Federal Bank Sees Significant Rise in Open Interest Amid Increased Trading Activity

2025-03-28 15:00:19Federal Bank Ltd, a prominent player in the private banking sector, has recently experienced a notable increase in open interest (OI). The latest OI stands at 22,947 contracts, reflecting a rise of 2,218 contracts or 10.7% from the previous OI of 20,729. This uptick in OI comes alongside a trading volume of 16,920 contracts, indicating heightened activity in the derivatives market. In terms of market performance, Federal Bank's stock has underperformed its sector, showing a 1D return of -1.62%, while the banking sector overall recorded a modest gain of 0.68%. The stock is currently trading below its 100-day moving average but remains above its 5-day, 20-day, 50-day, and 200-day moving averages, suggesting mixed short-term trends. Additionally, the stock has seen a significant rise in delivery volume, with 1.48 crore shares delivered on March 27, marking an increase of 332.42% compared to the 5-day average...

Read More

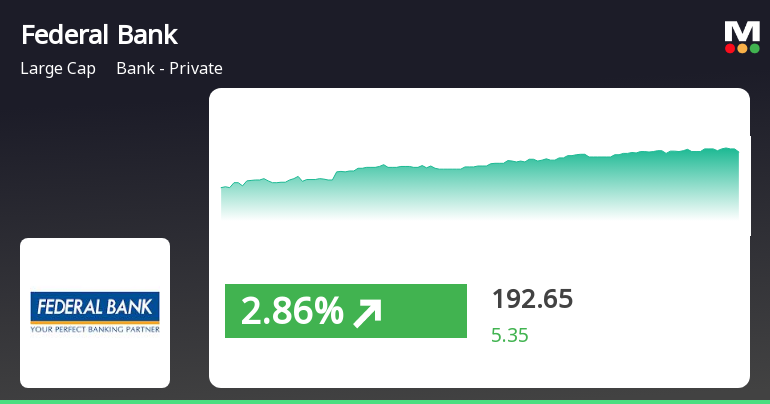

Federal Bank's Sustained Gains Reflect Broader Positive Trend in Private Banking Sector

2025-03-24 11:15:17Federal Bank has demonstrated strong performance, achieving six consecutive days of gains and a notable total return over this period. The stock is currently above several key moving averages, reflecting its resilience amid a positive trend in the private banking sector and overall market sentiment.

Read More

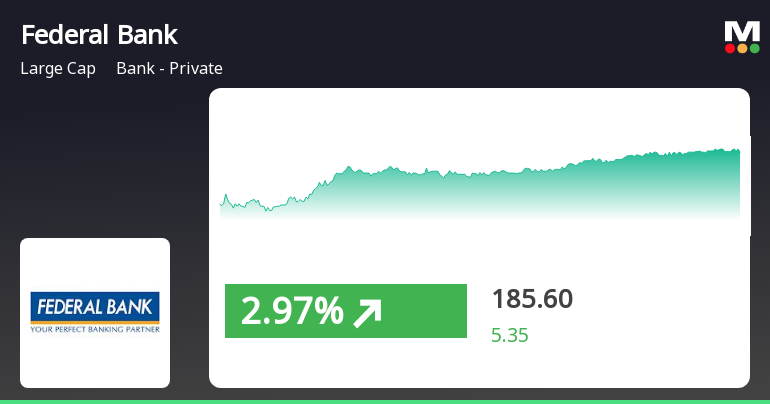

Federal Bank Demonstrates Resilience Amid Mixed Market Trends and Sector Performance

2025-03-19 13:45:47Federal Bank has demonstrated strong performance, gaining 3.08% on March 19, 2025, and outperforming its sector. The stock has shown a positive trend over the past three days, reaching an intraday high of Rs 185.9. Its positioning relative to moving averages indicates mixed short to medium-term performance.

