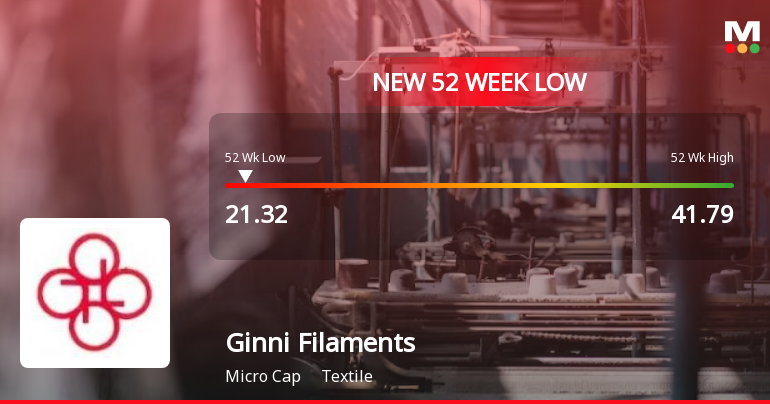

Ginni Filaments Faces Continued Decline Amidst Poor Financial Performance and High Debt Levels

2025-03-28 14:06:43Ginni Filaments, a microcap textile company, has reached a new 52-week low, continuing a downward trend with a significant decline over the past year. The company faces financial difficulties, including a high Debt to EBITDA ratio and a substantial drop in profit and net sales, while trading at a discount to peers.

Read MoreGinni Filaments Experiences Valuation Grade Change Amidst Competitive Textile Sector Challenges

2025-03-25 08:00:42Ginni Filaments, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (PE) ratio of 133.69, indicating a premium valuation relative to its earnings. Its price-to-book value stands at 0.95, suggesting that the market values the company slightly below its book value. In terms of operational efficiency, Ginni Filaments shows an EV to EBITDA ratio of 15.47, which is relatively moderate compared to its peers. The company's return on equity (ROE) is reported at 0.71%, while its return on capital employed (ROCE) is slightly negative at -0.03%. These metrics highlight the challenges the company faces in generating returns from its capital. When compared to its industry peers, Ginni Filaments maintains a higher PE ratio than several competitors, such as Mafatlal Industries and Ambik...

Read MoreGinni Filaments Experiences Valuation Grade Change Amidst Competitive Textile Sector Challenges

2025-03-19 08:00:42Ginni Filaments, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 20.15, slightly above its previous close of 19.76, with a 52-week range between 19.48 and 40.20. Key financial metrics reveal a PE ratio of 125.06 and an EV to EBITDA of 14.75, indicating a complex valuation landscape. The company's return on equity (ROE) is reported at 0.71%, while the return on capital employed (ROCE) is marginally negative at -0.03%. Ginni Filaments' PEG ratio is 1.03, suggesting a balanced growth perspective relative to its earnings. In comparison to its peers, Ginni Filaments presents a higher PE ratio than Sportking India and Mafatlal Industries, both of which also hold attractive valuations. However, it lags behind competitors like R&B Denims and Faze Three in terms of EV to EBITDA ratios. The...

Read More

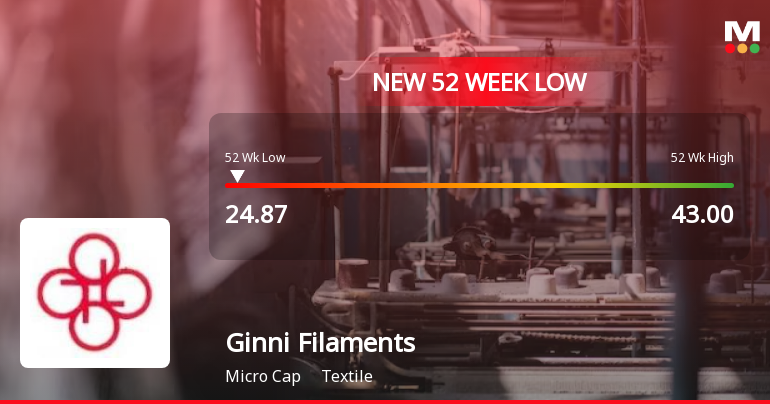

Ginni Filaments Faces Persistent Downward Trend Amid Significant Market Volatility

2025-03-03 10:36:21Ginni Filaments, a microcap textile company, has faced notable volatility, hitting a new 52-week low of Rs. 21. The stock has declined 10.14% over four days and is trading below all major moving averages, reflecting ongoing challenges in its market performance compared to the broader sector.

Read More

Ginni Filaments Faces Sustained Downward Trend Amid Industry Pressures and Volatility

2025-02-20 09:35:49Ginni Filaments, a microcap textile company, has faced significant volatility, reaching a new 52-week low. The stock has declined 16.94% over the past week and 45.12% over the last year, underperforming its sector and trading below key moving averages, indicating ongoing challenges in the market.

Read More

Ginni Filaments Faces Continued Decline Amidst Broader Textile Sector Challenges

2025-02-19 10:05:27Ginni Filaments, a microcap textile company, has hit a new 52-week low, continuing a downward trend with a significant decline over the past four days. The stock has underperformed its sector and is trading below all major moving averages, reflecting ongoing challenges in a competitive market.

Read More

Ginni Filaments Faces Sustained Downward Trend Amidst Market Scrutiny and Volatility

2025-02-18 11:55:25Ginni Filaments, a microcap textile company, has faced significant volatility, hitting a new 52-week low and experiencing a 12.35% decline over three days. The stock has underperformed its sector and is trading below key moving averages, raising concerns about its operational strategies and market position.

Read More

Ginni Filaments Hits 52-Week Low Amid Broader Textile Sector Decline

2025-02-14 12:05:32Ginni Filaments, a microcap textile company, has reached a new 52-week low, reflecting a significant decline in its stock price over the past year. The company underperformed in today's trading session, with its stock trading below multiple moving averages, indicating ongoing challenges in the market.

Read More

Ginni Filaments Hits 52-Week Low Amid Broader Textile Sector Challenges

2025-02-12 10:35:49Ginni Filaments, a microcap textile company, reached a new 52-week low today, reflecting a significant intraday decline. The stock has underperformed its sector and is trading below multiple moving averages. Over the past year, it has experienced a substantial decline, contrasting with the overall market performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under regulation 74(5) of SEBI (DP) regulation 2018

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window from 1st April 2025.

Board Meeting Outcome for Revised Outcome

10-Feb-2025 | Source : BSERevised outcome

Corporate Actions

No Upcoming Board Meetings

Ginni Filaments Ltd has declared 5% dividend, ex-date: 21 Mar 07

No Splits history available

No Bonus history available

No Rights history available