Flair Writing Industries Faces Mixed Technical Trends Amid Market Volatility

2025-04-02 08:10:35Flair Writing Industries, a small-cap player in the printing and stationery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 236.25, showing a notable increase from the previous close of 224.85. Over the past week, Flair Writing has demonstrated a stock return of 1.44%, contrasting with a decline of 2.55% in the Sensex, indicating a relative outperformance in the short term. The technical summary reveals a mixed outlook, with the MACD indicating bearish momentum on a weekly basis, while the moving averages suggest a mildly bearish stance. The Bollinger Bands also reflect a mildly bearish trend, indicating some volatility in the stock's price movements. Notably, the Relative Strength Index (RSI) shows no significant signals on both weekly and monthly charts, suggesting a period of consolidation. In terms of longer-term performanc...

Read MoreFlair Writing Industries Adjusts Valuation Grade Amid Competitive Market Dynamics

2025-04-02 08:03:13Flair Writing Industries, a small-cap player in the Printing & Stationery sector, has recently undergone a valuation adjustment. The company's current price stands at 236.25, reflecting a notable increase from the previous close of 224.85. Over the past week, Flair Writing has shown a stock return of 1.44%, contrasting with a decline of 2.55% in the Sensex. Key financial metrics for Flair Writing include a PE ratio of 20.23 and an EV to EBITDA ratio of 12.53, which position the company favorably within its industry. The return on capital employed (ROCE) is reported at 16.57%, while the return on equity (ROE) stands at 11.78%. These figures indicate a solid operational performance relative to its peers. In comparison, Kokuyo Camlin, another player in the same sector, is currently evaluated at a higher valuation level, with a PE ratio of 89.19 and an EV to EBITDA of 25.18. This contrast highlights Flair Wri...

Read More

Flair Writing Industries Faces Technical Shift Amidst Flat Financial Performance and Investor Caution

2025-03-27 08:13:23Flair Writing Industries has experienced a recent evaluation adjustment due to shifts in technical indicators, including bearish signals. This change follows a quarter of flat financial performance and a decline in institutional investor participation, despite the company's long-term growth potential and low debt levels.

Read MoreFlair Writing Industries Faces Bearish Technical Trends Amid Mixed Performance Metrics

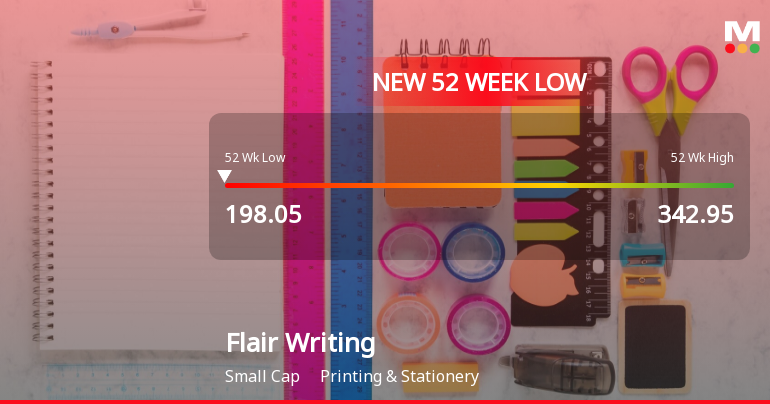

2025-03-27 08:04:12Flair Writing Industries, a small-cap player in the printing and stationery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 225.30, down from a previous close of 232.90, with a notable 52-week high of 342.95 and a low of 195.00. Today's trading saw a high of 239.40 and a low of 222.00, indicating some volatility. The technical summary reveals a bearish sentiment across several indicators. The MACD and Bollinger Bands are both signaling bearish trends on a weekly basis, while moving averages also reflect a bearish stance. The KST indicator aligns with this sentiment, further emphasizing the prevailing market conditions. Interestingly, the Dow Theory presents a mildly bullish outlook on a weekly basis, contrasting with the overall bearish trend. In terms of performance, Flair Writing's returns have shown a mixed picture when comp...

