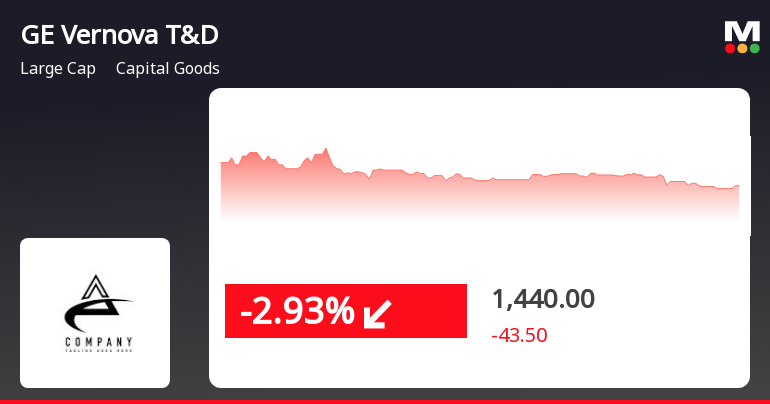

GE Vernova T&D India Faces Continued Decline Amid Broader Market Resilience

2025-04-03 11:35:15GE Vernova T&D India has seen a significant decline in its stock performance, losing 10.13% over the past four days. Currently trading below key moving averages, the company contrasts with a resilient broader market, as it faces a year-to-date decline of 30.58%, despite a strong annual increase.

Read MoreGE Vernova T&D Faces Increased Selling Pressure Amid Declining Investor Interest

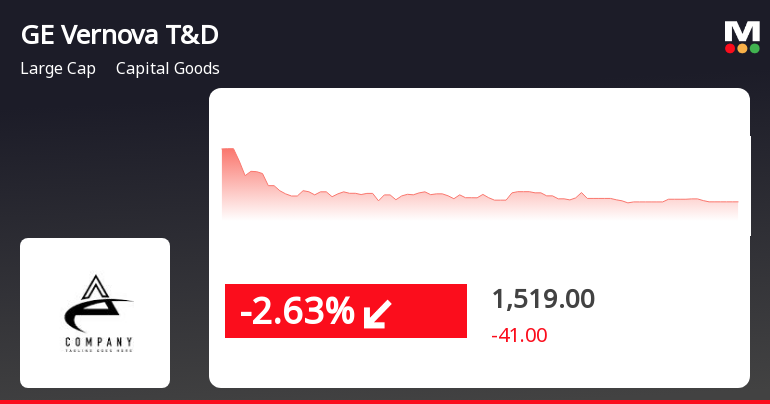

2025-04-02 10:00:10GE Vernova T&D India Ltd, a prominent player in the capital goods sector, experienced significant trading activity today as its stock hit the lower circuit limit. The last traded price stood at Rs 1480.85, reflecting a decline of Rs 77.90 or 5.0%. The stock's performance has been underwhelming, underperforming its sector by 0.34%, and has seen a consecutive fall over the last three days, accumulating a total decline of 8.44% during this period. The stock reached an intraday high of Rs 1587.55 and a low of Rs 1480.85, with a total traded volume of approximately 3.70 lakh shares, resulting in a turnover of around Rs 55.50 crore. Notably, GE Vernova T&D is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. Investor participation has also waned, with delivery volume dropping by 20.86% compared to the 5-day average. The stock remains liquid enou...

Read MoreGE Vernova T&D India Faces Increased Volatility Amid Declining Investor Participation

2025-04-01 15:00:05GE Vernova T&D India Ltd, a prominent player in the capital goods sector, experienced significant trading activity today as its stock hit the lower circuit limit. The stock closed at Rs 1480.85, reflecting a decline of Rs 77.90 or 5.0%. This drop marks a continuation of a downward trend, with the stock having fallen 7% over the past two days. During today's trading session, GE Vernova T&D India reached an intraday low of Rs 1481, showcasing a volatility of 5.18%. The total traded volume amounted to approximately 3.19 lakh shares, resulting in a turnover of Rs 47.95 crore. Notably, the stock underperformed its sector by 2.96%, with a 1D return of -4.07%, compared to the sector's -1.47% and the Sensex's -1.40%. Despite trading above its 20-day moving averages, the stock remains below its 5-day, 50-day, 100-day, and 200-day moving averages. Additionally, investor participation has declined, with delivery vol...

Read More

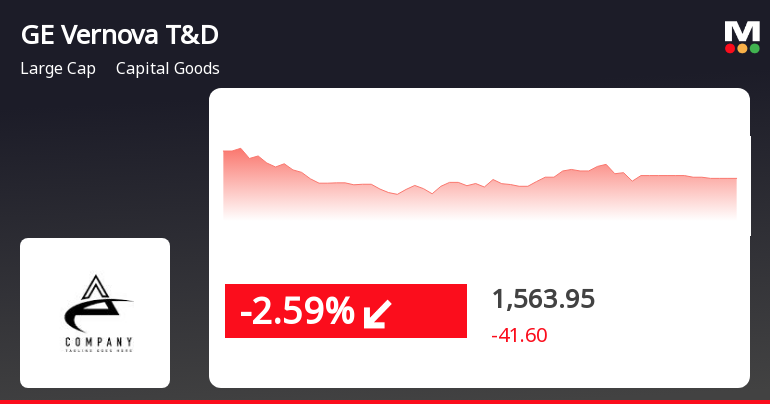

GE Vernova T&D India Faces Short-Term Challenges Amid Broader Market Decline

2025-04-01 10:15:23GE Vernova T&D India faced a decline on April 1, 2025, despite an initial gain. The stock's performance has been mixed, positioned above its 20-day moving average but below others. While it has shown strong one-year growth, recent trends indicate short-term challenges amid broader market conditions.

