GHCL Adjusts Valuation Grade Amid Competitive Chemicals Sector Landscape

2025-04-02 08:01:20GHCL, a midcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings ratio stands at 10.09, while its price-to-book value is recorded at 1.90. GHCL's enterprise value to EBITDA ratio is 6.17, and its enterprise value to EBIT is 7.09, indicating its operational efficiency in generating earnings relative to its valuation. In terms of profitability, GHCL boasts a return on capital employed (ROCE) of 28.11% and a return on equity (ROE) of 16.71%, showcasing its ability to generate returns for shareholders. The company also offers a dividend yield of 1.90%, which adds to its appeal among income-focused investors. When compared to its peers, GHCL's valuation metrics reveal a competitive landscape. Companies like Vinati Organics and Clean Science are positioned at higher valuation levels, while others such as Aarti...

Read MoreGHCL Adjusts Valuation Grade Amidst Competitive Market Positioning in Chemicals Sector

2025-03-18 08:00:34GHCL, a midcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 600.75, down from a previous close of 618.45, with a 52-week range between 434.95 and 779.30. Key financial metrics indicate a price-to-earnings (PE) ratio of 9.61 and an EV to EBITDA ratio of 5.83, suggesting a competitive position within its sector. In terms of returns, GHCL has shown varied performance against the Sensex. Over the past year, the stock has returned 33.40%, significantly outperforming the index's 2.10% return. However, year-to-date, GHCL has experienced a decline of 17.03%, while the Sensex has decreased by 5.08%. When compared to its peers, GHCL's valuation metrics stand out, particularly in contrast to companies like Himadri Special and Vinati Organics, which are positioned at higher valuation levels. This context ...

Read MoreGHCL Shows Mixed Technical Trends Amid Strong Long-Term Performance in Chemicals Sector

2025-03-05 08:01:42GHCL, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 617.00, showing a notable increase from the previous close of 569.25. Over the past year, GHCL has demonstrated a robust performance with a return of 22.73%, significantly outperforming the Sensex, which recorded a return of just -1.19% during the same period. In terms of technical indicators, the company presents a mixed picture. The MACD shows a mildly bearish trend on a weekly basis but is bullish on a monthly scale. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments, suggesting a neutral momentum. Bollinger Bands and On-Balance Volume (OBV) also reflect a mildly bearish trend weekly, while monthly indicators show bullish tendencies. GHCL's performance over longer periods is particularly notewor...

Read More

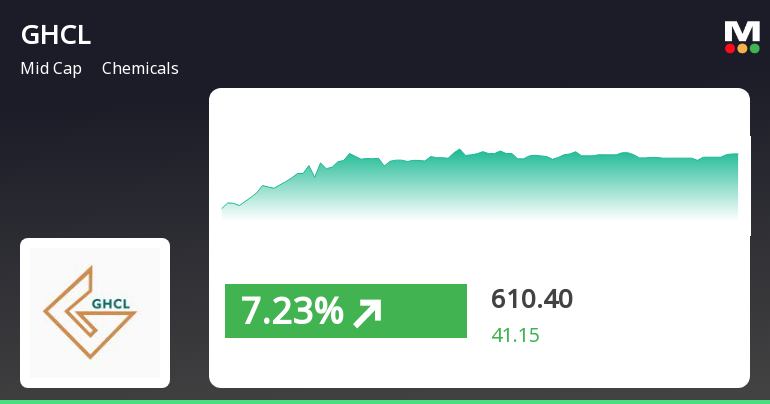

GHCL Shows Resilience Amid Broader Market Decline and Volatility

2025-03-04 09:35:14GHCL, a midcap chemicals company, experienced a notable increase on March 4, 2025, following a four-day decline. The stock reached an intraday high, outperforming its sector. Despite mixed signals from moving averages, GHCL has shown resilience with a strong one-year performance compared to the declining Sensex.

Read MoreGHCL Adjusts Valuation Grade Amid Competitive Chemicals Sector Landscape

2025-03-02 08:00:04GHCL, a midcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 579.75, slightly down from the previous close of 580.00. Over the past year, GHCL has shown a return of 12.88%, outperforming the Sensex, which returned 1.24% during the same period. However, the stock has faced challenges in the short term, with a year-to-date return of -19.93%, compared to the Sensex's -6.32%. Key financial metrics for GHCL include a PE ratio of 9.27 and an EV to EBITDA ratio of 5.59, which position it within a competitive landscape. The company's return on capital employed (ROCE) stands at 28.11%, and its return on equity (ROE) is 16.71%. When compared to its peers, GHCL's valuation metrics indicate a notable divergence. For instance, companies like Navin Fluorine International and Vinati Organics are positioned at...

Read MoreGHCL Adjusts Valuation Grade Amid Competitive Market Positioning and Strong Returns

2025-02-24 12:57:11GHCL, a midcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market positioning. The company's current price stands at 614.00, with a notable 52-week high of 779.30 and a low of 434.95. Key financial indicators reveal a PE ratio of 9.68 and an EV to EBITDA ratio of 5.88, which are critical metrics for assessing its valuation relative to peers. GHCL's return on capital employed (ROCE) is reported at 28.11%, while the return on equity (ROE) is at 16.71%. The company also offers a dividend yield of 1.98%, contributing to its attractiveness in the market. When compared to its peers, GHCL's valuation metrics indicate a competitive stance, particularly against companies like Navin Fluorine International and Vinati Organics, which exhibit significantly higher PE ratios. Despite the recent valuation adjustment, GHCL's performance ...

Read More

GHCL Faces Challenges Amid Broader Chemicals Sector Decline in February 2025

2025-02-14 13:15:20GHCL, a midcap chemicals company, saw a significant decline on February 14, 2025, with its stock dropping notably during the trading session. The company's recent performance reflects broader challenges in the chemicals sector, as it has experienced a substantial decline over the past month compared to the Sensex.

Read More

GHCL Faces Continued Stock Decline Amid Broader Chemicals Sector Weakness

2025-02-11 13:05:13GHCL, a midcap chemicals company, saw its stock decline by 5.06% on February 11, 2025, continuing a three-day downward trend totaling 7.79%. The stock underperformed against the chemicals sector and has faced challenges over the past month, recording a 3.92% decrease compared to the Sensex's 1.08% drop.

Read More

GHCL Faces Continued Stock Decline Amid Broader Chemicals Sector Weakness

2025-02-11 13:05:13GHCL, a midcap chemicals company, saw its stock decline by 5.06% on February 11, 2025, continuing a three-day downward trend totaling 7.79%. The stock underperformed against the chemicals sector and has faced challenges over the past month, recording a 3.92% decrease compared to the Sensex's 1.08% drop.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECompliance certificate under Regulation 74(5) SEBI(DP) Regulations 2018

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation for window closure announcement

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation for closure of trading window

Corporate Actions

No Upcoming Board Meetings

GHCL Ltd has declared 120% dividend, ex-date: 01 Jul 24

No Splits history available

No Bonus history available

No Rights history available