Force Motors Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:02:13Force Motors, a midcap player in the auto-trucks industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 9,252.00, showing a notable increase from the previous close of 8,884.95. Over the past year, Force Motors has demonstrated a robust performance, with a return of 22.52%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bullish signals on a weekly basis while remaining mildly bearish on a monthly scale. Bollinger Bands also reflect bullish trends for both weekly and monthly assessments. However, moving averages present a mildly bearish stance daily, suggesting some volatility in short-term performance. In terms of returns, Force Motors has excelled over various time frames, achieving a remarkable 743.70% return over t...

Read More

Force Motors Faces Technical Shift Amid Strong Financial Performance and Debt Concerns

2025-04-02 08:20:24Force Motors has recently experienced a change in its evaluation, reflecting a shift in the stock's technical landscape. Despite this adjustment, the company has shown strong financial performance, with significant growth in operating profit and a solid track record over the past ten quarters, although debt servicing remains a concern.

Read MoreForce Motors Exhibits Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:03:37Force Motors, a midcap player in the auto-trucks industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 8,884.95, having closed at 9,045.85 previously. Over the past year, Force Motors has demonstrated notable resilience, with a return of 17.87%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly outlook has shifted to a mildly bearish stance. The Bollinger Bands indicate a mildly bullish trend on both weekly and monthly charts, suggesting some volatility in price movements. The daily moving averages, however, reflect a mildly bearish sentiment, indicating mixed signals in the short term. Force Motors has shown impressive returns over longer periods, with a staggering 710.23% return over three years and an e...

Read More

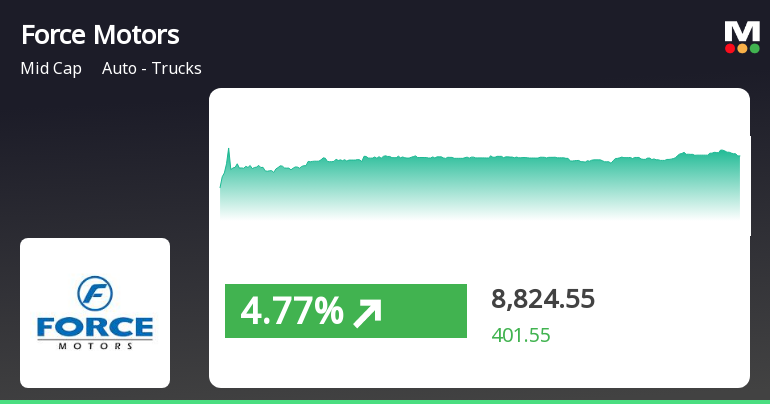

Force Motors Exhibits Strong Momentum Amidst Rising Market Trends

2025-03-24 13:15:23Force Motors has experienced notable stock performance, gaining 5.19% on March 24, 2025, and outperforming its sector. The stock has shown a remarkable 24.77% increase over the past five days and has consistently traded above key moving averages, reflecting strong momentum in a rising market.

Read More

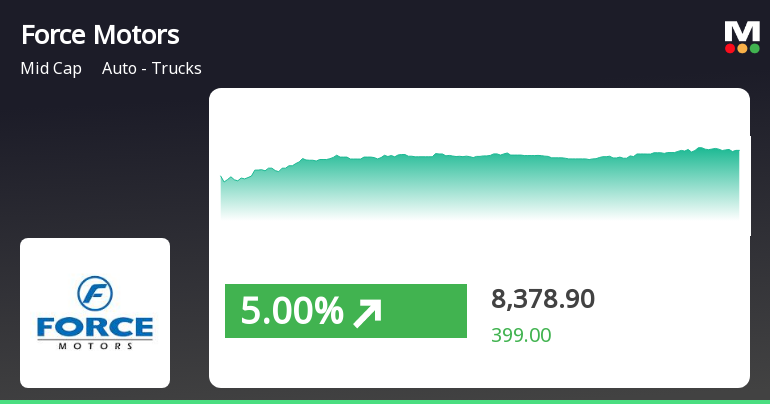

Force Motors Exhibits Strong Performance Amid Broader Market Recovery in Auto Sector

2025-03-21 11:45:21Force Motors has experienced notable gains, outperforming its sector and demonstrating a strong upward trend over the past four days. The stock is trading above all key moving averages, reflecting robust performance. The broader market has also shown positive movement, with significant gains in the Auto - Trucks sector and the BSE Small Cap index.

