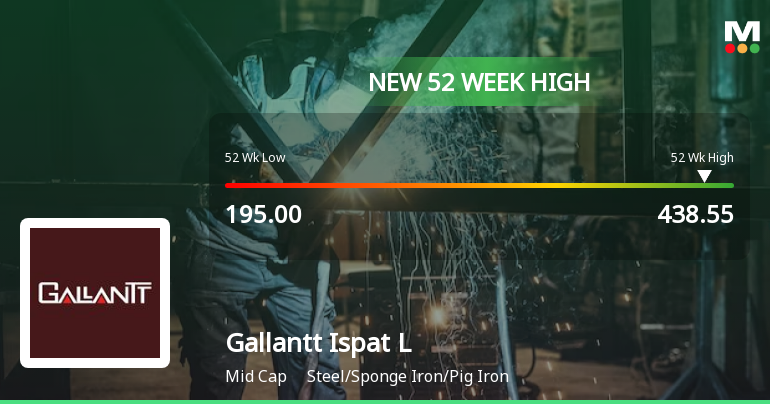

Gallantt Ispat Achieves 52-Week High Amid Broader Market Volatility

2025-04-03 09:39:18Gallantt Ispat Ltd. has reached a new 52-week high of Rs. 438.55, reflecting a strong performance with a 21.6% gain over four days. The stock is trading above key moving averages and has shown a significant one-year return of 111.69%, outperforming the broader market.

Read More

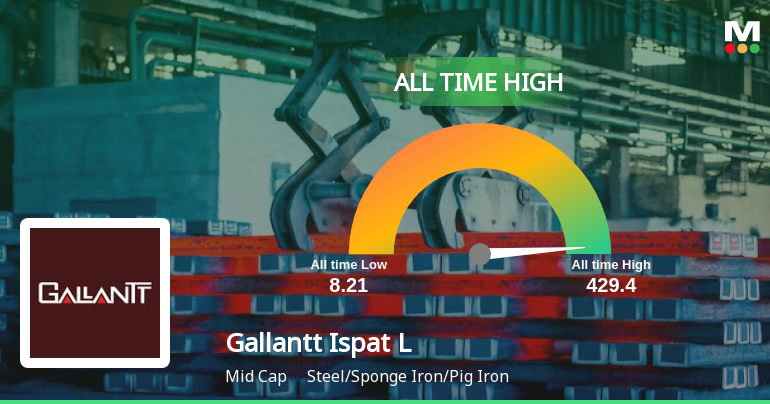

Gallantt Ispat Stock Reaches All-Time High, Signaling Strong Market Position and Growth

2025-04-03 09:30:45Gallantt Ispat has reached an all-time high stock price of Rs. 435, reflecting strong performance in the Steel/Sponge Iron/Pig Iron industry. The company has shown resilience despite intraday volatility and has outperformed its sector, with impressive returns over the past year and five years, indicating robust market presence.

Read More

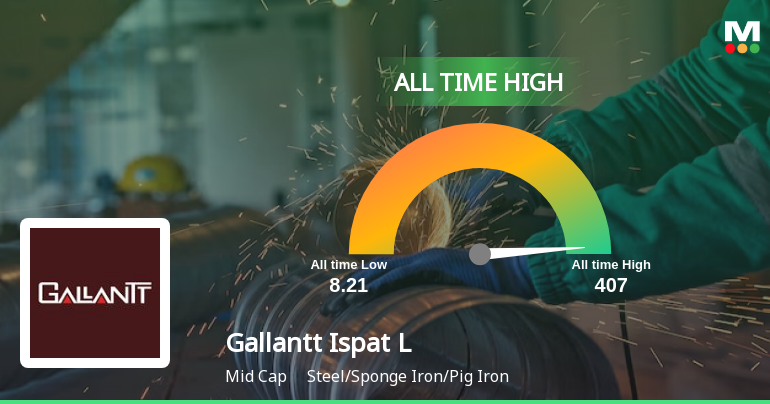

Gallantt Ispat Stock Reaches All-Time High, Signaling Strong Market Confidence

2025-04-02 09:30:42Gallantt Ispat Ltd. has reached an all-time high stock price of Rs. 428, marking a significant achievement for the company. Over the past three days, the stock has shown a strong upward trend, with notable increases in returns and high volatility, outperforming its sector and the Sensex.

Read MoreGallantt Ispat Adjusts Valuation Grade Amid Strong Stock Performance and Competitive Metrics

2025-04-02 08:02:05Gallantt Ispat, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone a valuation adjustment. The company's current price stands at 410.00, reflecting a notable performance with a 52-week high of 413.95 and a low of 192.65. Over the past year, Gallantt Ispat has demonstrated impressive stock returns, achieving a remarkable 108.23%, significantly outperforming the Sensex, which recorded a modest 2.72% return in the same period. Key financial metrics for Gallantt Ispat include a PE ratio of 26.05 and an EV to EBITDA ratio of 14.73. The company also boasts a return on capital employed (ROCE) of 16.15% and a return on equity (ROE) of 12.13%. In comparison to its peers, Gallantt Ispat's valuation metrics indicate a competitive position within the industry, particularly when juxtaposed with companies like Sarda Energy and Ratnamani Metals, which exhibit higher valuation ratios. This ...

