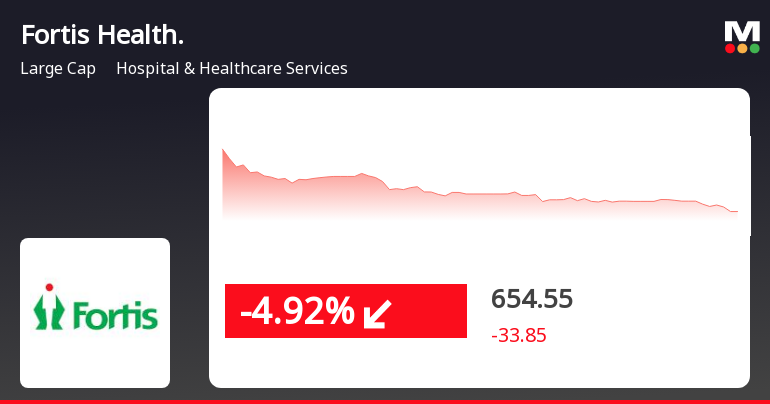

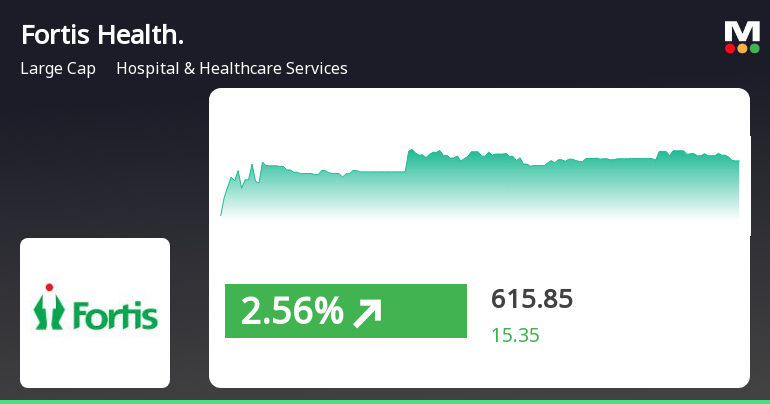

Fortis Healthcare Faces Short-Term Decline Amid Long-Term Resilience in Market

2025-04-02 09:50:21Fortis Healthcare's stock has faced a decline recently, marking two consecutive days of losses. Despite this, it remains above key moving averages, indicating a longer-term positive trend. Over the past year, the stock has shown significant growth, although it has encountered challenges year-to-date.

