting its financial dynamics and market position. The company reported a 75.78% annual growth in operating profit for Q3 FY24-25 and has shown consistent positive results over 11 quarters, despite facing challenges such as low return on equity and pledged promoter shares.

Read MoreEureka Forbes Shows Resilience Amid Mixed Technical Indicators and Market Dynamics

2025-03-17 08:01:36Eureka Forbes, a midcap player in the domestic appliances industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 516.55, showing a notable increase from the previous close of 497.40. Over the past week, the stock has demonstrated a positive return of 3.76%, contrasting with a decline of 0.69% in the Sensex during the same period. In terms of performance metrics, Eureka Forbes has experienced a 1-month return of 0.89%, while the Sensex has seen a more significant drop of 3.03%. Year-to-date, the stock has faced challenges with a return of -10.67%, compared to the Sensex's decline of 5.52%. However, on a yearly basis, Eureka Forbes has outperformed the Sensex with an 18.42% return against the index's 1.47%. The technical summary indicates a mixed outlook, with various indicators reflecting different trends. The MACD shows bearish sig...

Read More

Eureka Forbes Shows Potential Trend Reversal Amid Broader Market Decline

2025-03-13 15:35:27Eureka Forbes experienced a notable increase in stock value today, following two days of decline, suggesting a potential trend reversal. The stock is currently above its short-term moving averages but below longer-term ones. Over the past year, it has significantly outperformed the broader Sensex index.

Read More

Eureka Forbes Reports Strong Profit Growth Amid Management Efficiency Concerns

2025-03-03 19:02:39Eureka Forbes has recently adjusted its evaluation, reflecting its current market position amid strong financial performance in Q3 FY24-25, with a significant increase in operating profit. However, concerns about management efficiency and a high percentage of pledged promoter shares have been noted, alongside consistent positive results over the past 11 quarters.

Read MoreAnnouncement Under Regulation 30 - Update On Pending Litigation

03-Apr-2025 | Source : BSEAnnouncement under Regulation 30 - Update on Pending Litigation

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation for closure of Trading window

Intimation Of Schedule Of Analyst/Institutional Investor Meeting Under Regulation 30 Of SEBI LODR

19-Mar-2025 | Source : BSEPursuant to the above the Company wished to intimate the schedule of the Analyst/Institutional Investor Meet

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available