Finolex Industries Sees Surge in Trading Volume Amid Notable Stock Rebound

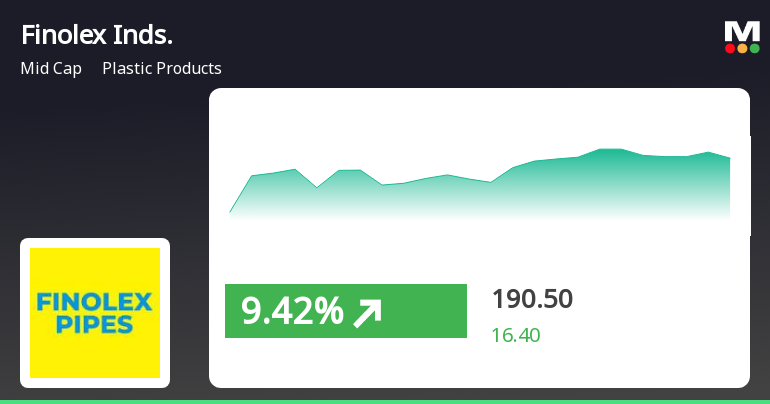

2025-03-24 12:00:07Finolex Industries Ltd, a prominent player in the plastic products sector, has emerged as one of the most active equities today, with a total traded volume of 17,777,875 shares and a total traded value of approximately Rs 34.15 crore. The stock opened at Rs 181.99, reflecting a gain of 4.53% from the previous close of Rs 174.1, and reached an intraday high of Rs 197, marking a 13.15% increase. Today’s performance indicates a notable trend reversal for Finolex Industries, as the stock has gained after three consecutive days of decline. It has outperformed its sector by 7.64%, while the broader plastic products industry has seen a gain of 3.63%. The stock's last traded price stands at Rs 192.56, which is higher than both the 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. Additionally, investor participation has risen significantly, with a delive...

Read MoreFinolex Industries Sees Significant Trading Activity Amid Notable Trend Reversal

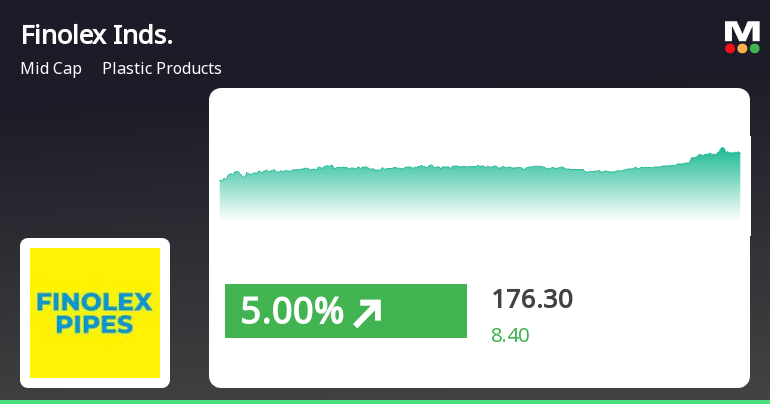

2025-03-24 11:00:04Finolex Industries Ltd, a prominent player in the plastic products sector, has emerged as one of the most active equities today, with a total traded volume of 15,836,053 shares and a total traded value of approximately Rs 30.41 crore. The stock opened at Rs 181.99, reflecting a gain of 4.53%, and reached an intraday high of Rs 197, marking a 13.15% increase from its previous close of Rs 174.1. Today’s performance indicates a notable trend reversal for Finolex Industries, as it has gained after three consecutive days of decline. The stock has outperformed its sector by 8.62%, while the broader plastic products industry has seen a gain of 3.16%. Additionally, the stock's liquidity remains robust, with a delivery volume of 773,000 shares on March 21, which is up 57.44% compared to the five-day average. In terms of moving averages, Finolex Industries is currently above its 5-day, 20-day, and 50-day moving ave...

Read More

Finolex Industries Shows Strong Rebound Amid Market Volatility and Sector Outperformance

2025-03-24 09:30:21Finolex Industries saw a notable increase today, reversing a three-day decline and outperforming its sector. The stock exhibited high volatility during trading, with significant intraday movements. In the broader market, the Sensex opened higher and has shown resilience, particularly among small-cap stocks.

Read More

Finolex Industries Shows Mixed Performance Amid Broader Market Gains and Challenges

2025-03-18 15:15:55Finolex Industries, a midcap in the plastic products sector, experienced a notable increase on March 18, 2025, outperforming its sector. Despite this rise, the stock is trading below key moving averages, indicating potential challenges. In the broader market, the Sensex also rose but remains below its 50-day moving average.

Read MoreFinolex Industries Adjusts Valuation Grade Amidst Mixed Performance and Peer Comparison

2025-03-18 08:00:21Finolex Industries, a midcap player in the plastic products sector, has recently undergone a valuation adjustment reflecting its current market standing. The company's price-to-earnings ratio stands at 21.83, while its price-to-book value is recorded at 1.54. Other key financial metrics include an EV to EBIT ratio of 21.37 and an EV to EBITDA ratio of 16.90, indicating its operational efficiency. The company has a dividend yield of 1.49%, with a return on capital employed (ROCE) of 8.82% and a return on equity (ROE) of 7.05%. In comparison to its peers, Finolex Industries presents a more favorable valuation profile, particularly when contrasted with companies like Safari Industries and Shaily Engineering, which are positioned at significantly higher valuation metrics. Despite recent fluctuations in its stock price, which has seen a 52-week range between 166.75 and 355.70, Finolex's performance over variou...

