Gala Precision Engineering Faces Mixed Technical Signals Amid Market Volatility

2025-03-28 08:04:17Gala Precision Engineering, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 817.00, down from a previous close of 849.95, with a notable 52-week high of 1,480.80 and a low of 685.60. Today's trading saw a high of 864.95 and a low of 814.75, indicating some volatility in its performance. The technical summary reveals mixed signals across various indicators. The MACD and KST show no definitive trends, while the Bollinger Bands indicate a bearish stance on a weekly basis. The Dow Theory and On-Balance Volume (OBV) suggest a mildly bullish outlook on a weekly basis, although the overall technical landscape remains complex. In terms of performance, Gala Precision Engineering has faced challenges compared to the Sensex. Over the past week, the stock has returned -5.22%, w...

Read More

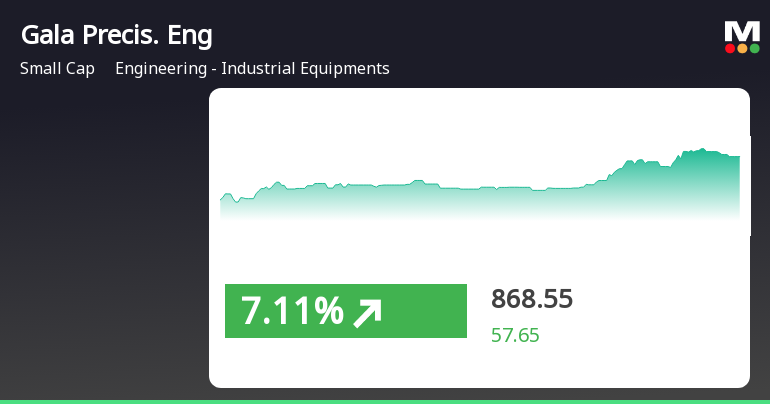

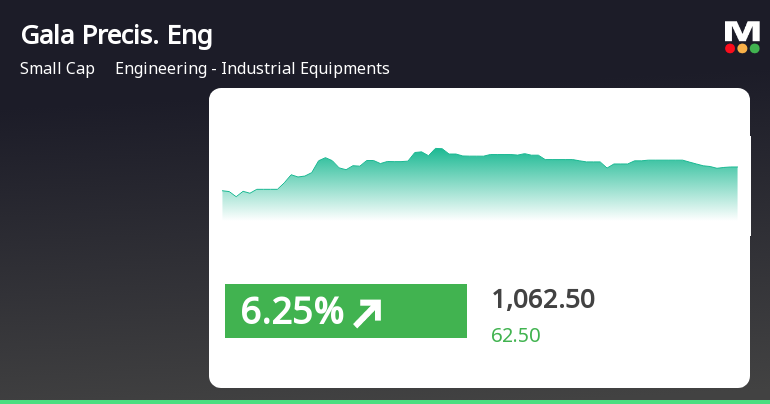

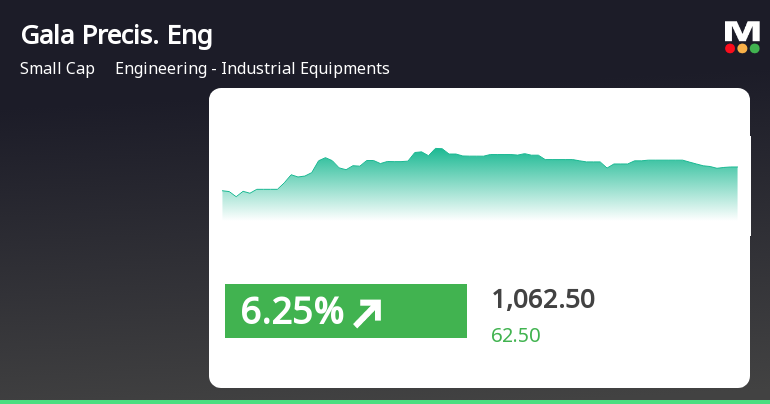

Gala Precision Engineering Shows Strong Short-Term Gains Amid Long-Term Challenges

2025-03-19 12:35:30Gala Precision Engineering experienced notable stock activity, rising significantly on March 19, 2025, and outperforming its sector. The stock has gained for two consecutive days, achieving a total return of 10.07%. Despite today's gains, it remains down for the year, reflecting longer-term challenges.

Read MoreGala Precision Engineering Faces Technical Challenges Amidst Market Volatility

2025-03-06 08:03:23Gala Precision Engineering, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 840.00, down from a previous close of 848.00, with a notable 52-week high of 1,480.80 and a low of 685.60. Today's trading saw a high of 900.00 and a low of 840.00, indicating some volatility. The technical summary reveals a mixed picture, with the MACD and KST showing no significant signals on both weekly and monthly charts. The Relative Strength Index (RSI) also indicates no signal on a weekly basis, while the Bollinger Bands suggest a bearish trend on the weekly timeframe. Additionally, the On-Balance Volume (OBV) and Dow Theory metrics are both categorized as mildly bearish on a weekly basis. In terms of performance, Gala Precision Engineering has faced challenges compared to the Sensex....

