Fermenta Biotech Experiences Valuation Grade Change Amid Strong Market Performance

2025-03-24 08:00:11Fermenta Biotech, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 276.35, reflecting a notable increase from the previous close of 251.25. Over the past year, Fermenta has demonstrated a strong return of 81.09%, significantly outperforming the Sensex, which recorded a return of 5.87% during the same period. Key financial metrics for Fermenta include a PE ratio of 22.89 and an EV to EBITDA ratio of 11.52, indicating its market positioning within the industry. The company's return on capital employed (ROCE) is reported at 6.61%, while the return on equity (ROE) is at 2.92%. In comparison to its peers, Fermenta's valuation metrics show a diverse landscape. For instance, Kopran is noted for its attractive valuation, while Shree Ganesh Rem and Wanbury are categorized as expensive. Anuh Pharma stands out with a very a...

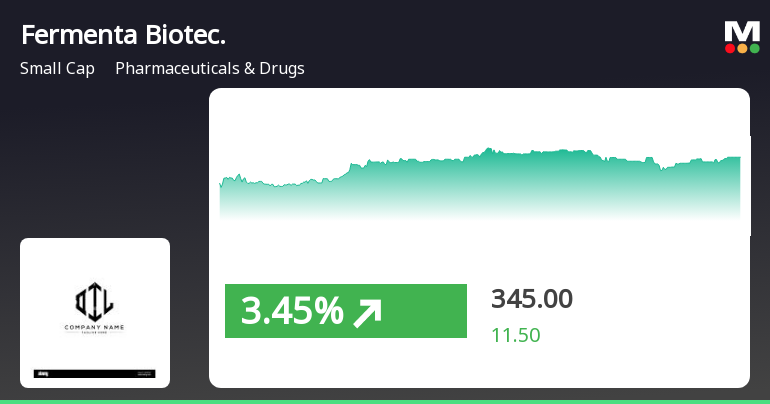

Read MoreFermenta Biotech Experiences Surge Amid Strong Buying Activity and Market Divergence

2025-03-21 13:30:05Fermenta Biotech Ltd is currently witnessing significant buying activity, with the stock surging by 9.99% today, outperforming the Sensex, which rose by only 0.83%. Over the past week, Fermenta Biotech has gained 12.80%, compared to the Sensex's 4.27% increase. This strong performance is notable, especially considering the stock's year-to-date decline of 24.07% against the Sensex's modest drop of 1.48%. The stock reached an intraday high of Rs 276.35, reflecting robust buyer interest. In terms of moving averages, Fermenta Biotech is currently above its 5-day and 20-day moving averages, indicating short-term strength, although it remains below the 50-day, 100-day, and 200-day moving averages, suggesting potential challenges in the medium to long term. The recent buying pressure may be attributed to various factors, including market sentiment within the pharmaceuticals and drugs sector, as well as specific ...

Read MoreFermenta Biotech Adjusts Valuation Grade Amid Competitive Pharmaceutical Landscape

2025-03-07 08:00:39Fermenta Biotech, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company currently reports a price-to-earnings (PE) ratio of 22.09 and an EV to EBITDA ratio of 11.16, indicating its market positioning relative to its earnings and operational performance. The price-to-book value stands at 2.71, while the PEG ratio is notably low at 0.02, suggesting a unique valuation perspective. In terms of financial performance, Fermenta Biotech has a return on capital employed (ROCE) of 6.61% and a return on equity (ROE) of 2.92%. The company’s dividend yield is recorded at 0.47%, reflecting its approach to shareholder returns. When compared to its peers, Fermenta Biotech's valuation metrics reveal a competitive landscape. For instance, Shree Ganesh Rem and Kopran exhibit higher PE ratios, while Anuh Pharma presents a more attractive valuation profile. The per...

Read MoreFermenta Biotech Experiences Valuation Grade Change Amid Competitive Industry Landscape

2025-02-24 12:56:38Fermenta Biotech, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 266.55, with a previous close of 268.50. Over the past year, Fermenta has shown a stock return of 35.89%, significantly outperforming the Sensex, which recorded a return of 1.92%. Key financial metrics for Fermenta include a PE ratio of 22.20 and an EV to EBITDA ratio of 11.21. The company's return on equity (ROE) is reported at 2.92%, while the return on capital employed (ROCE) is at 6.61%. The PEG ratio is notably low at 0.02, indicating potential discrepancies in growth expectations relative to earnings. In comparison to its peers, Fermenta's valuation metrics reflect a competitive landscape. For instance, Shree Ganesh Rem and Shukra Pharma are positioned at higher valuation levels, while Kopran and Wanbury present more attractive metrics. This ...