Read MoreFederal Bank's Technical Indicators Signal Mixed Trends Amid Strong Long-Term Performance

2025-03-17 08:00:44Federal Bank, a prominent player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 176.65, down from a previous close of 178.30. Over the past year, Federal Bank has demonstrated a notable return of 19.40%, significantly outperforming the Sensex, which recorded a return of 1.47% during the same period. In terms of technical indicators, the bank's MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance on a monthly scale. The Relative Strength Index (RSI) remains neutral, with no signals detected for both weekly and monthly assessments. Bollinger Bands present a mixed picture, with a bearish outlook weekly and a mildly bullish perspective monthly. Daily moving averages also reflect a bearish trend. When examining the bank's performance over various time frames, it has sho...

Read MoreFederal Bank's Technical Indicators Reflect Mixed Sentiment Amid Market Evaluation Changes

2025-03-13 08:01:07Federal Bank, a prominent player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 178.30, showing a slight decline from the previous close of 179.15. Over the past year, Federal Bank has demonstrated a notable return of 17.42%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the bank's weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators present a mixed picture with some mildly bullish signals. The Relative Strength Index (RSI) shows no clear signal for both weekly and monthly assessments, indicating a period of indecision in market momentum. When examining the bank's performance over various time frames, it has shown resilience, particularly over the last three and five years, with...

Read MoreFederal Bank's Technical Indicators Reflect Mixed Sentiment Amid Market Evaluation Changes

2025-03-13 08:01:07Federal Bank, a prominent player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 178.30, showing a slight decline from the previous close of 179.15. Over the past year, Federal Bank has demonstrated a notable return of 17.42%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the bank's weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators present a mixed picture with some mildly bullish signals. The Relative Strength Index (RSI) shows no clear signal for both weekly and monthly assessments, indicating a period of indecision in market momentum. When examining the bank's performance over various time frames, it has shown resilience, particularly over the last three and five years, with...

Read More

Federal Bank Adjusts Evaluation Amidst Flat Financial Performance and Strong Lending Metrics

2025-03-12 08:01:23Federal Bank has recently adjusted its evaluation following a comprehensive analysis of its financial metrics and market position. In Q3 FY24-25, the bank reported flat financial performance, with a profit before tax of Rs 360.96 crore and a profit after tax of Rs 955.44 crore, reflecting a slight decline. Despite challenges, the bank maintains a strong lending framework and robust long-term fundamentals.

Read More

Federal Bank Shows Strong Credit Quality and Growth Amid Market Challenges

2025-03-07 08:01:30Federal Bank has recently adjusted its evaluation, reflecting its strong market position. With a low Gross Non-Performing Asset ratio of 1.95% and a stable Return on Assets of 1.01%, the bank shows solid credit quality and growth potential, outperforming the broader market over the past year.

Read MoreFederal Bank Adjusts Valuation Grade Amid Competitive Private Banking Landscape

2025-03-07 08:00:55Federal Bank has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The bank's price-to-earnings ratio stands at 11.33, while its price-to-book value is recorded at 1.42. The PEG ratio is noted at 2.40, and the dividend yield is 0.66%. Key performance indicators include a return on equity (ROE) of 12.49% and a return on assets (ROA) of 1.17%. Additionally, the net non-performing assets (NPA) to book value ratio is 3.60. In comparison to its peers, Federal Bank's valuation appears more favorable. HDFC Bank and ICICI Bank are positioned at higher valuation levels, with PE ratios of 19.52 and 19, respectively. Axis Bank and Kotak Mahindra Bank also reflect higher valuations, while IndusInd Bank and Yes Bank show attractive metrics, but with varying performance indicators. Federal Bank's recent performance has shown resilience, particularly over the one-yea...

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

09-Apr-2025 | Source : BSEChange in Senior Management Personnel

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

05-Apr-2025 | Source : BSEAllotment of equity shares on exercise of Stock Options pursuant to Employee Stock Option Scheme

Announcement under Regulation 30 (LODR)-Change in Directorate

04-Apr-2025 | Source : BSEChange in Directorate

Corporate Actions

No Upcoming Board Meetings

Federal Bank Ltd has declared 60% dividend, ex-date: 23 Aug 24

Federal Bank Ltd has announced 2:10 stock split, ex-date: 17 Oct 13

Federal Bank Ltd has announced 1:1 bonus issue, ex-date: 08 Jul 15

Federal Bank Ltd has announced 1:1 rights issue, ex-date: 19 Nov 07