Read More

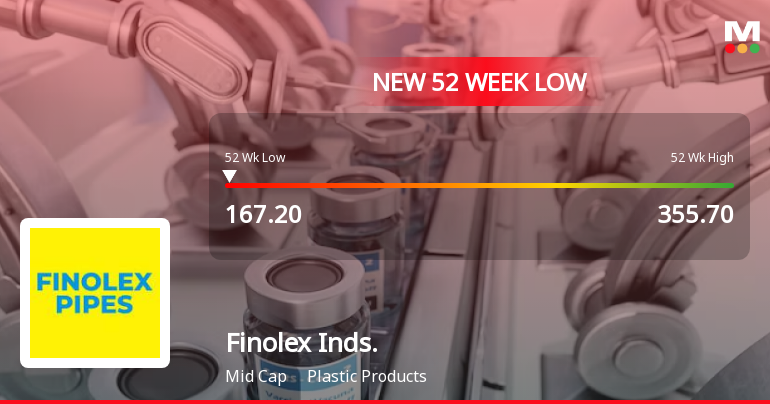

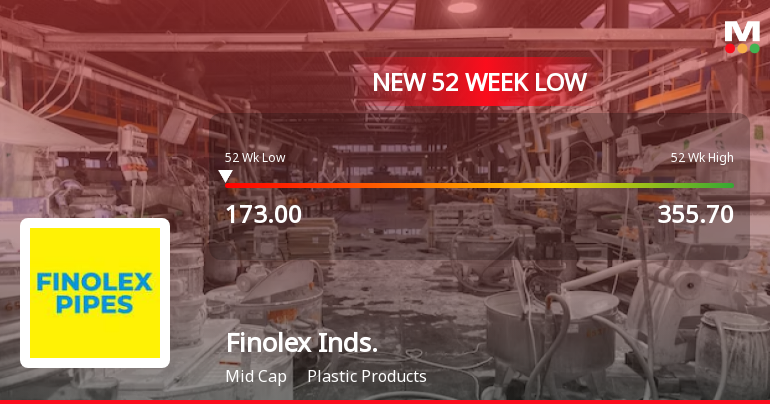

Finolex Industries Faces Persistent Downward Trend Amid Significant Market Volatility

2025-03-03 10:05:42Finolex Industries, a midcap in the plastic products sector, has hit a new 52-week low amid significant volatility, marking a 10.76% decline over the past six trading sessions. The stock has underperformed its sector and is trading below multiple moving averages, reflecting ongoing challenges in the market.

Read More

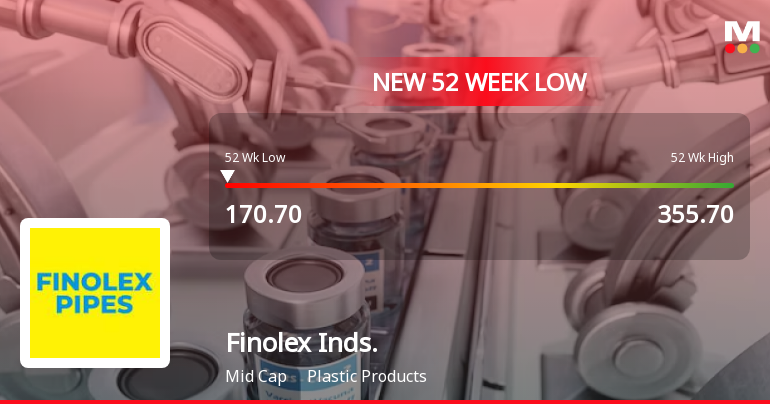

Finolex Industries Faces Significant Market Challenges Amidst Sustained Stock Decline

2025-02-28 09:35:42Finolex Industries has faced significant volatility, hitting a new 52-week low of Rs. 170.7. The stock has underperformed its sector and has seen a consecutive decline over the past five days. Additionally, it is trading below multiple moving averages, indicating ongoing challenges in the market.

Read More

Finolex Industries Faces Significant Volatility Amidst Ongoing Market Challenges

2025-02-27 09:35:21Finolex Industries has faced notable volatility, reaching a new 52-week low of Rs. 173 amid a 7.93% decline over the past four days. The stock is trading below key moving averages and has experienced a year-to-date drop of 20.06%, contrasting with the Sensex's gains.

Read More

Finolex Industries Hits 52-Week Low Amid Sustained Downward Trend in Stock Performance

2025-02-25 15:05:14Finolex Industries has reached a new 52-week low, reflecting a significant downturn in its stock performance. The company has seen a consecutive decline over the past three days, with a notable drop in returns. Its longer-term performance also shows a decline compared to the broader market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Announcement under Regulation 30 (LODR)-Change in Management

01-Apr-2025 | Source : BSEChange in Senior Management Personnel of the Company

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Trading Window Closure

Corporate Actions

No Upcoming Board Meetings

Finolex Industries Ltd has declared 125% dividend, ex-date: 11 Sep 24

Finolex Industries Ltd has announced 2:10 stock split, ex-date: 15 Apr 21

No Bonus history available

No Rights history available