Read More

Flair Writing Industries Faces Technical Shift Amid Declining Institutional Interest

2025-03-24 08:11:03Flair Writing Industries has recently experienced a technical outlook adjustment, reflecting a mildly bearish sentiment. Despite this, the company boasts a low debt-to-equity ratio and strong long-term growth, with significant increases in net sales and operating profit. However, it has faced challenges, including reduced institutional investor participation and underperformance relative to the broader market.

Read MoreFlair Writing Industries Faces Mixed Technical Trends Amid Strong Short-Term Performance

2025-03-24 08:03:07Flair Writing Industries, a small-cap player in the printing and stationery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 236.00, showing a notable increase from the previous close of 226.10. Over the past week, Flair Writing has demonstrated a strong performance with a return of 15.54%, significantly outpacing the Sensex, which returned 4.17% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the moving averages indicate a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish sentiment, suggesting some caution in the market. The On-Balance Volume (OBV) shows a mildly bearish trend on a weekly basis, contrasting with a mildly bullish outlook on a monthly scale. Despite the recent fluctuations, Flair Writing's performance over the past month has yielded a return ...

Read MoreFlair Writing Industries Ltd Experiences Surge Amidst Positive Market Momentum

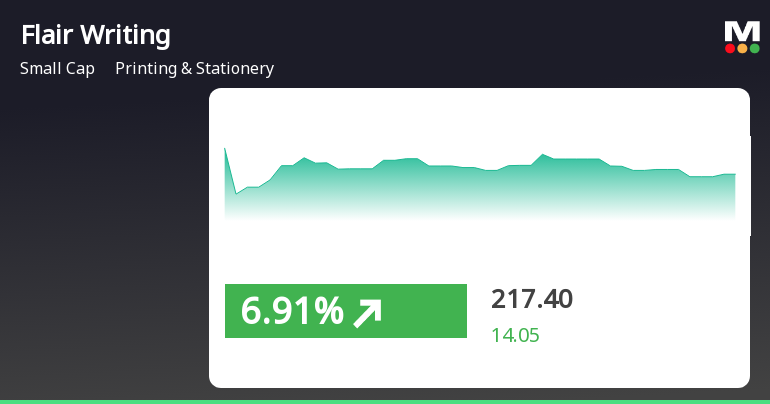

2025-03-19 10:01:01Flair Writing Industries Ltd, a small-cap player in the Printing & Stationery sector, has shown remarkable activity today, hitting its upper circuit limit. The stock reached an intraday high of Rs 223.75, reflecting a 10% increase from its previous close. This surge is part of a broader trend, as the stock has gained 10.77% over the last two days, outperforming its sector by 2.9%. Today, Flair Writing Industries opened with a notable gain of 3.41% and recorded a total traded volume of approximately 0.78116 lakh shares, resulting in a turnover of Rs 1.70 crore. The last traded price stood at Rs 219.60, with a change of Rs 16.19, or 7.96%. The stock's performance is further highlighted by its delivery volume, which saw a significant increase of 452.96% compared to the five-day average. While the stock is currently trading above its 5-day and 20-day moving averages, it remains below the longer-term averages...

Read More

Flair Writing Industries Sees Short-Term Gains Amid Long-Term Challenges in Small-Cap Sector

2025-03-19 09:35:29Flair Writing Industries, a small-cap company in the Printing & Stationery sector, experienced notable gains today, outperforming its sector. The stock showed short-term upward momentum with significant intraday increases. However, it has faced longer-term challenges, reflected in a year-to-date performance decline. The broader market also saw positive movement.

Read More

Flair Writing Industries Faces Continued Volatility Amid Declining Stock Performance

2025-03-17 12:07:26Flair Writing Industries has faced notable volatility, reaching a new 52-week low and experiencing a six-day losing streak. The stock has underperformed its sector and declined significantly over the past year. Despite challenges, the company shows healthy long-term growth and maintains a low debt-to-equity ratio.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSEWe are enclosing herewith the copy of the certificate received from our Registrar and Transfer Agent M/s. MUFG Intime India Private Limited (formerly Link Intime India Private Limited) for the quarter ended March 31 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window from Tuesday April 01 2025 till 48 hours after declaration of the audited financial results for the quarter and year ending on March 31 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

17-Mar-2025 | Source : BSESchedule of Investors meet.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available