Read More

Fermenta Biotech Shows High Volatility Amidst Fluctuating Small-Cap Pharma Trends

2025-02-12 12:30:17Fermenta Biotech has shown notable trading activity, with significant volatility throughout the session. The stock opened lower but reached an intraday high, while also experiencing a marked decline. Its performance over the past month contrasts with broader market trends, reflecting its fluctuating position in the small-cap pharmaceuticals sector.

Read More

Fermenta Biotech Reports Strong Financial Growth and Improved Operational Efficiency in December 2024 Results

2025-02-12 12:19:12Fermenta Biotech has announced its financial results for the quarter ending December 2024, highlighting significant growth in key metrics. Profit Before Tax reached Rs 43.11 crore, while Profit After Tax stood at Rs 36.91 crore. Net Sales totaled Rs 156.47 crore, and the company maintained a low Debt-Equity Ratio of 0.43 times.

Read More

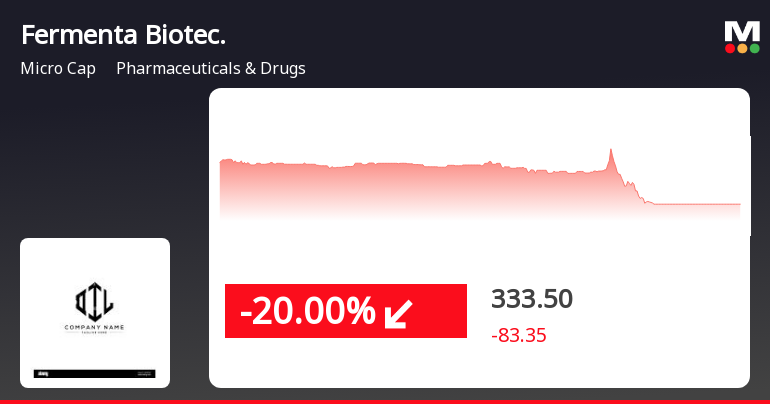

Fermenta Biotech Reaches 52-Week High Amidst Sector Volatility and Mixed Performance

2025-02-11 14:35:15Fermenta Biotech's stock reached a 52-week high of Rs. 449, showcasing significant growth over the past year. However, it faced volatility during trading, with notable intraday fluctuations. Despite outperforming the Sensex, the stock underperformed relative to its sector, which experienced a decline.

Read More

Fermenta Biotech Faces Significant Volatility Amid Broader Sector Decline

2025-02-11 14:30:18Fermenta Biotech's stock experienced notable volatility, reaching a 52-week high before declining significantly. The stock's performance has lagged behind its sector and the broader market over the past day and month. Despite this, it remains above several key moving averages, indicating mixed longer-term trends.

Read More

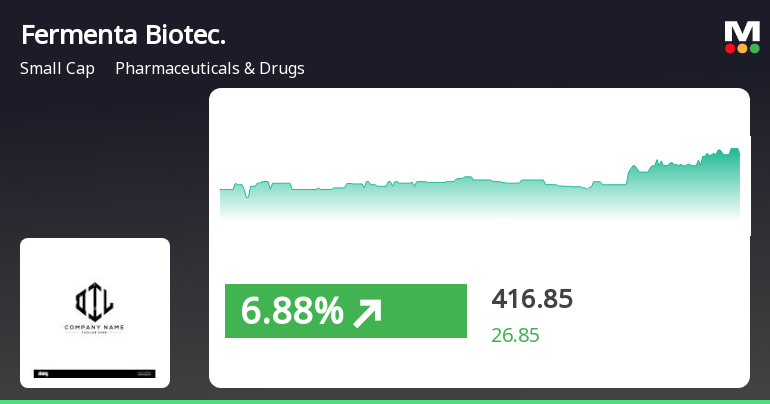

Fermenta Biotech Outperforms Market Amid Strong Upward Price Trends

2025-02-10 15:30:18Fermenta Biotech experienced notable trading activity on February 10, 2025, with a significant increase in its stock price, outperforming both its sector and the broader market. The stock is currently positioned above multiple moving averages, indicating a strong upward trend, contrasting with a decline in the Sensex.

Read MoreIntimation Of Proposed Incorporation Of Wholly-Owned Subsidiary

09-Apr-2025 | Source : BSEIntimation of proposed incorporation of wholly-owned subsidiary

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Apr-2025 | Source : BSEPostal Ballot notice March 26 2025.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

02-Apr-2025 | Source : BSEPostal Ballot notice dated March 26 2025

Corporate Actions

No Upcoming Board Meetings

Fermenta Biotech Ltd has declared 25% dividend, ex-date: 06 Aug 24

Fermenta Biotech Ltd has announced 5:5 stock split, ex-date: 08 Aug 18

Fermenta Biotech Ltd has announced 2:1 bonus issue, ex-date: 13 Feb 20

No Rights history available