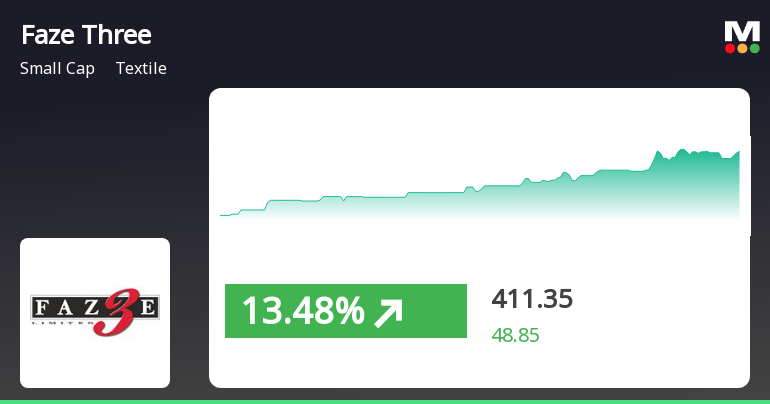

Faze Three's Strong Performance Highlights Resilience in Small-Cap Textile Sector

2025-04-03 12:15:17Faze Three, a small-cap textile company, experienced significant stock activity on April 3, 2025, with a notable upward trend over three days. Despite initial losses, the stock rebounded to reach an intraday high, showcasing volatility while remaining above several key moving averages in a fluctuating market.

Read MoreFaze Three Adjusts Valuation Amidst Competitive Textile Sector Dynamics

2025-04-02 08:00:14Faze Three, a microcap player in the textile industry, has recently undergone a valuation adjustment. The company's current price stands at 359.45, reflecting a notable shift from its previous close of 346.20. Over the past year, Faze Three has experienced a stock return of -8.32%, contrasting with a positive return of 2.72% from the Sensex. Key financial metrics for Faze Three include a PE ratio of 27.19 and an EV to EBITDA ratio of 13.36. The company's return on capital employed (ROCE) is reported at 10.27%, while the return on equity (ROE) stands at 9.12%. These figures provide insight into the company's operational efficiency and profitability. When compared to its peers, Faze Three's valuation metrics reveal a diverse landscape. For instance, Mafatlal Industries boasts a significantly lower PE ratio of 7.85, while R&B Denims shows a higher PE ratio of 28.42. This comparison highlights the varying fin...

Read MoreFaze Three Adjusts Valuation Grade, Reflecting Competitive Position in Textile Sector

2025-03-25 08:00:07Faze Three, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (PE) ratio of 26.52 and an EV to EBITDA ratio of 13.07, indicating its market valuation relative to earnings before interest, taxes, depreciation, and amortization. Additionally, Faze Three's return on capital employed (ROCE) stands at 10.27%, while its return on equity (ROE) is recorded at 9.12%. In comparison to its peers, Faze Three's valuation metrics present a mixed picture. For instance, Mafatlal Industries and Ambika Cotton also show attractive valuations, but with significantly lower PE ratios. Meanwhile, Indo Rama Synth is currently loss-making, which impacts its valuation metrics. Other competitors like R&B Denims and GHCL Textiles are positioned differently in the market, with higher PE ratios and va...

Read MoreFaze Three Adjusts Valuation Grade Amid Competitive Textile Industry Landscape

2025-03-18 08:00:05Faze Three, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently reports a price-to-earnings (PE) ratio of 26.52 and an EV to EBITDA ratio of 13.07, indicating its market valuation relative to earnings and operational performance. Additionally, the company's return on capital employed (ROCE) stands at 10.27%, while the return on equity (ROE) is at 9.12%, showcasing its efficiency in generating profits from its capital and equity. In comparison to its peers, Faze Three's valuation metrics present a mixed picture. For instance, Sportking India and Mafatlal Industries also show attractive valuations, but with significantly lower PE ratios. Meanwhile, R&B Denims is positioned as very expensive, highlighting a stark contrast in market perceptions within the sector. The textile industry remains competitive, w...

