Family Care Hospitals Adjusts Valuation Grade Amid Strong Financial Metrics and Competitive Positioning

2025-04-02 08:00:21Family Care Hospitals has recently undergone a valuation adjustment, reflecting its financial metrics and market position within the Hospital & Healthcare Services industry. The company currently exhibits a price-to-earnings (PE) ratio of 0.60 and an enterprise value to EBITDA ratio of 0.79, indicating a favorable valuation relative to its earnings potential. Additionally, Family Care boasts impressive return on capital employed (ROCE) and return on equity (ROE) figures, standing at 204.55% and 263.57%, respectively. In comparison to its peers, Family Care Hospitals demonstrates a significantly lower PE ratio than Aashka Hospitals, which does not qualify for valuation, and other competitors like Fortis Malar and Lotus Eye Hospital, which are categorized as risky. Notably, Asarfi Hospital and Choksi Laboratories are also marked as very attractive, yet Family Care's metrics suggest a competitive edge in term...

Read More

Family Care Hospitals Faces Severe Financial Decline Amid Broader Market Volatility

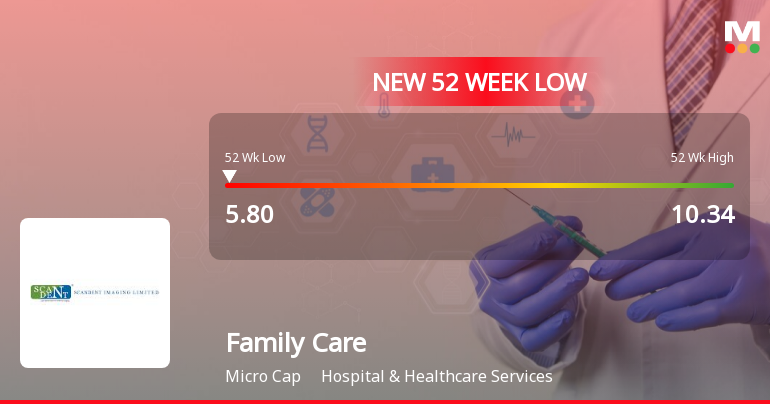

2025-03-28 10:07:29Family Care Hospitals has faced notable volatility, reaching a new 52-week low and experiencing a significant decline in financial performance, with net sales down nearly 78%. The stock is trading below key moving averages, and a large portion of promoter shares are pledged, contributing to ongoing challenges.

Read More

Family Care Hospitals Faces Severe Decline Amid Broader Market Trends and Financial Struggles

2025-03-27 09:46:22Family Care Hospitals has faced significant volatility, reaching a new 52-week low. The stock has declined sharply over the past year, with net sales dropping dramatically and a substantial quarterly loss reported. Despite high return on equity and favorable valuation metrics, the technical outlook remains negative.

Read More

Family Care Hospitals Faces Significant Volatility Amidst Declining Financial Performance

2025-03-27 09:46:13Family Care Hospitals has faced notable volatility, hitting a 52-week low and experiencing a significant decline in net sales and profit after tax. With a high percentage of pledged promoter shares and underperformance over the past year, the company continues to show a bearish technical outlook despite its attractive valuation metrics.

Read More

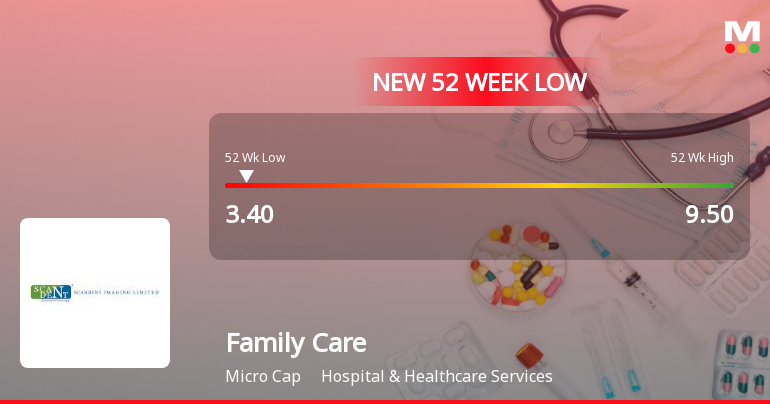

Family Care Hospitals Faces Significant Financial Challenges Amid Broader Market Trends

2025-03-26 10:36:29Family Care Hospitals has faced notable volatility, reaching a new 52-week low and underperforming its sector. The stock has declined over three consecutive days and reported a significant drop in net sales. Concerns about financial health are compounded by a high percentage of pledged promoter shares.

