Finolex Cables Faces Technical Trend Shifts Amidst Market Volatility and Declining Performance

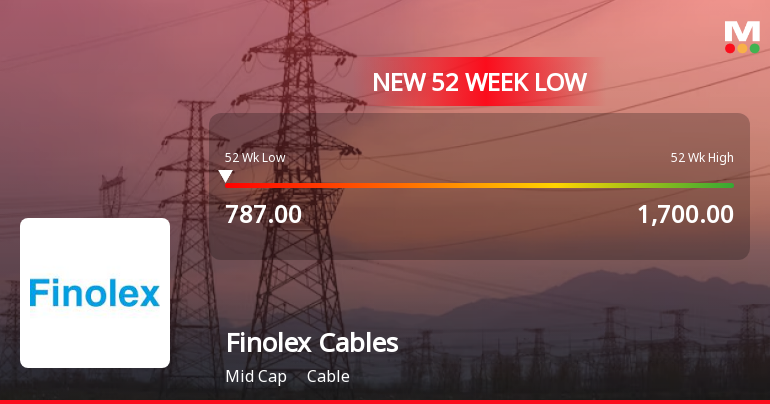

2025-04-02 08:05:08Finolex Cables, a midcap player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 884.90, down from a previous close of 914.25. Over the past year, Finolex Cables has experienced a decline of 9.41%, contrasting with a 2.72% gain in the Sensex, highlighting a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD and Bollinger Bands signal bearish trends, while the monthly metrics show a mildly bearish stance. The daily moving averages also reflect a bearish sentiment. Notably, the stock's 52-week high stands at 1,700.00, with a low of 781.00, indicating significant volatility over the past year. When examining the company's returns, it has shown a remarkable performance over the longer term, with a 303.05% increase over five years, significantly outpacing the Sense...

Read MoreFinolex Cables Sees Surge in Trading Activity Amid Strong Investor Participation

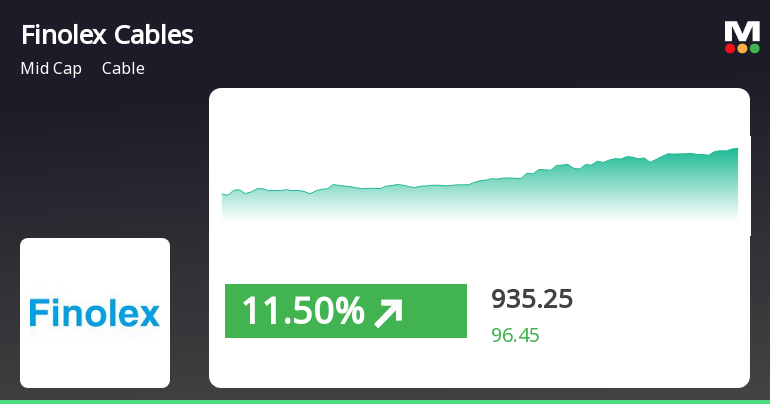

2025-03-25 10:00:12Finolex Cables Ltd., a prominent player in the cable industry, has emerged as one of the most active equities today, with a total traded volume of 3,019,772 shares and a total traded value of approximately Rs 292.63 crores. The stock opened at Rs 945.00 and reached a day high of Rs 988.00, reflecting a notable intraday performance. Currently, the last traded price stands at Rs 965.55, marking a 3.38% increase for the day. Finolex Cables has outperformed its sector by 2.66%, continuing a positive trend with gains over the last three days, accumulating a total return of 17.03%. The stock's performance is supported by a significant rise in investor participation, with delivery volume on March 24 reaching 497,000 shares, a 139.77% increase compared to the five-day average. In terms of moving averages, the stock is currently above its 5-day, 20-day, and 50-day averages, although it remains below the 100-day an...

Read MoreFinolex Cables Shows Technical Trend Shifts Amid Market Dynamics and Volatility

2025-03-25 08:02:44Finolex Cables, a midcap player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 937.55, showing a notable increase from the previous close of 838.80. Over the past year, Finolex Cables has experienced a 5.39% return, which is slightly below the Sensex's 7.07% return during the same period. However, the company has demonstrated impressive long-term performance, with a remarkable 439.75% return over the last five years, significantly outpacing the Sensex's 192.36%. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also reflect a similar trend. Notably, the stock has seen fluctuations within a 52-week range of 781.00 to 1,700.00, indicating volatility in its price movements. The r...

Read MoreFinolex Cables Adjusts Valuation Grade Amid Competitive Market Dynamics

2025-03-25 08:00:27Finolex Cables has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the cable industry. The company's current price stands at 937.55, showing a notable increase from the previous close of 838.80. Over the past year, Finolex Cables has experienced a stock return of 5.39%, which is slightly below the Sensex return of 7.07% for the same period. Key financial metrics for Finolex Cables include a price-to-earnings (PE) ratio of 20.63 and an EV to EBITDA ratio of 22.17. The company also boasts a return on capital employed (ROCE) of 18.21% and a return on equity (ROE) of 13.46%. In comparison to its peers, Finolex Cables maintains a lower PE ratio than R R Kabel, which has a valuation marked as attractive, while Diamond Power is categorized as risky with a significantly higher PE ratio. These metrics highlight Finolex Cables' competitive position in the market, par...

