Everest Kanto Cylinder Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-04-02 08:01:22Everest Kanto Cylinder, a small-cap player in the packaging industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 124.75, showing a notable increase from the previous close of 118.50. Over the past year, the stock has experienced a decline of 14.50%, contrasting with a modest gain of 2.72% in the Sensex. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no clear signal monthly. Bollinger Bands and KST also reflect a mildly bearish trend, while moving averages indicate bearish conditions on a daily basis. In terms of returns, Everest Kanto has shown resilience over longer periods, with an impressive 995.26% return over five years, signif...

Read MoreEverest Kanto Cylinder Experiences Valuation Grade Change Amidst Competitive Packaging Landscape

2025-04-02 08:00:25Everest Kanto Cylinder, a small-cap player in the packaging industry, has recently undergone a valuation adjustment. The company's current price stands at 124.75, reflecting a notable shift from its previous close of 118.50. Over the past year, Everest Kanto has experienced a decline of 14.50%, contrasting with a 2.72% gain in the Sensex, indicating a challenging market environment for the company. Key financial metrics reveal a PE ratio of 13.88 and an EV to EBITDA ratio of 8.69, positioning Everest Kanto within a competitive landscape. The company's return on capital employed (ROCE) is reported at 11.36%, while the return on equity (ROE) stands at 10.27%. In comparison to its peers, Everest Kanto's valuation metrics appear more favorable than those of TCPL Packaging, which has a significantly higher PE ratio of 29.39, but less attractive than Uflex and Cosmo First, which boast lower PE ratios and EV to E...

Read MoreEverest Kanto Cylinder Experiences Valuation Grade Change Amidst Competitive Packaging Sector Dynamics

2025-03-27 08:00:04Everest Kanto Cylinder, a small-cap player in the packaging industry, has recently undergone a valuation adjustment. The company's current price stands at 118.85, reflecting a decline from the previous close of 122.65. Over the past year, Everest Kanto has experienced a stock return of -8.22%, contrasting with a 6.65% return from the Sensex, indicating a challenging performance relative to the broader market. Key financial metrics for Everest Kanto include a PE ratio of 13.23 and an EV to EBITDA ratio of 8.29, which position the company competitively within its sector. The company's return on capital employed (ROCE) is reported at 11.36%, while the return on equity (ROE) stands at 10.27%. These figures suggest a solid operational efficiency, although the stock's performance has lagged behind some peers. In comparison, other companies in the packaging sector, such as AGI Greenpac and Uflex, exhibit varying...

Read MoreEverest Kanto Cylinder Adjusts Valuation Amidst Competitive Industry Landscape

2025-03-18 08:00:08Everest Kanto Cylinder, a small-cap player in the packaging industry, has recently undergone a valuation adjustment reflecting its current market standing. The company’s price-to-earnings ratio stands at 12.64, while its price-to-book value is recorded at 1.10. Other key financial metrics include an EV to EBIT ratio of 10.59 and an EV to EBITDA ratio of 7.93, indicating its operational efficiency. The company has a dividend yield of 0.62%, with a return on capital employed (ROCE) of 11.36% and a return on equity (ROE) of 10.27%. These figures suggest a stable financial performance, although the stock has faced challenges recently, with a year-to-date return of -38.61%, contrasting with a modest decline in the Sensex. In comparison to its peers, Everest Kanto's valuation metrics appear competitive. For instance, AGI Greenpac and Uflex also show attractive valuations, but with differing performance indicato...