Read MoreFaze Three Adjusts Valuation Amidst Competitive Textile Industry Landscape

2025-03-05 08:00:07Faze Three, a microcap player in the textile industry, has recently undergone a valuation adjustment. The company's current price stands at 378.10, reflecting a notable shift from its previous close of 344.90. Over the past year, Faze Three has experienced a stock return of -10.73%, contrasting with a modest -1.19% return from the Sensex, indicating a relative underperformance in the market. Key financial metrics for Faze Three include a PE ratio of 28.60 and an EV to EBITDA ratio of 13.97. The company's return on capital employed (ROCE) is reported at 10.27%, while the return on equity (ROE) is at 9.12%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, Faze Three's valuation metrics reveal a diverse landscape within the textile sector. For instance, Sportking India stands out with a significantly lower PE ratio of 9.41 and an attractiv...

Read More

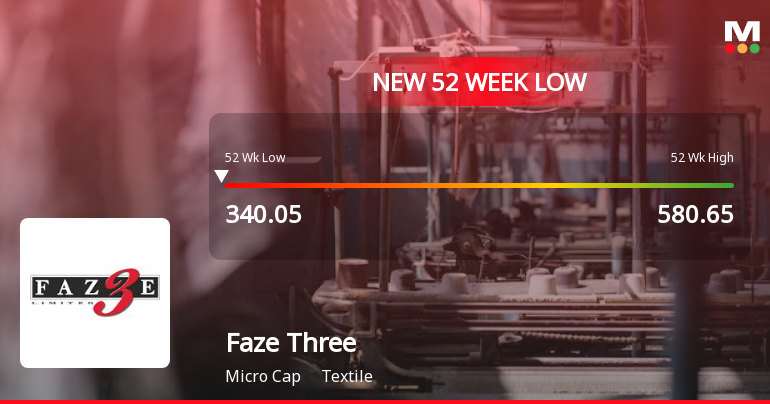

Faze Three Faces Sustained Decline Amidst Broader Market Challenges in Textiles

2025-03-03 10:05:15Faze Three, a microcap textile company, has faced significant volatility, hitting a new 52-week low and experiencing consecutive losses over the past six days. The stock has underperformed its sector and declined 24.31% over the past year, contrasting with the Sensex's minor decrease.

Read More

Faze Three Faces Significant Volatility Amidst Underperformance in Textile Sector

2025-02-28 10:05:12Faze Three, a microcap textile company, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has seen consecutive losses over the past week and is trading below key moving averages, indicating a bearish trend. Its annual performance contrasts sharply with the Sensex.

Read More

Faze Three Hits 52-Week Low Amidst Ongoing Market Volatility and Decline

2025-02-27 11:35:11Faze Three, a microcap textile company, has reached a new 52-week low of Rs. 335 after a notable decline, underperforming its sector. The stock has seen consecutive falls over four days and is trading below key moving averages, reflecting ongoing challenges in the market.

Read More

Faze Three Faces Challenges Amid Significant Stock Activity Near 52-Week Low

2025-02-18 15:35:11Faze Three, a microcap textile company, is nearing a 52-week low, trading slightly above its recent low. The stock has declined over the past two days and is underperforming against its sector. Over the past year, it has seen a significant decline, contrasting with the overall market's gains.

Read MoreSubmission Of Certificate Under Reg. 74 (5) Of SEBI (DP) Regulations 2018 For The Quarter Ended March 31 2025.

09-Apr-2025 | Source : BSEPlease refer the attached annexure.

Closure of Trading Window

29-Mar-2025 | Source : BSEPlease refer the attached intimation for closure of trading window.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

21-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Ajay Anand & PACs

Corporate Actions

No Upcoming Board Meetings

Faze Three Ltd has declared 5% dividend, ex-date: 06 Jun 22

Faze Three Ltd has announced 10:2 stock split, ex-date: 24 Oct 07

No Bonus history available

No Rights history available