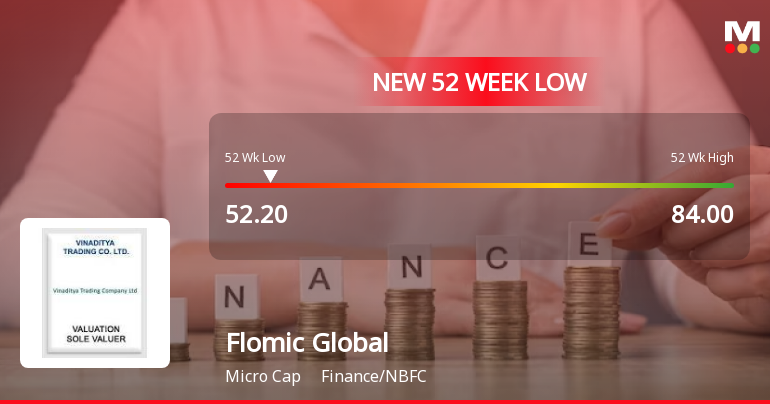

Flomic Global Logistics Faces Significant Volatility Amidst Strong Profit Growth and High Valuation

2025-03-28 10:35:51Flomic Global Logistics has faced significant volatility, reaching a new 52-week low and underperforming its sector. Despite a notable profit increase, the stock's high valuation and consistent underperformance against benchmarks raise concerns about its market position, even as its fundamentals indicate long-term potential.

Read MoreFlomic Global Logistics Adjusts Valuation Amid Mixed Financial Performance Trends

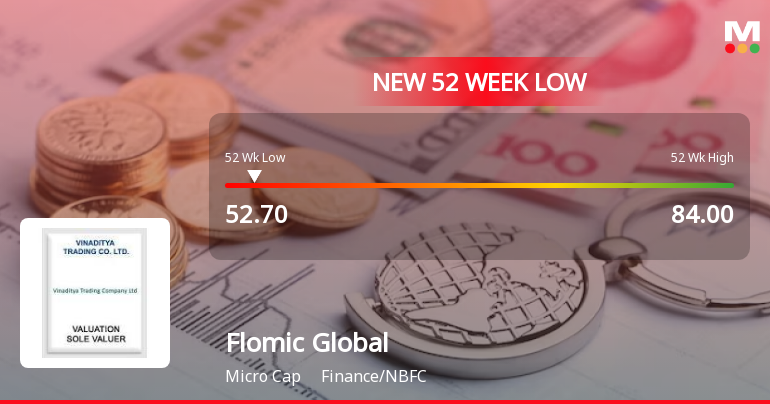

2025-03-13 08:00:18Flomic Global Logistics, a microcap player in the Finance/NBFC sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 62.27, up from a previous close of 57.15, with a 52-week high of 84.00 and a low of 52.70. Key financial metrics reveal a PE ratio of 31.96 and an EV to EBITDA of 5.23, indicating a robust valuation relative to its earnings. The PEG ratio is notably low at 0.18, suggesting potential for growth relative to its price. However, the company's return metrics show a mixed performance; while it has outperformed the Sensex over the past week and month, it has lagged behind over the year and in longer-term comparisons. In terms of peer performance, Flomic Global's valuation stands out, particularly when compared to companies like Abans Holdings and Centrum Capital, which exhibit different financial profiles. This c...

Read MoreFlomic Global Logistics Adjusts Valuation Amid Mixed Financial Performance Trends

2025-03-13 08:00:18Flomic Global Logistics, a microcap player in the Finance/NBFC sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 62.27, up from a previous close of 57.15, with a 52-week high of 84.00 and a low of 52.70. Key financial metrics reveal a PE ratio of 31.96 and an EV to EBITDA of 5.23, indicating a robust valuation relative to its earnings. The PEG ratio is notably low at 0.18, suggesting potential for growth relative to its price. However, the company's return metrics show a mixed performance; while it has outperformed the Sensex over the past week and month, it has lagged behind over the year and in longer-term comparisons. In terms of peer performance, Flomic Global's valuation stands out, particularly when compared to companies like Abans Holdings and Centrum Capital, which exhibit different financial profiles. This c...

Read MoreFlomic Global Logistics Adjusts Valuation Amidst Competitive Market Landscape

2025-03-06 08:00:24Flomic Global Logistics, a microcap player in the Finance/NBFC sector, has recently undergone a valuation adjustment. The company's current price stands at 58.41, reflecting a decline from its previous close of 60.00. Over the past year, Flomic has experienced a stock return of -25.43%, contrasting sharply with a slight gain of 0.07% in the Sensex during the same period. Key financial metrics for Flomic Global include a PE ratio of 29.98 and an EV to EBITDA ratio of 5.06. The company's return on capital employed (ROCE) is reported at 9.71%, while the return on equity (ROE) is at 8.07%. These figures indicate a competitive positioning within its industry, although they also highlight some challenges in performance relative to peers. In comparison, other companies in the sector exhibit a range of valuation metrics, with some showing significantly lower PE ratios and varying EV to EBITDA ratios. This context...

Read More

Flomic Global Logistics Faces Significant Volatility Amid Ongoing Market Challenges

2025-03-03 09:35:32Flomic Global Logistics, a microcap in the finance and NBFC sector, hit a new 52-week low today, reflecting significant volatility and underperformance compared to its sector. The stock has declined 29.90% over the past year, highlighting ongoing challenges as it trades below key moving averages.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEIntimation pursuant Regulation 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Investor Presentation

18-Mar-2025 | Source : BSEPursuant to Regulation 30 read with Part A of Schedule III of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we enclose herewith the Investor Presentation of our company.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Flomic Global Logistics Ltd has announced 47:1 bonus issue, ex-date: 15 Oct 15

No Rights history available