Read MoreGE Vernova T&D India Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-04-01 08:02:04GE Vernova T&D India, a prominent player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1560.00, down from a previous close of 1605.55. Over the past year, the company has demonstrated significant resilience, with a remarkable return of 83.41%, outpacing the Sensex's return of 5.11% during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators present a mixed picture with some mildly bearish signals. The stock's performance has shown volatility, with a 52-week high of 2,215.70 and a low of 807.65, indicating a wide trading range. When comparing returns, GE Vernova T&D India has exhibited strong performance over longer periods, particularly with a staggering 1650.84% return over three years and 2084.87% over five yea...

Read MoreGE Vernova T&D India Ltd Sees Active Trading Amid Mixed Sector Performance

2025-03-28 10:00:21GE Vernova T&D India Ltd, a prominent player in the Capital Goods sector, has captured attention today as its stock hit the upper circuit limit, reaching a high price of Rs 1617.05. The stock experienced a notable change of Rs 64.95, reflecting a percentage increase of 4.22%. Throughout the trading session, the stock fluctuated between an intraday low of Rs 1514.45 and the aforementioned high, with a total traded volume of approximately 10.14 lakh shares, resulting in a turnover of Rs 161.36 crore. Despite this positive movement, the stock underperformed against its sector, showing a 1D return of -3.04%, while the sector and Sensex recorded returns of -0.35% and -0.31%, respectively. The weighted average price indicated that more volume was traded closer to the low price, suggesting varied investor engagement throughout the day. In terms of liquidity, the stock remains accessible for trading, with a de...

Read More

GE Vernova T&D India Faces Volatility Amid Broader Market Caution and Mixed Performance Indicators

2025-03-28 09:35:15GE Vernova T&D India saw a decline on March 28, 2025, underperforming its sector. The stock's intraday low reflected a drop, with mixed performance indicated by its moving averages. In the broader market, the Sensex opened positively but experienced a slight decrease, suggesting a cautious environment.

Read MoreGE Vernova T&D India Shows Mixed Technical Trends Amid Strong Long-Term Returns

2025-03-28 08:02:07GE Vernova T&D India, a prominent player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 1605.55, showing a notable increase from the previous close of 1539.95. Over the past year, GE Vernova has demonstrated significant resilience, with a remarkable return of 92.15%, outperforming the Sensex, which recorded a return of 6.32% during the same period. In terms of technical indicators, the company's performance presents a mixed picture. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands indicate a bearish trend weekly but shift to bullish on a monthly scale. Moving averages reflect a mildly bearish sentiment daily, while the KST and OBV metrics also suggest a mildly bearish stance over the monthly timeframe. Notably, GE Vernova's stock...

Read More

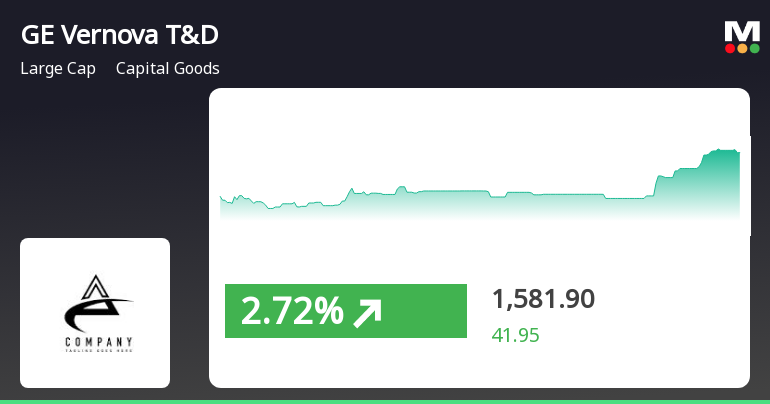

GE Vernova T&D India Shows Trend Reversal Amid Broader Market Resilience

2025-03-27 12:50:16GE Vernova T&D India has experienced a notable uptick, reversing a three-day decline and outperforming its sector. The stock is currently above its short-term moving averages, while the broader Sensex has shown resilience with a significant rebound and a notable increase over the past three weeks.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEConfirmation Certificate Under Regulation 74(5) of SEBI (Depositories and Participation) Regulations 2018

Announcement under Regulation 30 (LODR)-Change in Management

28-Mar-2025 | Source : BSEIntimation under Regulation 30 of SEBI (Listing Obligation & Disclosure Requirements 2015-Retirement of Independent Director

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

GE Vernova T&D India Ltd has declared 100% dividend, ex-date: 28 Aug 24

GE Vernova T&D India Ltd has announced 2:10 stock split, ex-date: 22 Oct 08

No Bonus history available

No Rights history available