Read MoreFinolex Cables Sees Surge in Trading Activity Amid Strong Investor Engagement

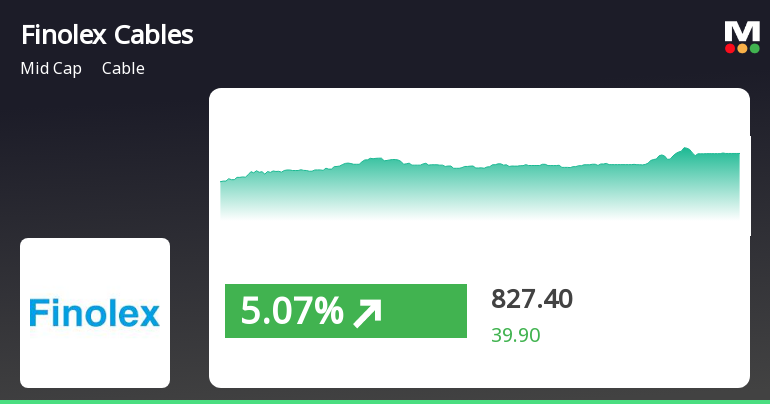

2025-03-24 12:00:04Finolex Cables Ltd. has emerged as one of the most active equities today, reflecting significant trading activity in the cable industry. The stock, trading under the symbol FINCABLES, has seen a total traded volume of 6,794,911 shares, with a total traded value of approximately Rs 62.89 crores. Opening at Rs 843.0, Finolex Cables reached an intraday high of Rs 949.95, marking a notable increase of 13.22% during the trading session. The stock has demonstrated a strong performance, outperforming its sector by 10.86% and achieving a 12.23% return for the day. Over the past two days, it has gained 13.67%, indicating a positive trend. The stock has traded within a wide range of Rs 106.95 today, with a last traded price of Rs 947.0. It is currently positioned above its 5-day, 20-day, and 50-day moving averages, although it remains below its 100-day and 200-day moving averages. Additionally, the delivery volume...

Read More

Finolex Cables Shows Resilience Amid Broader Market Gains and Small-Cap Strength

2025-03-24 10:15:16Finolex Cables has experienced notable trading activity, achieving a significant gain and outperforming its sector. The stock has shown consecutive gains over two days and reached an intraday high. In the broader market, the Sensex opened positively, with small-cap stocks leading the upward trend.

Read MoreFinolex Cables Adjusts Valuation Amid Competitive Cable Industry Landscape

2025-03-19 08:00:30Finolex Cables has recently undergone a valuation adjustment, reflecting a shift in its financial assessment. The company, operating within the cable industry, currently presents a price-to-earnings (P/E) ratio of 19.21 and a price-to-book value of 2.57. Its enterprise value to EBITDA stands at 20.32, while the enterprise value to EBIT is recorded at 22.23. The company also shows a return on capital employed (ROCE) of 18.21% and a return on equity (ROE) of 13.46%. In terms of market performance, Finolex Cables has experienced a notable return of 119.96% over the past three years, significantly outperforming the Sensex, which recorded a 30.14% return in the same period. However, the year-to-date performance indicates a decline of 26.05%, contrasting with the Sensex's modest drop of 3.63%. When compared to its peer, R R Kabel, Finolex Cables maintains a more favorable P/E ratio, while R R Kabel's enterpris...

Read More

Finolex Cables Shows Mixed Performance Amid Broader Market Gains and Small-Cap Strength

2025-03-18 12:20:15Finolex Cables Ltd. experienced significant trading activity, outperforming its sector and reaching an intraday high. While its short-term performance has been positive, the stock faces challenges with declines over the past three months and year-to-date. However, it has shown substantial growth over the last five years.

Read More

Finolex Cables Approaches 52-Week Low Amid Broader Market Gains and Sector Underperformance

2025-03-17 12:36:36Finolex Cables is facing notable market activity, with its stock price approaching a 52-week low and underperforming its sector. The company has seen a year-over-year decline, while its operating profit growth has been modest. Institutional holdings reflect considerable interest from larger investors amid a bearish trend.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation regarding closure of trading window from 01st April 2025

Clarification On Volume Movement

19-Mar-2025 | Source : BSEClarification on Volume Movement

Clarification sought from Finolex Cables Ltd

19-Mar-2025 | Source : BSEThe Exchange has sought clarification from Finolex Cables Ltd on March 19 2025 with reference to Movement in Volume.

The reply is awaited.

Corporate Actions

No Upcoming Board Meetings

Finolex Cables Ltd. has declared 400% dividend, ex-date: 17 Sep 24

Finolex Cables Ltd. has announced 2:10 stock split, ex-date: 08 Jan 07

No Bonus history available

No Rights history available