Read More

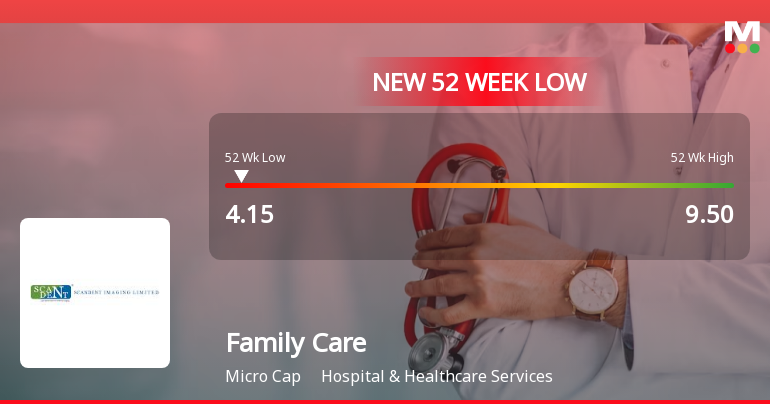

Family Care Hospitals Faces Significant Stock Decline Amid Market Volatility and Underperformance

2025-02-17 10:05:34Family Care Hospitals has faced significant volatility, hitting a new 52-week low and experiencing a 25.63% decline over the past six days. The stock has decreased by 51.27% in the past year, underperforming against the Sensex, and is trading below multiple moving averages, indicating ongoing challenges.

Read More

Family Care Hospitals Faces Significant Challenges Amidst Ongoing Market Volatility

2025-02-14 11:05:22Family Care Hospitals has faced notable volatility, hitting a 52-week low and experiencing a 19.15% loss over the past five days. The microcap company has underperformed its sector and recorded a 45.10% decline over the past year, trading below its moving averages across multiple time frames.

Read More

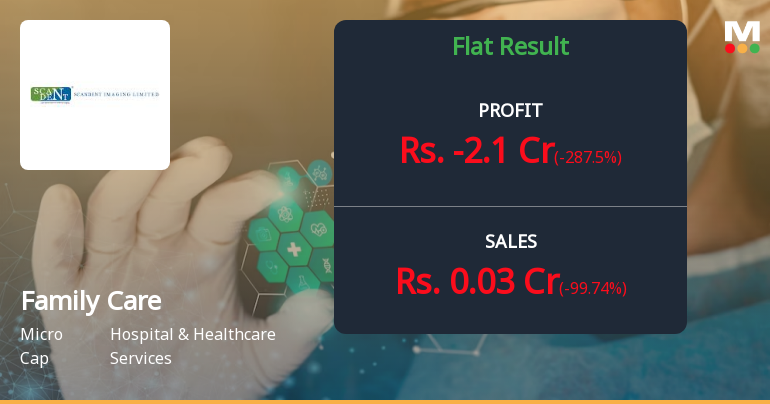

Family Care Hospitals Reports Flat Financial Performance Amid Score Adjustment in February 2025

2025-02-13 10:05:11Family Care Hospitals has announced its financial results for the quarter ending December 2024, revealing a flat performance. The company's evaluation score has significantly adjusted to 0 from 13 over the past three months, indicating a notable change in the assessment of its financial standing within the competitive healthcare sector.

Read More

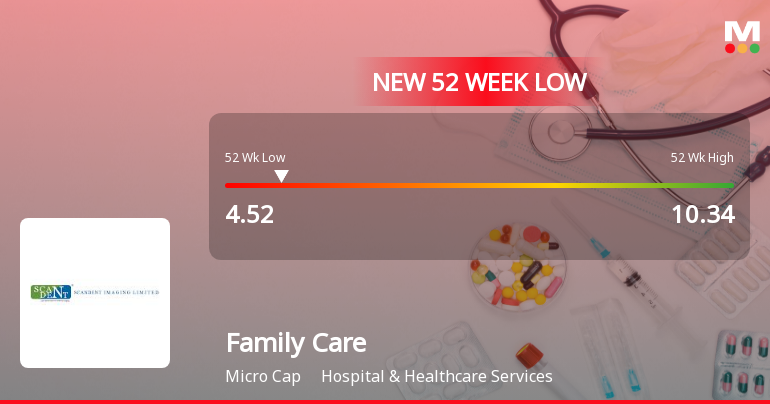

Family Care Hospitals Hits 52-Week Low Amidst Challenging Market Conditions

2025-02-11 09:35:22Family Care Hospitals has reached a new 52-week low, reflecting a significant decline of 37.32% over the past year, while the Sensex has gained 7.67%. The stock is trading below its moving averages and is being closely watched by investors amid a challenging market environment.

Read MoreNon Applicability Of SEBI Circular SEBI/HO/DDHS/CIR/P/2018/144 Dated November 26 2018 - Fund Raising By Issuance Of Debt Securities By Large Entities

07-Apr-2025 | Source : BSENon Applicability of SEBI Circular on Large Entities

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECompliance- certificate under Reg. 74(5) of SEBI (DP) Regulation for the quarter and year ended 31st March 2025

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of closure of trading window for the quarter and year ended 31-03-2025

Corporate Actions

No Upcoming Board Meetings

No Splits history available

No Bonus history available

Family Care Hospitals Ltd has announced 127:100 rights issue, ex-date: 03 Jan 23