Foseco India Faces Bearish Technical Trends Amid Market Volatility

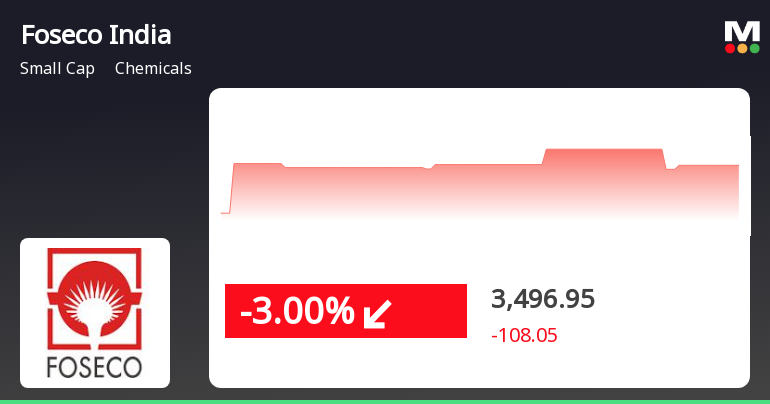

2025-03-26 08:02:10Foseco India, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 3,550.00, has seen fluctuations with a 52-week high of 5,425.00 and a low of 2,903.20. Today's trading session recorded a high of 3,701.20 and a low of 3,550.00, indicating some volatility. The technical summary for Foseco India reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and KST indicators also reflect bearish tendencies. The moving averages on a daily basis align with this sentiment, suggesting a cautious outlook. In terms of performance, Foseco India has shown varied returns compared to the Sensex. Over the past year, the stock has delivered an 18.32% return, significantly outperforming the Sen...

Read MoreFoseco India Shows Mixed Technical Trends Amid Strong Performance Resilience

2025-03-24 08:01:13Foseco India, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,739.05, showing a notable increase from the previous close of 3,620.00. Over the past week, Foseco India has demonstrated a strong performance, with a return of 8.67%, significantly outpacing the Sensex's return of 4.17% during the same period. In terms of technical indicators, the MACD and KST metrics indicate a bearish sentiment on a weekly basis, while the monthly outlook shows a mildly bearish trend. The Bollinger Bands and moving averages also reflect a mildly bearish stance, suggesting a cautious market environment. Notably, the On-Balance Volume (OBV) indicates a mildly bullish trend on a weekly basis, contrasting with the monthly bearish outlook. Foseco India's performance over various time frames highlights its resilie...

Read MoreFoseco India Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-21 08:01:29Foseco India, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,620.00, down from a previous close of 3,728.00, with a notable 52-week high of 5,425.00 and a low of 2,903.20. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands and KST also reflect a similar mildly bearish stance on a monthly basis. Notably, the On-Balance Volume (OBV) presents a mildly bullish outlook on a weekly basis, contrasting with its monthly bearish trend. In terms of performance, Foseco India has shown resilience over various time frames. Over the past week, the stock returned 5.21%, outperforming the Sensex, which returned 3.41%. In the last month, Foseco's return was 5.67%, significantly higher th...

Read MoreFoseco India Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-20 08:01:33Foseco India, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,728.00, showing a notable increase from the previous close of 3,520.00. Over the past year, Foseco India has demonstrated a robust performance with a return of 27.52%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments, indicating a neutral momentum. Bollinger Bands and moving averages also reflect a mildly bearish sentiment on a weekly basis. The KST and On-Balance Volume (OBV) metrics further support this cautious stance, with both showing bearish tendencies in the weekly analysis. Fose...

Read More

Foseco India Ltd. Exhibits Strong Resilience Amid Market Volatility and Sector Gains

2025-03-10 12:05:16Foseco India Ltd., a small-cap chemicals company, experienced notable activity on March 10, 2025, with a significant rebound after an initial loss. The stock has shown consecutive gains over four days, outperforming its sector. It remains above several short-term moving averages, indicating positive momentum amidst market fluctuations.

Read MoreFoseco India Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-10 08:01:04Foseco India, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3609.20, showing a notable increase from the previous close of 3527.95. Over the past year, Foseco India has demonstrated resilience with a return of 10.59%, significantly outperforming the Sensex, which recorded a mere 0.29% return in the same period. In terms of technical indicators, the weekly MACD and KST are positioned in a bearish trend, while the monthly indicators show a mildly bearish stance. The Bollinger Bands also reflect a mildly bearish outlook on a weekly and monthly basis. Daily moving averages indicate a bearish trend, suggesting a cautious market sentiment. Foseco India's performance over various time frames highlights its volatility, with a remarkable 178.19% return over three years and an impressive 188.72% ov...

Read MoreFoseco India Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-07 08:02:04Foseco India, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,527.95, showing a notable increase from the previous close of 3,405.00. Over the past year, Foseco India has demonstrated resilience with a return of 6.55%, outperforming the Sensex, which recorded a modest gain of 0.34%. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates a bullish stance on a weekly basis, but shows no signal for the monthly period. Bollinger Bands and KST also reflect a mildly bearish trend on both weekly and monthly scales, while the On-Balance Volume (OBV) suggests a mildly bullish sentiment in the short term. Foseco India’s performance over various time frames highlights its strong historical returns, p...

Read More

Foseco India Reports Mixed Financial Results with Record Profit Amid Income Concerns in December'24

2025-02-28 23:45:25Foseco India has reported its financial results for the quarter ending December 2024, achieving its highest Profit After Tax in five quarters at Rs 19.55 crore and a peak Earnings per Share of Rs 30.59. However, concerns arise from a significant increase in Non-Operating Income, prompting questions about sustainability.

Read MoreCompanys Reply In Reference To The Clarification Sought By The Stock Exchange

09-Apr-2025 | Source : BSESee the attachment

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Change in Management

04-Apr-2025 | Source : BSE1. Change in Secretarial Auditor 2. Change in Senior Management Personnel

Corporate Actions

14 May 2025

Foseco India Ltd. has declared 250% dividend, ex-date: 04 Jun 24

No Splits history available

No Bonus history available

No Rights history available