Gilada Finance & Investments Adjusts Evaluation Amid Mixed Performance and Technical Shift

2025-04-02 08:08:26Gilada Finance & Investments has experienced a recent evaluation adjustment, reflecting a shift in technical trends. Key indicators suggest a change in market sentiment, while the stock has shown a notable return over the past year despite facing profit declines. The company's valuation remains complex compared to peers.

Read More

Gilada Finance Experiences Shift in Market Sentiment Amid Valuation Adjustments

2025-03-20 08:02:33Gilada Finance & Investments has recently experienced a change in its evaluation, with its technical indicators shifting to a bearish outlook. The company's valuation has been revised, reflecting its financial metrics, including a PE ratio of 9.69 and a return on equity of 7.15%.

Read MoreGilada Finance Shows Mixed Performance Amidst Market Fluctuations and Long-Term Growth Potential

2025-03-19 18:00:15Gilada Finance & Investments Ltd, a microcap player in the Finance/NBFC sector, has shown notable activity in the stock market today. The company currently holds a market capitalization of Rs 16.00 crore and has a price-to-earnings (P/E) ratio of 9.69, significantly lower than the industry average of 20.91. In terms of performance, Gilada Finance has delivered a 5.49% return over the past year, outperforming the Sensex, which recorded a 4.77% gain during the same period. Today, the stock increased by 1.05%, while the Sensex rose by only 0.20%. However, the stock has faced challenges over the longer term, with a year-to-date decline of 10.63% compared to the Sensex's drop of 3.44%. Over the past three years, Gilada Finance has seen a significant decline of 45.08%, contrasting sharply with the Sensex's growth of 30.39%. Despite these fluctuations, the company has demonstrated impressive growth over five a...

Read MoreGilada Finance Adjusts Valuation Grade Amidst Competitive Market Dynamics in NBFC Sector

2025-03-17 08:00:06Gilada Finance & Investments has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the finance and non-banking financial company (NBFC) sector. The company's current price stands at 11.53, slightly down from the previous close of 11.55. Over the past year, Gilada Finance has experienced a stock return of -2.86%, contrasting with a 1.47% return from the Sensex, indicating a lag in performance relative to the broader market. Key financial metrics for Gilada Finance include a price-to-earnings (PE) ratio of 9.70 and an EV to EBITDA ratio of 7.96, which position it competitively against its peers. Notably, the company has a return on capital employed (ROCE) of 10.25% and a return on equity (ROE) of 7.15%. In comparison to its peers, Gilada Finance's valuation metrics suggest a more favorable position relative to companies like Centrum Capital and Oswal Green Tech,...

Read MoreGilada Finance Adjusts Valuation Grade Amid Mixed Sector Comparisons and Strong Returns

2025-03-06 08:00:10Gilada Finance & Investments has recently undergone a valuation adjustment, reflecting its current standing in the finance and non-banking financial company (NBFC) sector. The company’s price-to-earnings (PE) ratio stands at 9.59, while its price-to-book value is noted at 0.69. Other key metrics include an EV to EBIT of 8.01 and an EV to EBITDA of 7.91, indicating its operational efficiency relative to its enterprise value. In comparison to its peers, Gilada Finance's valuation metrics present a mixed picture. For instance, Vardhman Holdings shows a significantly lower PE ratio of 3.99, while Nisus Finance is positioned at a much higher valuation with a PE of 39.2. Additionally, the company's return on capital employed (ROCE) is reported at 10.25%, and its return on equity (ROE) is at 7.15%. When examining stock performance, Gilada Finance has experienced varied returns over different periods, with a not...

Read More

Gilada Finance Faces Evaluation Adjustment Amidst Flat Performance and Market Challenges

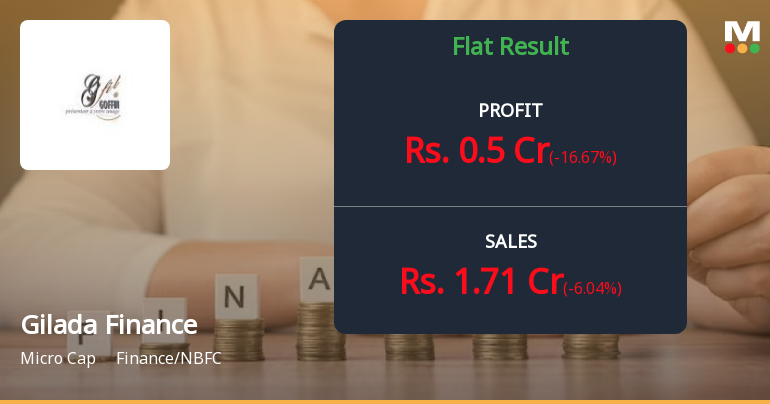

2025-02-28 18:23:03Gilada Finance & Investments, a microcap in the NBFC sector, has recently experienced a score adjustment reflecting its financial dynamics. The company reported flat performance in Q3 FY24-25, raising concerns about its long-term strength, while maintaining a consistent Return on Equity of 7.22%. The stock has underperformed against benchmarks recently.

Read More

Gilada Finance Reports Flat Performance Amidst Weak Long-Term Fundamentals and Declining Profits

2025-02-19 18:56:53Gilada Finance & Investments, a microcap in the NBFC sector, recently experienced a score adjustment following flat financial performance in Q3 FY24-25. Key metrics reveal a long-term fundamental weakness, with a low average Return on Equity. The stock's valuation remains attractive despite a year of underperformance against benchmarks.

Read More

Gilada Finance Reports Steady Q3 FY24-25 Results Amid Market Dynamics

2025-02-11 16:13:43Gilada Finance & Investments has announced its financial results for the third quarter of FY24-25, revealing consistent performance with no changes in evaluation over the past three months. This stability suggests operational consistency for the company amid evolving market conditions, warranting close monitoring of future developments.

Read MoreAnnouncement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

01-Apr-2025 | Source : BSEThis is in continuation to the intimation dated 04.02.2025. It is to inform you that Mrs Mohita Agrawal Company Secretary and Compliance Officer of the company has resigned from the company vide letter dated 03.02.2025 due to some personal reasons. She has served the office as Company Secretary and Compliance officer till the closure hours of 31.03.2025 and is now relieved from the services of the company.

Closure of Trading Window

27-Mar-2025 | Source : BSEThe trading window for trading/ dealing in Equity Shares of the company will remain closed from 1st April 2025 till 48 hours after declaration of Audited Financial results for quarter and financial year ending 31st March 2025. During closure of trading window all desginated persons of the company (including immediate relatives) have been advised not to deal in Equity shares of the company.

Integrated Filing (Financial)

03-Mar-2025 | Source : BSEIntegrated filing of un audited financial results for Quarter ended December 2024 along with Limited Review Report given by statutory Auditor of the Company.

Corporate Actions

No Upcoming Board Meetings

Gilada Finance & Investments Ltd has declared 2% dividend, ex-date: 05 Mar 18

Gilada Finance & Investments Ltd has announced 5:10 stock split, ex-date: 30 Mar 22

Gilada Finance & Investments Ltd has announced 1:1 bonus issue, ex-date: 30 Mar 22

No Rights history available