Ganon Products Adjusts Valuation Amidst Mixed Market Performance and Peer Comparison

2025-04-03 08:00:32Ganon Products, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. This revision reflects the company's current financial metrics, which include a PE ratio of -6.25 and a return on capital employed (ROCE) of -11.09%. The company's price-to-book value stands at 0.57, while its return on equity (ROE) is reported at -2.18%. In terms of market performance, Ganon Products has experienced a mixed trajectory. Over the past week, the stock returned 3.24%, contrasting with a decline in the Sensex of 0.87%. However, the year-to-date performance shows a decline of 21.18%, while the Sensex has only decreased by 1.95%. When compared to its peers, Ganon Products' valuation metrics indicate a notable divergence. For instance, while companies like Oswal Green Tech and Adit Birla Money also reflect high valuation levels, their financial ratios...

Read MoreGanon Products Faces Valuation Grade Change Amidst Profitability Challenges and Market Decline

2025-03-17 08:00:33Ganon Products, a microcap player in the Finance/NBFC sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of -6.38 and an EV to EBIT of -4.87, indicating challenges in profitability. Additionally, the latest Return on Capital Employed (ROCE) stands at -11.09%, while the Return on Equity (ROE) is at -2.18%, suggesting that the company is facing difficulties in generating returns for its shareholders. In comparison to its peers, Ganon Products exhibits a less favorable valuation profile. For instance, Fedders Holding and Dhunseri Investments maintain fair valuations, while Abans Holdings is noted for its attractive standing. Ganon's valuation metrics, including a price-to-book value of 0.58 and an EV to sales ratio of 0.23, position it differently against competitors, highlighting the varying financial health and market positions within the industry. The ...

Read MoreGanon Products Ltd Experiences Stock Surge Amid Broader Market Decline and Profitability Concerns

2025-03-12 18:00:28Ganon Products Ltd, a microcap company in the Finance/NBFC sector, has experienced significant stock activity today, with a notable increase of 8.37%. This uptick comes amid a broader market context where the Sensex has seen a slight decline of 0.10%. Despite today's positive movement, Ganon Products has faced challenges over the past year, with a performance decline of 24.24%, contrasting sharply with the Sensex's modest gain of 0.49%. Over the last three years, the stock has decreased by 28.22%, while the Sensex has risen by 33.27%. Key financial metrics reveal a market capitalization of Rs 6.00 crore and a price-to-earnings (P/E) ratio of -6.77, significantly lower than the industry average of 20.41. This indicates potential concerns regarding profitability relative to its peers. In terms of technical indicators, the stock shows bearish trends across various time frames, including MACD and moving a...

Read MoreGanon Products Adjusts Valuation Amidst Competitive Finance Sector Dynamics

2025-03-11 08:00:24Ganon Products, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. This revision reflects the company's current financial metrics, which include a PE ratio of -6.67 and an EV to EBIT of -5.09. The company's return on capital employed (ROCE) stands at -11.09%, while the return on equity (ROE) is reported at -2.18%. In comparison to its peers, Ganon Products is positioned within a competitive landscape where companies like Centrum Capital and Oswal Green Tech also exhibit high valuation metrics. Centrum Capital, for instance, is noted for its significant losses, while Oswal Green Tech shows a stark contrast with a PE ratio of 72.76. Other competitors, such as Vardhman Holdings and Dhunseri Investments, present varying valuation profiles, indicating a diverse market environment. Ganon Products' stock price has fluctuated between a...

Read MoreGanon Products Faces Valuation Grade Change Amidst Profitability Challenges and Peer Comparisons

2025-02-24 12:57:19Ganon Products, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of -7.04 and an EV to EBIT of -5.38, indicating challenges in profitability. Additionally, the latest return on capital employed (ROCE) stands at -11.09%, while the return on equity (ROE) is recorded at -2.18%. In comparison to its peers, Ganon Products presents a stark contrast in valuation metrics. For instance, Dhunseri Investments holds a fair valuation with a PE ratio of 7.38, while Oswal Green Tech and Adit Birla Money are categorized as very expensive, showcasing significantly higher PE ratios of 79.02 and 11.57, respectively. Despite the recent valuation adjustment, Ganon Products has shown a mixed performance against the Sensex, with a one-week return of 4.65%, while the one-year return reflects a decli...

Read More

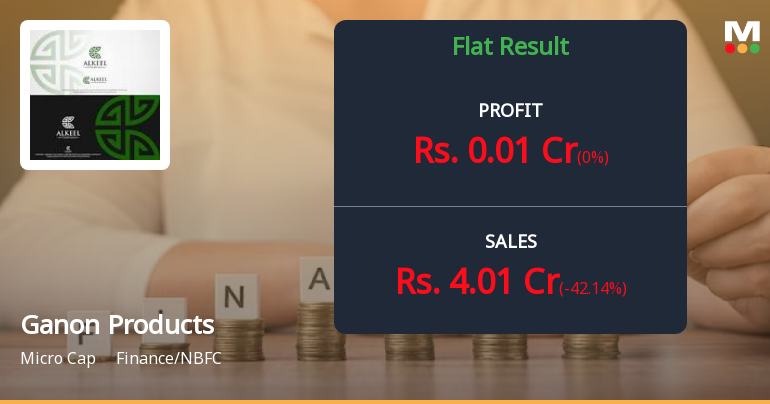

Ganon Products Reports Stable Financial Performance and Improved Evaluation Score in February 2025

2025-02-14 16:12:57Ganon Products has announced its financial results for the quarter ending December 2024, revealing steady performance and operational stability. An evaluation score adjustment reflects a more favorable assessment of the company's financial standing, offering insights into its effectiveness and market positioning within the finance/NBFC sector.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSETrading window for dealing in securities of the Company by Designated persons and their immediate relatives will remain closed w.e.f April 01 2025 untill 48 hours after the declaration of the Audited Financial Result by the Company for the Quarter and Year ended on March 31 2025.

Announcement under Regulation 30 (LODR)-Resignation of Director

20-Mar-2025 | Source : BSEResignation of Independent Directors of the Company

Announcement under Regulation 30 (LODR)-Change in Directorate

20-Mar-2025 | Source : BSEIntimation of Resignation of Independent Directors of the Company wef 20th March 2025

Corporate Actions

No Upcoming Board Meetings

No Splits history available

Ganon Products Ltd has announced 30:1 bonus issue, ex-date: 15 Oct 12

No Rights history available