Read More

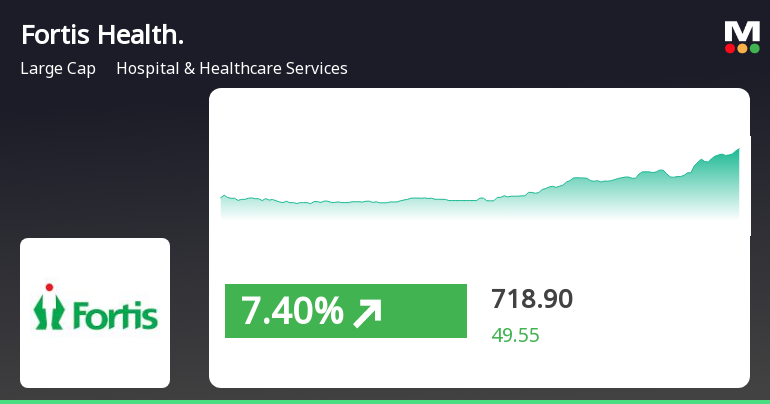

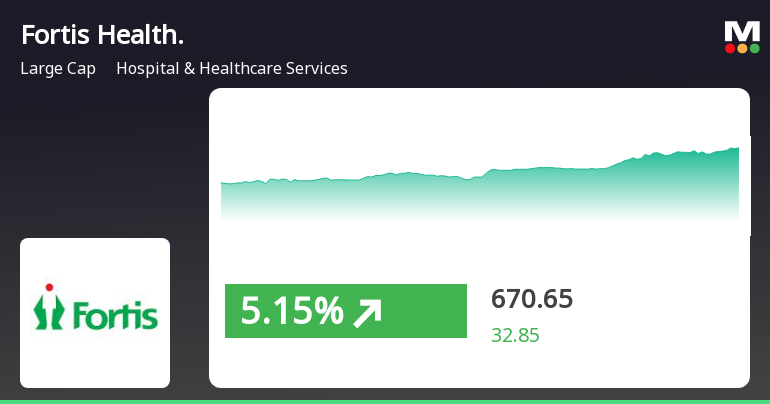

Fortis Healthcare Shows Strong Performance Amid Positive Market Trends in Healthcare Sector

2025-03-28 11:05:22Fortis Healthcare has demonstrated strong performance, gaining 3.28% on March 28, 2025, and outperforming its sector. The stock has achieved consecutive gains over three days, with a total return of 5.84%. It is trading above all key moving averages, indicating a solid position in the healthcare sector.

Read More

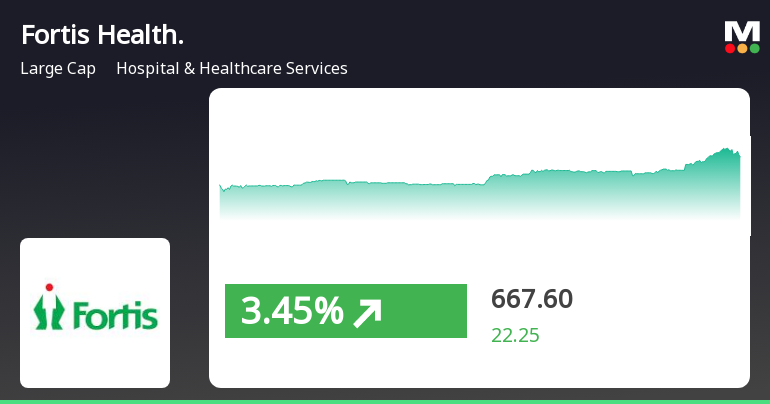

Fortis Healthcare Shows Strong Performance Amid Broader Market Recovery Trends

2025-03-27 15:20:27Fortis Healthcare has demonstrated strong performance, gaining 4.45% on March 27, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, with a notable increase of 63.34% over the past year, significantly surpassing the Sensex's growth during the same timeframe.

Read More

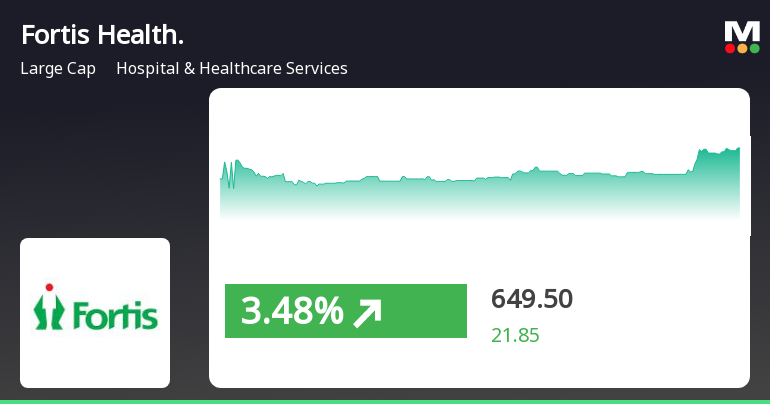

Fortis Healthcare Shows Strong Short-Term Gains Amid Broader Market Rally

2025-03-24 13:05:24Fortis Healthcare has demonstrated strong performance, gaining 3.23% on March 24, 2025, and outperforming its sector. The stock has seen consecutive gains over three days, with a total return of 5.84%. Over the past year, it has delivered a 60.25% return, significantly exceeding the Sensex's performance.