Read More

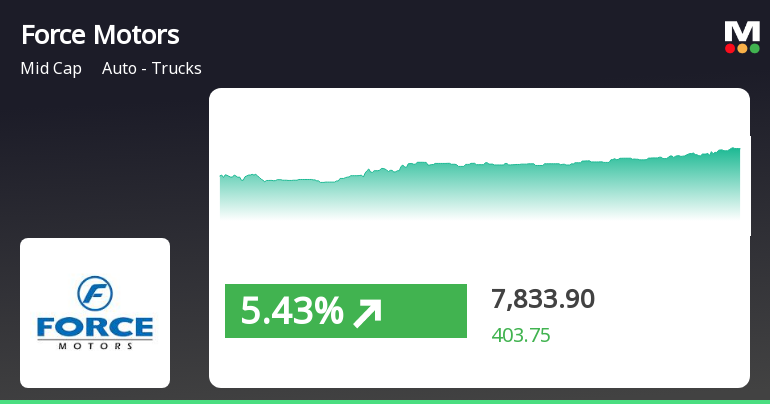

Force Motors Shows Strong Momentum Amid Broader Mid-Cap Market Gains

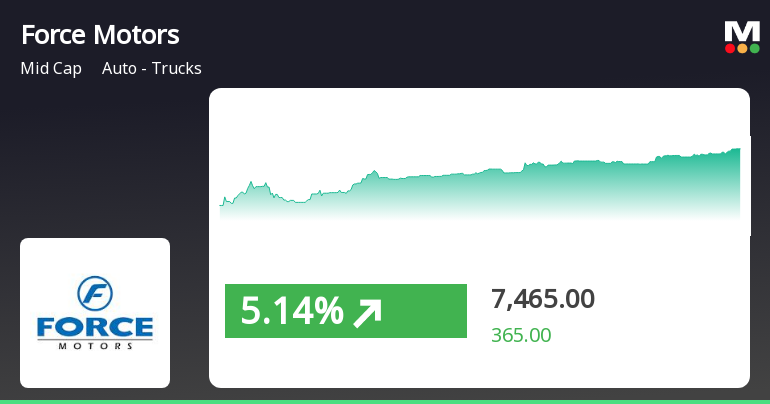

2025-03-19 14:00:54Force Motors has shown notable performance in the auto-trucks sector, gaining 5.11% on March 19, 2025, and achieving consecutive gains over two days. The stock is trading above multiple moving averages and has recorded a year-to-date increase of 20.07%, significantly outperforming the Sensex.

Read MoreForce Motors Shows Technical Trend Shifts Amid Market Volatility and Strong Performance

2025-03-19 08:01:52Force Motors, a midcap player in the auto-trucks industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 7,430.15, showing a notable increase from the previous close of 7,100.00. Over the past week, the stock has reached a high of 7,482.00 and a low of 7,100.05, indicating some volatility in trading. In terms of technical indicators, the weekly MACD and KST suggest a mildly bullish sentiment, while the monthly indicators present a mixed picture with some bearish signals. The Bollinger Bands are indicating bullish trends on both weekly and monthly charts, which may reflect positive market sentiment. The On-Balance Volume (OBV) also supports a mildly bullish outlook on a weekly basis. When comparing the stock's performance to the Sensex, Force Motors has demonstrated significant returns over various periods. Notably, in the last three ...

Read More

Force Motors Shows Strong Performance Amidst Broader Auto-Truck Sector Gains

2025-03-18 14:30:24Force Motors has experienced notable trading activity, outperforming its sector with a significant intraday high. The stock shows a mixed trend in short-term performance relative to longer-term averages. Over recent weeks and years, it has demonstrated substantial growth, significantly exceeding broader market indices.

Read MoreForce Motors Adjusts Evaluation Amid Mixed Technical Trends and Strong Long-Term Performance

2025-03-11 08:01:54Force Motors, a midcap player in the auto-trucks industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 7,515.00, down from a previous close of 7,659.55. Over the past year, Force Motors has demonstrated notable resilience, achieving a return of 15.89%, while the Sensex remained relatively flat with a return of -0.01%. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments, suggesting a lack of strong momentum in either direction. Bollinger Bands indicate a mildly bullish trend on a weekly basis, with a bullish outlook for the monthly timeframe. Force Motors has shown impressive long-term performance, particularly over three and five years, with returns of...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Announcement under Regulation 30 (LODR)-Monthly Business Updates

04-Apr-2025 | Source : BSEInformation in respect of sale and export of the products manufactured by the Company during the month of March 2025 being made available to the Government Authorities and association.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

27-Mar-2025 | Source : BSEAnnouncement under Regulation 30_Press Release

Corporate Actions

No Upcoming Board Meetings

Force Motors Ltd has declared 200% dividend, ex-date: 28 Aug 24

No Splits history available

No Bonus history available

No Rights history available