Galactico Corporate Services Adjusts Valuation Grade Amidst Market Challenges and Peer Comparison

2025-03-28 08:00:49Galactico Corporate Services, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 2.39, with a 52-week range between 2.21 and 4.89. Key financial metrics reveal a price-to-earnings (PE) ratio of 15.76 and an EV to EBITDA ratio of 20.31, indicating a competitive position within its industry. In comparison to its peers, Galactico's valuation metrics present a more favorable outlook. For instance, Fedders Holding, categorized as fair, has a significantly higher PE ratio of 23.43, while Centrum Capital and Adit Birla Money are marked as very expensive, with PE ratios of NA and 11.61, respectively. Additionally, Galactico's return metrics show a stark contrast to the Sensex, with a year-to-date decline of 29.91% compared to the index's slight decrease of 0.68%. Overall, the evaluation revision ref...

Read More

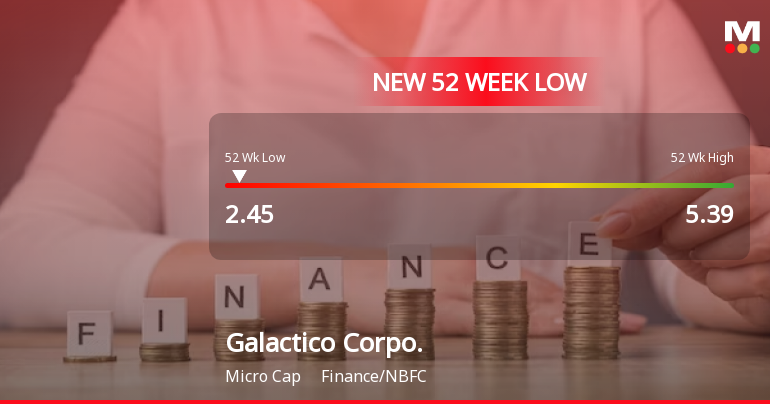

Galactico Corporate Services Hits 52-Week Low Amidst Ongoing Financial Struggles

2025-03-13 10:37:57Galactico Corporate Services, a microcap in the finance and NBFC sector, has reached a new 52-week low, continuing a five-day losing streak. Over the past year, the stock has declined significantly, contrasting with broader market gains, while the company reports a notable drop in profits despite some growth in operating profits.

Read MoreGalactico Corporate Services Adjusts Valuation Amidst Mixed Stock Performance Trends

2025-03-06 08:01:25Galactico Corporate Services, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 2.78, reflecting a notable shift from its previous close of 2.60. Over the past year, Galactico has experienced a significant decline in stock performance, with a return of -38.22%, contrasting sharply with a slight gain of 0.07% in the Sensex during the same period. Key financial metrics for Galactico include a PE ratio of 18.33 and an EV to EBITDA ratio of 22.32, which position it within a competitive landscape. In comparison to its peers, Galactico's valuation metrics indicate a higher relative standing, particularly when looking at companies like Vardhman Holdings and Indl. & Prud. Inv., which exhibit varying valuation profiles. Despite the challenges reflected in its stock performance, Galactico's long-ter...

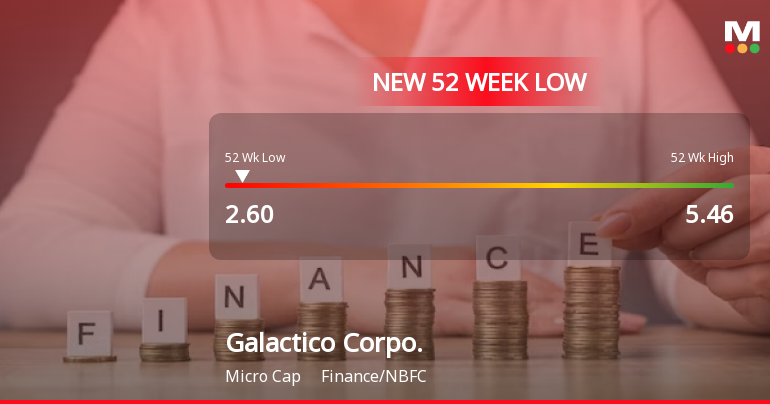

Read MoreGalactico Corporate Services Faces Valuation Grade Change Amidst Market Challenges

