Geojit Financial Services Shows Mixed Technical Trends Amid Market Volatility

2025-04-02 08:06:42Geojit Financial Services, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 72.35, showing a slight increase from the previous close of 71.40. Over the past year, Geojit has experienced a notable high of 159.30 and a low of 58.61, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows bullish momentum on a weekly basis, but no signal is present for the monthly timeframe. Bollinger Bands and KST indicators also reflect a mildly bearish trend on both weekly and monthly scales. The Dow Theory indicates a mildly bullish stance weekly, with no discernible trend monthly. When comparing the company's performance to the Sensex, Geoji...

Read MoreGeojit Financial Services Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-03-26 08:00:30Geojit Financial Services has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company's price-to-earnings (PE) ratio stands at 10.66, while its price-to-book value is recorded at 2.22. Additionally, Geojit exhibits a robust EV to EBITDA ratio of 4.57 and an impressive return on capital employed (ROCE) of 83.17%, indicating efficient capital utilization. In comparison to its peers, Geojit demonstrates a favorable valuation profile. For instance, while Indus Inf. Trust is positioned at a significantly higher PE ratio of 332.88, other competitors like MAS Financial Services and Pilani Investments show varying valuation metrics, with MAS at 15.93 and Pilani at 29.49. Geojit's PEG ratio of 0.24 further highlights its growth potential relative to its earnings. Despite recent fluctuation...

Read More

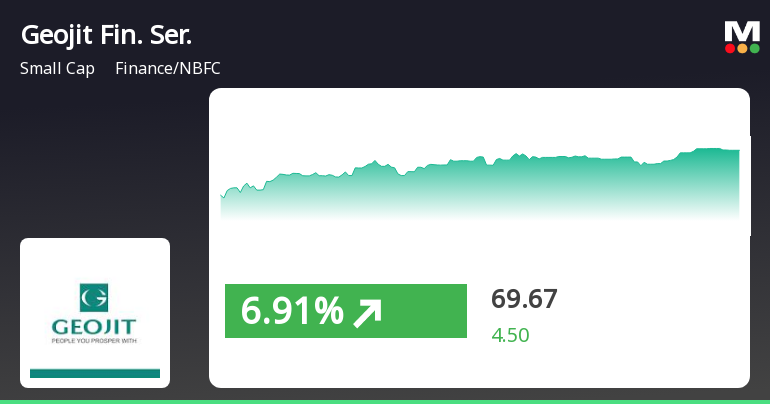

Geojit Financial Services Shows Mixed Performance Amid Broader Market Gains

2025-03-19 11:50:25Geojit Financial Services has demonstrated notable activity, achieving a significant gain and outperforming its sector. The stock has shown a mixed trend in moving averages, with recent consecutive gains contributing to a substantial return over the past two days. The broader market reflects a slight increase, led by small-cap stocks.

Read MoreGeojit Financial Services Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-18 08:00:43Geojit Financial Services has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company currently exhibits a price-to-earnings (PE) ratio of 9.19 and a price-to-book value of 1.92, indicating a competitive valuation relative to its peers. Additionally, Geojit shows strong operational efficiency with an EV to EBITDA ratio of 3.70 and an impressive return on capital employed (ROCE) of 83.17%. In comparison to its industry peers, Geojit stands out with a lower PE ratio than companies like MAS Financial Services and Pilani Investments, which have higher valuations. Furthermore, Geojit's PEG ratio of 0.20 suggests a favorable growth outlook relative to its earnings. Despite recent stock performance challenges, including a notable decline over the past month, Geojit maintains a ...

Read More

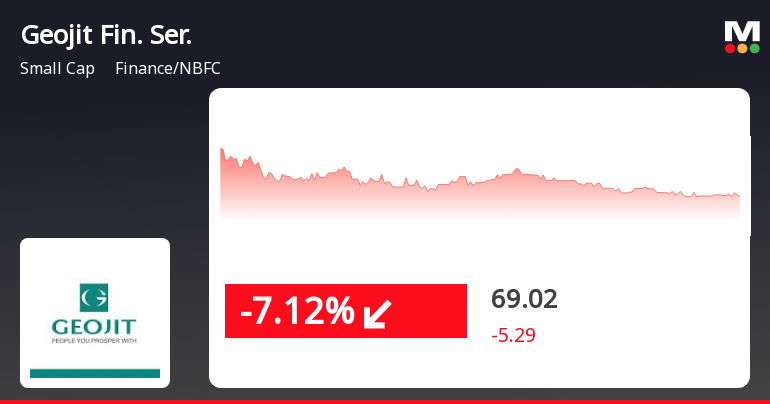

Geojit Financial Services Faces Continued Stock Volatility Amid Sector Underperformance

2025-03-17 14:15:24Geojit Financial Services has faced notable volatility, with its stock declining for two consecutive days and experiencing a significant drop today. Despite an initial gain, the stock reversed direction, reflecting high intraday volatility. Over the past week and month, it has shown substantial declines, underperforming its sector.