Read More

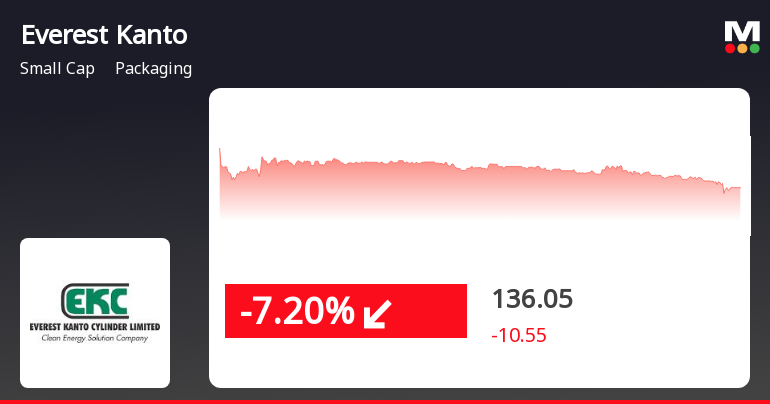

Everest Kanto Cylinder Faces Significant Volatility Amidst Ongoing Market Challenges

2025-03-03 14:20:30Everest Kanto Cylinder, a small-cap packaging company, has faced significant volatility, hitting a 52-week low of Rs. 111.5. The stock has underperformed its sector and has seen a 15.42% decline over the past six days. It is trading below all key moving averages, reflecting ongoing market challenges.

Read MoreEverest Kanto Cylinder's Stock Activity Highlights Diverging Trends in Market Performance

2025-02-20 11:56:53Everest Kanto Cylinder, a small-cap player in the packaging industry, has shown notable activity today, with its stock rising by 3.50%. This uptick comes amid a challenging performance backdrop, as the company has experienced a year-to-date decline of 25.67%, significantly underperforming the Sensex, which has seen a decrease of only 3.11% during the same period. The company's market capitalization stands at Rs 1,543.42 crore, with a price-to-earnings (P/E) ratio of 14.79, which is below the industry average of 20.87. Over the past year, Everest Kanto Cylinder's stock has declined by 15.14%, contrasting sharply with the Sensex's gain of 3.63%. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The stock's performance over various time frames reveals a mixed picture, with a significant 450.20% increase over the past five years, juxtap...

Read More

Everest Kanto Cylinder Faces Significant Volatility Amid Broader Market Challenges in February 2025

2025-02-13 15:30:15Everest Kanto Cylinder, a small-cap packaging company, faced notable volatility on February 13, 2025, with a significant decline in its stock price. The company has underperformed relative to the broader market and is trading below key moving averages, reflecting ongoing challenges in its market performance.

Read More

Everest Kanto Cylinder Reports Mixed Financial Results Amid Sales Growth in December 2024

2025-02-12 22:16:05Everest Kanto Cylinder has reported flat financial performance for the quarter ending December 2024, despite a 20.06% year-on-year growth in net sales for the nine-month period. Challenges include declines in profit before tax and profit after tax, alongside a notable decrease in the debtors turnover ratio.

Read More

Everest Kanto Cylinder Faces Financial Challenges Amidst Flat Quarterly Performance and Increased Interest Expenses

2025-02-11 18:59:57Everest Kanto Cylinder, a small-cap packaging company, recently experienced a change in evaluation amid flat financial performance and rising interest expenses. Despite challenges in managing financial obligations and a low debtors turnover ratio, the company shows strong debt servicing capacity and has attracted increased institutional interest.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEWe enclose herewith intimation of closure of trading window for dealing in securities of the Company for all designated persons and their immediate relatives from April 1 2025 until 48 hours after declaration of Audited Financial Results for the quarter and year ending March 31 2025.

Integrated Filing (Financial)

04-Mar-2025 | Source : BSEWe enclose herewith integrated financials.

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

01-Mar-2025 | Source : BSEWe enclose herewith the Order received from Deputy Commissioner GST Lucknow UP.

Corporate Actions

No Upcoming Board Meetings

Everest Kanto Cylinder Ltd. has declared 35% dividend, ex-date: 23 Aug 24

Everest Kanto Cylinder Ltd. has announced 2:10 stock split, ex-date: 21 Aug 07

No Bonus history available

No Rights history available