Read More

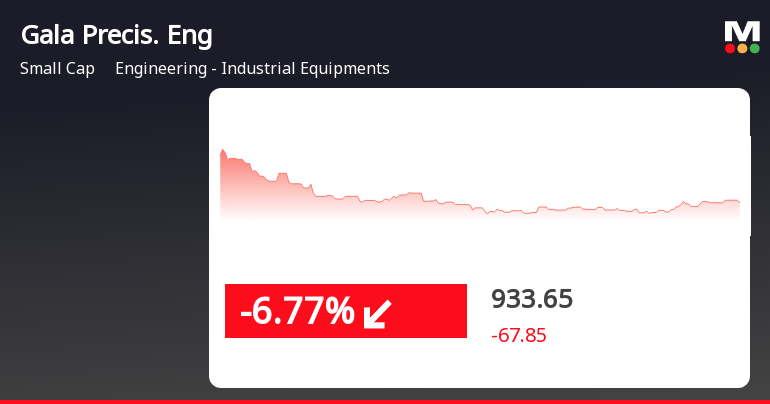

Gala Precision Engineering Faces High Volatility Amidst Sector Underperformance

2025-03-03 11:05:32Gala Precision Engineering's stock has faced notable volatility, declining significantly during trading. The company has underperformed its sector and is trading below key moving averages, reflecting a bearish trend. Over the past month, its stock has decreased, highlighting challenges in a competitive market environment.

Read More

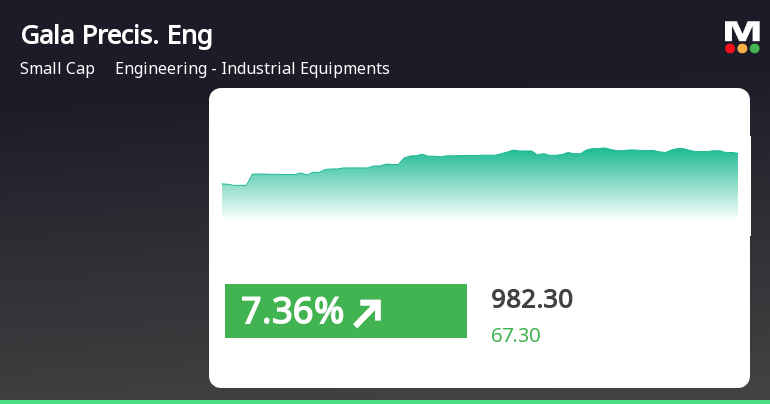

Gala Precision Engineering Shows Signs of Trend Reversal Amid Mixed Performance Signals

2025-02-19 10:20:34Gala Precision Engineering saw a significant rebound on February 19, 2025, after three days of decline, with an intraday high of Rs 990.95. Despite outperforming its sector, the stock has faced a monthly decline. Its moving averages present mixed signals regarding its performance trajectory.

Read More

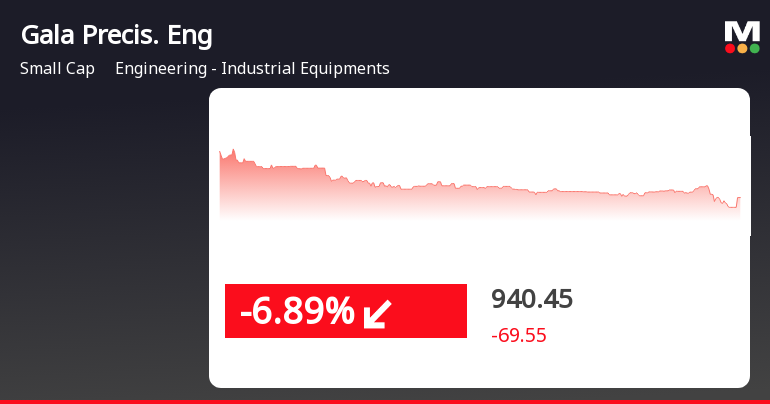

Gala Precision Engineering Faces Significant Challenges Amidst Sector Decline in February 2025

2025-02-14 15:35:26Gala Precision Engineering's shares fell significantly on February 14, 2025, underperforming the broader sector. The stock exhibited high volatility, reaching an intraday low and consistently trading below key moving averages. Over the past month, it has declined notably, reflecting ongoing challenges in the industrial equipment market.

Read More

Gala Precision Engineering Reports Stable Financial Performance Amid Mixed Results in February 2025

2025-02-12 17:49:56Gala Precision Engineering announced its financial results for the quarter ending December 2024, highlighting stable performance. The operating profit to interest ratio reached a five-quarter high, while net sales peaked at Rs 58.12 crore. However, profit before tax declined, raising concerns about sustainability in non-operating income.

Read More

Gala Precision Engineering Sees Market Reversal Amid Mixed Performance Indicators

2025-02-04 09:50:23Gala Precision Engineering experienced notable trading activity, reversing a two-day decline with a significant intraday high. The stock outperformed its sector, although it has seen a substantial decline over the past month. Its moving averages indicate mixed trends, reflecting the current dynamics in the engineering and industrial equipment sector.

Read More

Gala Precision Engineering Sees Market Reversal Amid Mixed Performance Indicators

2025-02-04 09:50:23Gala Precision Engineering experienced notable trading activity, reversing a two-day decline with a significant intraday high. The stock outperformed its sector, although it has seen a substantial decline over the past month. Its moving averages indicate mixed trends, reflecting the current dynamics in the engineering and industrial equipment sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulations 74(5) of SEBI(Depositories & Participants) Regulations 2018 for the Quater ended March 31 2025

Closure of Trading Window

25-Mar-2025 | Source : BSEClosing of Trading Window

Announcement under Regulation 30 (LODR)-Investor Presentation

19-Mar-2025 | Source : BSEUpdated Investor presentation for march 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available