Read MoreGeojit Financial Services Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-03-12 08:00:33Geojit Financial Services has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company boasts a price-to-earnings (PE) ratio of 10.00 and an impressive return on capital employed (ROCE) of 83.17%, indicating efficient capital utilization. Additionally, its price-to-book value stands at 2.09, while the enterprise value to EBITDA ratio is recorded at 4.18. In comparison to its peers, Geojit Financial Services demonstrates a competitive edge with a PEG ratio of 0.22, suggesting favorable growth prospects relative to its valuation. Notably, while some competitors are categorized as very expensive, Geojit maintains a more attractive valuation profile. Despite recent fluctuations in stock price, with a current price of 67.03 and a 52-week range between 54.90 and 159.30, the company's pe...

Read More

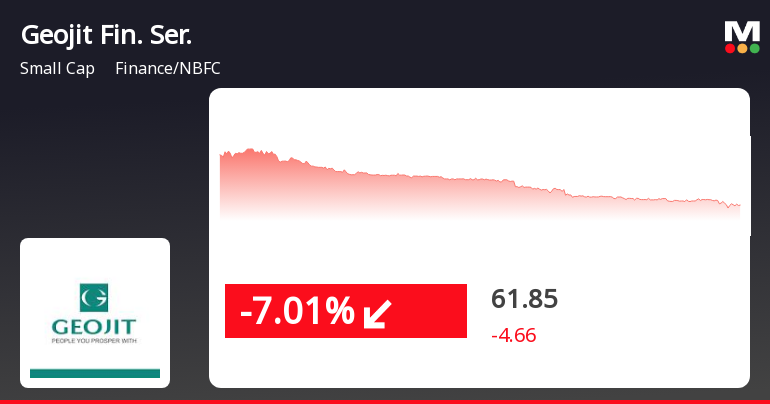

Geojit Financial Services Faces Significant Stock Decline Amid Broader Market Challenges

2025-03-11 12:15:23Geojit Financial Services has faced a notable decline, with shares dropping significantly today and experiencing a cumulative loss over the past two days. The stock is currently trading below multiple moving averages, reflecting a bearish outlook, while the broader market also shows signs of weakness.

Read MoreGeojit Financial Services Faces Significant Volatility Amid Broader Market Challenges

2025-03-11 09:35:15Geojit Financial Services, a small-cap player in the finance and non-banking financial company (NBFC) sector, has experienced significant volatility today. The stock opened with a notable loss of 5.65%, reflecting a broader trend of underperformance compared to its sector, lagging by 3.63%. Over the past two days, Geojit has seen a consecutive decline, accumulating a total drop of 9.35%. During intraday trading, the stock reached a low of Rs 70.11, marking a challenging session for investors. In terms of moving averages, Geojit Financial Services is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day averages, indicating a bearish trend in its short to long-term performance. In the context of broader market movements, Geojit’s one-day performance stands at -5.13%, significantly underperforming the Sensex, which has only dipped by 0.53%. Over the past month, the stock has declined by 14...

Read More

Geojit Financial Services Reports Decline in Profit and Sales Amid Market Evaluation Adjustments

2025-02-06 18:47:29Geojit Financial Services has recently adjusted its evaluation, reflecting its current market position. The company reported flat financial results for the quarter ending December 2024, with a decline in profit after tax and net sales. Despite challenges, it maintains strong long-term fundamentals and has outperformed the broader market over the past year.

Read MoreBoard Meeting Outcome for Outcome Of Board Meeting Dated 20.03.2025

20-Mar-2025 | Source : BSEOutcome of Board Meeting dated 20.03.2025 - Disclosure pursuant to Regulation 30 (6) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Announcement Under Regulation 30 (6) Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

20-Mar-2025 | Source : BSEPlease find enclosed the announcement under Regulation 30(6) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Closure of Trading Window

13-Mar-2025 | Source : BSEPlease find the intimation regarding the closure of trading window.

Corporate Actions

No Upcoming Board Meetings

Geojit Financial Services Ltd has declared 150% dividend, ex-date: 01 Jul 24

Geojit Financial Services Ltd has announced 1:10 stock split, ex-date: 26 Sep 06

No Bonus history available

Geojit Financial Services Ltd has announced 1:6 rights issue, ex-date: 07 Oct 24