2025-02-24 12:57:54Galactico Corporate Services, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 2.93, reflecting a decline from its previous close of 3.07. Over the past year, Galactico has experienced a significant drop in stock value, with a return of -41.05%, contrasting sharply with a modest gain of 1.96% in the Sensex. Key financial metrics reveal a PE ratio of 20.24 and an EV to EBITDA ratio of 23.82, indicating a complex market position. The company's return on capital employed (ROCE) is recorded at 3.26%, while the return on equity (ROE) is at 5.89%. These figures suggest a challenging environment for Galactico, particularly when compared to its peers. In the competitive landscape, companies like Dhunseri Investments and Abans Holdings exhibit more favorable valuation metrics, with lower PE ratios...

Read More

Galactico Corporate Services Faces Persistent Downturn Amid Market Volatility Challenges

2025-02-18 14:05:27Galactico Corporate Services, a microcap in the finance and NBFC sector, has hit a new 52-week low, reflecting significant volatility and a 20.2% decline over the past eight days. The company is trading below all key moving averages and has seen a 52.54% drop in its one-year performance.

Read More

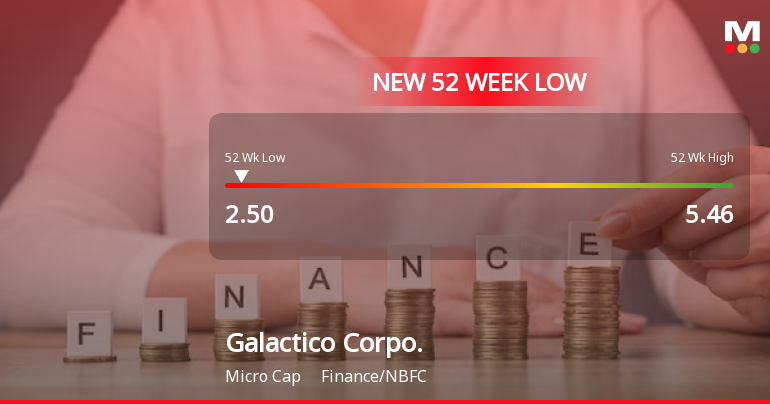

Galactico Corporate Services Faces Significant Stock Volatility Amidst Market Challenges

2025-02-17 10:36:18Galactico Corporate Services, a microcap in the finance and NBFC sector, has hit a new 52-week low, reflecting significant volatility. The stock has underperformed its sector and faced consecutive weekly losses, with a notable decline over the past year, contrasting sharply with broader market trends.

Read More

Galactico Corporate Services Faces Continued Volatility Amid Significant Stock Decline in October 2023

2025-02-14 12:35:50Galactico Corporate Services, a microcap in the finance and NBFC sector, has hit a new 52-week low, marking six consecutive days of losses and a significant one-year decline. Despite outperforming its sector slightly today, the company's overall performance remains concerning compared to the broader market.

Read More

Galactico Corporate Services Reports Strongest Quarterly Profit in Five Quarters

2025-01-29 10:03:27Galactico Corporate Services has announced its financial results for the quarter ending December 2024, revealing a Profit After Tax of Rs 0.72 crore, the highest in five quarters. The Earnings per Share also reached a peak of Rs 0.05, indicating improved profitability and earnings for shareholders.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Board Meeting Outcome for Outcome Of Board Meeting Dated March 31 2025 For Approval Of Scheme Of Arrangement

31-Mar-2025 | Source : BSEOutcome of Board Meeting dated March 31 2025 for approval of Scheme of Arrangement

Beembox Technologies Private Limited A Subsidiary Of The Company Ceasing To Be A Subsidiary Of The Company By Virtue Of Transfer Of Debentures.

29-Mar-2025 | Source : BSEBeembox Technologies Private Limited a subsidiary of the Company ceasing to be a subsidiary of the Company by virtue of transfer of debentures

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Galactico Corporate Services Ltd has announced 1:10 stock split, ex-date: 16 Jun 22

Galactico Corporate Services Ltd has announced 3:10 bonus issue, ex-date: 16 Jun 22

No Rights history available