Read More

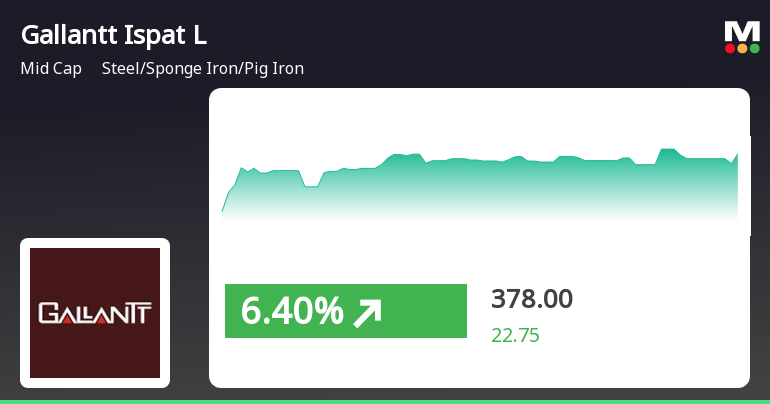

Gallantt Ispat Achieves 52-Week High Amid Broader Market Decline

2025-04-01 14:37:04Gallantt Ispat has reached a new 52-week high of Rs. 407, reflecting a strong performance boost with a 14.31% return over two days. Despite broader market challenges, the company has outperformed its sector and demonstrated significant recovery from its 52-week low of Rs. 192.65.

Read More

Gallantt Ispat Reaches All-Time High, Signaling Strong Market Momentum and Growth Potential

2025-04-01 14:30:46Gallantt Ispat, a midcap player in the steel industry, reached an all-time high on April 1, 2025, after rebounding from an initial loss. The stock has outperformed its sector and demonstrated impressive returns over various time frames, indicating a strong upward trend and robust market position.

Read More

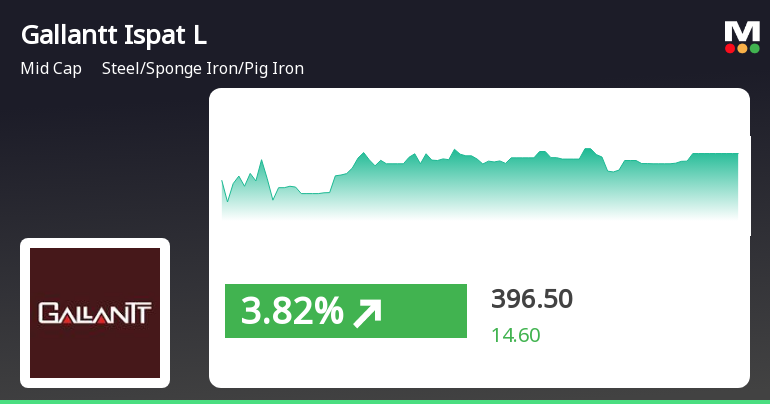

Gallantt Ispat Shows Strong Resilience Amid Broader Market Decline

2025-04-01 10:15:36Gallantt Ispat Ltd., a midcap steel and sponge iron company, has shown notable resilience, rebounding from an early loss to achieve significant gains. The stock is trading near its 52-week high and has outperformed the broader market, reflecting strong momentum and positive trends in moving averages.

Read More

Gallantt Ispat Ltd. Shows Strong Resilience Amid Broader Market Downturn

2025-03-28 09:50:16Gallantt Ispat Ltd., a midcap player in the steel industry, has experienced notable stock performance, significantly outperforming its sector. The company is trading above key moving averages, indicating a strong upward trend. Despite broader market declines, Gallantt Ispat has shown impressive gains over various timeframes, highlighting its robust growth.

Read More

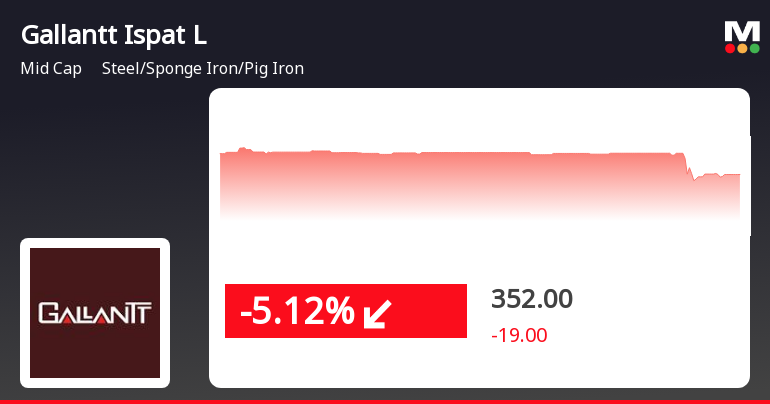

Gallantt Ispat Faces Short-Term Decline Amid Strong Long-Term Performance Trends

2025-03-27 14:50:17Gallantt Ispat, a midcap player in the steel industry, saw a decline on March 27, 2025, following three days of gains. Despite this drop, the stock remains above key moving averages, indicating a generally positive long-term trend. Over the past year, it has significantly outperformed the broader market.

Read MoreCancellation of Board Meeting

08-Apr-2025 | Source : BSEThe Board Meeting to be held on 09/04/2025 Stands Cancelled.

Board Meeting Intimation for Consideration And Approval Of Expansion In The Capacities Of Various Manufacturing Units Of The Company

03-Apr-2025 | Source : BSEGallantt Ispat Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 09/04/2025 inter alia to consider and approve expansion in the capacities of various manufacturing units of the Company situated at Gorakhpur Uttar Pradesh

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 28 2025 for Dinesh R Agarwal

Corporate Actions

No Upcoming Board Meetings

Gallantt Ispat Ltd. has declared 10% dividend, ex-date: 23 Sep 24

No Splits history available

No Bonus history available

No Rights history available