Read More

Fortis Healthcare Rebounds After Seven-Day Decline Amid Broader Market Gains

2025-03-18 11:35:24Fortis Healthcare experienced a rebound after seven days of decline, gaining 3.0% on March 18, 2025. The stock outperformed its sector and has shown strong annual growth of 54.07%, significantly exceeding the Sensex's performance. Long-term trends indicate a substantial increase over the past five years.

Read MoreFortis Healthcare Adjusts Valuation Grade Amid Mixed Industry Performance Metrics

2025-03-18 08:00:55Fortis Healthcare has recently undergone a valuation adjustment, reflecting its current standing within the Hospital & Healthcare Services industry. The company's price-to-earnings ratio stands at 57.45, while its price-to-book value is recorded at 5.78. Additionally, Fortis shows an EV to EBITDA ratio of 29.94 and an EV to EBIT of 39.66, indicating its operational performance metrics. In terms of returns, Fortis Healthcare has experienced a notable decline year-to-date, with a return of -16.55%, contrasting with the Sensex's -5.08% during the same period. However, over a longer horizon, the company has demonstrated strong performance, with a 54.25% return over the past year and an impressive 357.52% over the last five years. When compared to its peers, Fortis Healthcare's valuation metrics present a mixed picture. For instance, Max Healthcare is positioned at a significantly higher valuation, while Naray...

Read MoreFortis Healthcare Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-07 08:03:16Fortis Healthcare, a prominent player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 646.95, having experienced fluctuations with a previous close at 659.95. Over the past year, Fortis has demonstrated significant resilience, achieving a remarkable 70.00% return, notably outperforming the Sensex, which recorded a modest 0.34% return during the same period. In terms of technical indicators, the company shows a mixed picture. The Moving Averages indicate a mildly bullish sentiment on a daily basis, while the MACD and Bollinger Bands present a more cautious outlook on a weekly basis. The KST and Dow Theory also reflect varying trends, with some indicators suggesting a bullish stance on a monthly basis. Fortis Healthcare's performance over longer periods is particularly noteworthy, with a 334....

Read MoreFortis Healthcare Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-06 08:02:21Fortis Healthcare, a prominent player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 659.95, showing a notable increase from the previous close of 637.80. Over the past year, Fortis has demonstrated significant resilience, with a remarkable return of 72.29%, vastly outperforming the Sensex, which recorded a mere 0.07% return during the same period. In terms of technical indicators, the company exhibits a mixed performance across various metrics. The Moving Averages indicate a bullish sentiment on a daily basis, while the Bollinger Bands also reflect a bullish trend on both weekly and monthly scales. However, the MACD and KST present a more nuanced picture, with weekly readings showing mildly bearish tendencies, contrasting with their monthly bullish outlook. Fortis Healthcare's performance...

Read More

Fortis Healthcare's Strong Performance Highlights Divergence from Broader Market Trends

2025-03-05 11:10:27Fortis Healthcare has demonstrated strong performance, achieving notable gains over three consecutive days and significantly outperforming its sector. The stock is trading above multiple moving averages, indicating a positive trend. In contrast, the broader market, represented by the Sensex, has shown modest gains but remains below key moving averages.

Read MoreDisclosure Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

03-Apr-2025 | Source : BSEThe relevant disclosure with respect to Demand Letter received by International Hospitals Limited (an Indirect wholly owned subsidiary of the Company) from Income Tax Department is attached.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEPlease find enclosed certificate under Regulation 74(5) of SEBI (DP) regulations 2018.

Disclosure Under Regulation 30 Of SEBI (Listing Obligations & Disclosure Requirements) - Regarding Fortis Trademarks And Allied Trademarks.

02-Apr-2025 | Source : BSEThe relevant disclosure with respect to Fortis Trademarks and Allied Trademarks is attached.

Corporate Actions

No Upcoming Board Meetings

Fortis Healthcare Ltd has declared 10% dividend, ex-date: 24 Jul 24

No Splits history available

No Bonus history available

Fortis Healthcare Ltd has announced 2:5 rights issue, ex-date: 18 Aug 09