Eveready Industries Adjusts Valuation Grade Amidst Competitive Battery Market Dynamics

2025-04-02 08:00:59Eveready Industries India has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the battery industry. The company's price-to-earnings ratio stands at 27.92, while its price-to-book value is recorded at 5.11. Additionally, the enterprise value to EBITDA ratio is 16.48, and the EV to EBIT ratio is noted at 20.64. The PEG ratio is particularly noteworthy at 0.24, indicating a favorable growth outlook relative to its earnings. In terms of profitability, Eveready showcases a return on capital employed (ROCE) of 16.48% and a return on equity (ROE) of 17.22%. The dividend yield is modest at 0.33%, which may appeal to certain investors seeking income. When comparing Eveready to its peers, it is essential to note that while the company has faced challenges in stock performance over various periods, including a year-to-date return of -21.65%, it has signi...

Read More

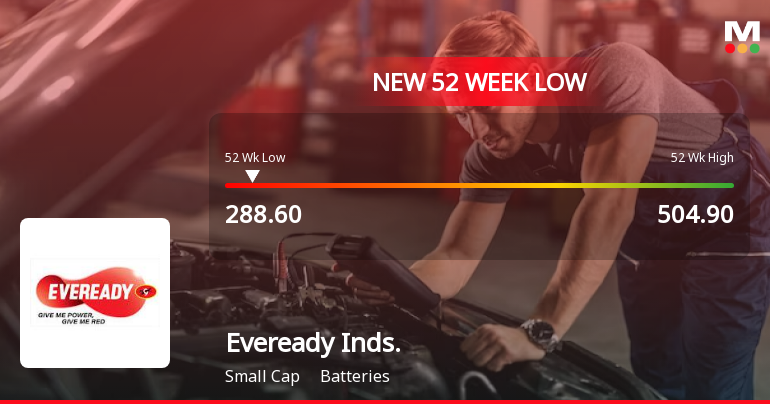

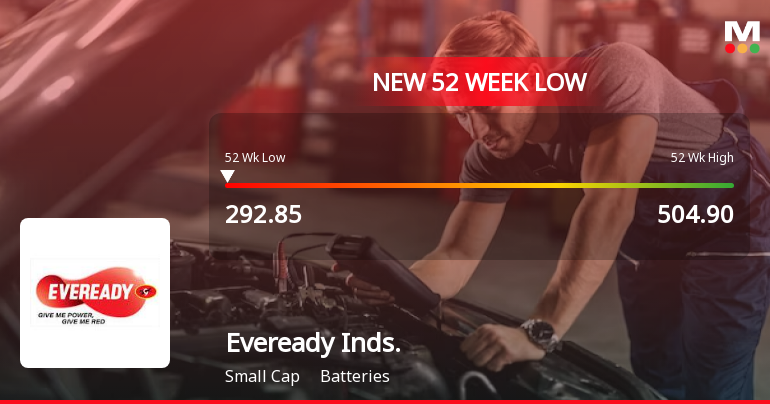

Eveready Industries Faces Persistent Challenges Amid Significant Stock Volatility

2025-03-03 10:05:58Eveready Industries India has faced notable volatility, reaching a new 52-week low amid a significant decline over the past four days. The stock's performance has lagged behind its sector, and it is currently trading below multiple moving averages, indicating ongoing challenges in a competitive market.

Read MoreEveready Industries Faces Stock Volatility Amid Broader Market Trends and Declines

2025-02-24 09:35:05Eveready Industries India Ltd, a small-cap player in the batteries sector, has experienced significant volatility in its stock performance today. The stock opened with a notable loss of 5.84%, marking a reversal after three consecutive days of gains. Throughout the trading session, Eveready touched an intraday low of Rs 300.05, reflecting a day’s performance decline of 2.62%, which underperformed the Sensex, which fell by only 0.74%. In terms of broader market trends, Eveready has shown a concerning 11.96% decline over the past month, contrasting sharply with the Sensex's modest drop of 1.88%. Analyzing its moving averages, the stock is currently positioned higher than its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day moving averages, indicating a mixed short-term performance relative to longer-term trends. This performance highlights the challenges faced by Eveready Indus...

Read More

Eveready Industries Faces Trading Challenges Amidst Signs of Potential Recovery

2025-02-19 09:35:59Eveready Industries India has seen notable trading activity, reaching a new 52-week low while managing to outperform its sector. After eight days of decline, the stock opened higher, suggesting a potential trend reversal. However, it remains below key moving averages, indicating ongoing challenges. Over the past year, it has declined significantly compared to the Sensex.

Read More

Eveready Industries Faces Significant Stock Volatility Amid Competitive Market Challenges

2025-02-18 11:53:25Eveready Industries India has faced notable volatility in trading, reaching a new 52-week low and experiencing significant fluctuations in investor sentiment. The stock's performance has been below key moving averages, reflecting a challenging environment, with a year-over-year decline contrasting with broader market gains.

Read More

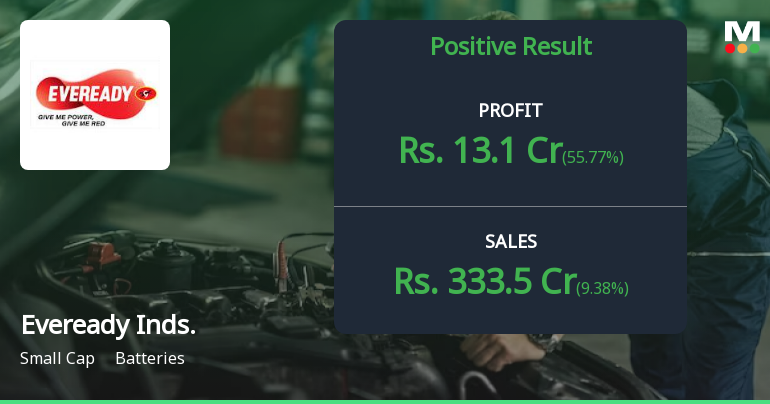

Eveready Industries Reports Strong Profit Growth Amid Mixed Financial Indicators for Q3 2024

2025-02-05 17:33:23Eveready Industries India has announced its financial results for the quarter ending December 2024, highlighting a significant increase in Profit Before Tax and Profit After Tax. The company also achieved a notable reduction in its Debt-Equity Ratio, although its Debtors Turnover Ratio has declined, indicating slower debt settlement.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSENotice of Closure of Trading Window.

Announcement under Regulation 30 (LODR)-Newspaper Publication

08-Mar-2025 | Source : BSENewspaper Publication of Postal Ballot Notice

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

07-Mar-2025 | Source : BSENotice of Postal Ballot.

Corporate Actions

No Upcoming Board Meetings

Eveready Industries India Ltd has declared 20% dividend, ex-date: 26 Jul 24

No Splits history available

No Bonus history available

No Rights history available