Gamco Ltd Faces Significant Volatility Amidst Declining Sales and High Debt Concerns

2025-04-02 10:36:47Gamco Ltd has faced significant volatility, reaching a new 52-week low amid a challenging year marked by an 83.59% decline in stock price and a 91.98% drop in net sales. Financial metrics reveal low management efficiency and high debt concerns, despite some long-term growth potential.

Read More

Visco Trade Associates Faces Financial Challenges Amid Declining Sales and Market Sentiment Shift

2025-03-24 08:09:10Visco Trade Associates has recently experienced an evaluation adjustment reflecting changes in its financial metrics and market position. The company's valuation grade has been revised to a fair level amid declining net sales and a challenging operating environment, alongside bearish technical indicators and concerns over profitability and debt management.

Read MoreVisco Trade Associates Adjusts Valuation Amidst Competitive Trading Sector Dynamics

2025-03-24 08:00:57Visco Trade Associates, a microcap player in the trading industry, has recently undergone a valuation adjustment, reflecting shifts in its financial metrics. The company's price-to-earnings (PE) ratio stands at 9.40, while its price-to-book value is recorded at 2.29. Other notable metrics include an enterprise value to EBITDA ratio of 8.99 and a return on equity (ROE) of 38.21%. In comparison to its peers, Visco Trade's valuation metrics reveal a distinct positioning. For instance, Sat Industries holds a higher PE ratio of 19.75, while Kamdhenu maintains a PE of 15.15. The enterprise value to EBITDA ratios also vary significantly, with STEL Holdings at 37.04, indicating a more premium valuation compared to Visco Trade. Despite recent challenges reflected in its stock performance—showing a decline of 76.9% over the past year—Visco Trade's long-term performance remains noteworthy, with a 221.99% return ov...

Read MoreVisco Trade Associates Faces Significant Buying Activity Amidst Recent Price Declines

2025-03-21 09:40:13Visco Trade Associates Ltd is currently experiencing significant buying activity, despite its recent performance showing a stark contrast to the broader market. The stock has faced consecutive declines, losing 53.65% over the last two days, and today it opened with a substantial gap down of 57.79%, hitting a new 52-week low of Rs. 41.5. In terms of performance, Visco Trade Associates has underperformed relative to the Sensex across various time frames. Over the past day, the stock declined by 47.12%, while the Sensex saw a modest gain of 0.23%. The one-week performance shows a drop of 33.35% for Visco, compared to a 3.65% increase in the Sensex. Over the past month, the stock is down 38.56%, while the Sensex has risen by 1.61%. Factors contributing to the current buying pressure may include market volatility, as evidenced by an intraday volatility of 7.26%. Additionally, the stock's performance relative...

Read More

Visco Trade Associates Faces Severe Volatility Amidst Plummeting Sales and Profitability Concerns

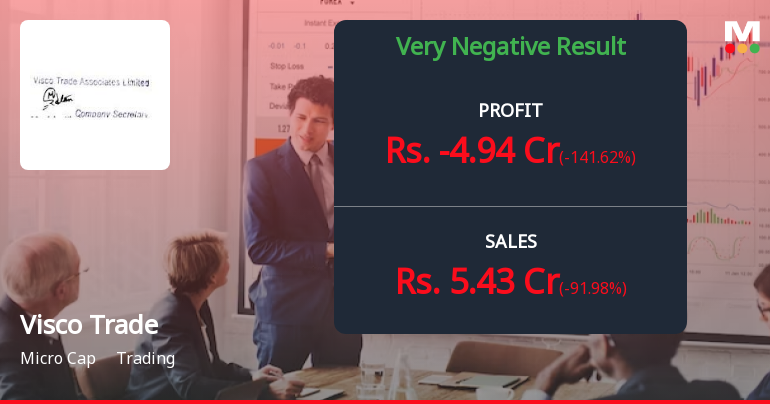

2025-03-21 09:37:29Visco Trade Associates has faced significant volatility, reaching a new 52-week low amid a sharp decline in net sales and profitability. The company reported a substantial quarterly loss and a low return on capital employed, alongside a high debt-to-EBITDA ratio, raising concerns about its financial stability.

Read More

Visco Trade Associates Faces Declining Sales and Profitability Amid Technical Shift

2025-03-20 08:08:51Visco Trade Associates, a microcap trading company, has recently adjusted its evaluation amid a challenging financial landscape. The company reported a significant decline in net sales and profitability, alongside a constrained debt servicing capability. Despite these issues, it has shown long-term growth potential with increasing net sales.

Read More

Visco Trade Associates Reports Significant Financial Decline for December Quarter

2025-01-28 18:16:58Visco Trade Associates has announced its financial results for the quarter ending December 2024, highlighting significant challenges. Net sales fell to Rs 5.43 crore, with profit before tax at Rs -6.26 crore. The company also reported a decline in operating profit and a negative debtors turnover ratio, indicating operational difficulties.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find enclosed herewith the certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter and year ended March 31 2025 as received from our RTA M/s Maheshwari Datamatics Pvt. ltd.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Nikita Goenka

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Raj Goenka

Corporate Actions

No Upcoming Board Meetings

Gamco Ltd has declared 10% dividend, ex-date: 05 Apr 24

Gamco Ltd has announced 2:10 stock split, ex-date: 14 Jun 24

Gamco Ltd has announced 5:4 bonus issue, ex-date: 21 Mar 25

No Rights history available