Gland Pharma Shows Trend Reversal Amid Mixed Long-Term Performance in Pharmaceuticals Sector

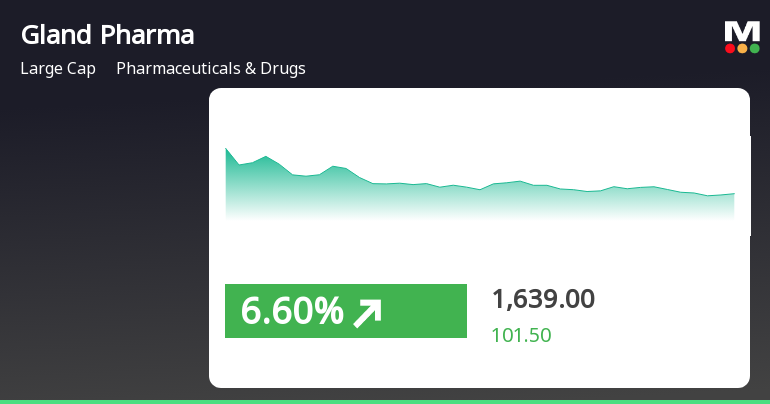

2025-04-03 09:35:30Gland Pharma experienced a notable rebound on April 3, 2025, reversing two days of decline with a significant intraday gain. The stock has outperformed its sector recently, despite longer-term challenges. Its moving averages indicate a mixed performance relative to various timeframes within the pharmaceuticals industry.

Read MoreGland Pharma Faces Mixed Technical Signals Amidst Market Volatility and Declining Performance

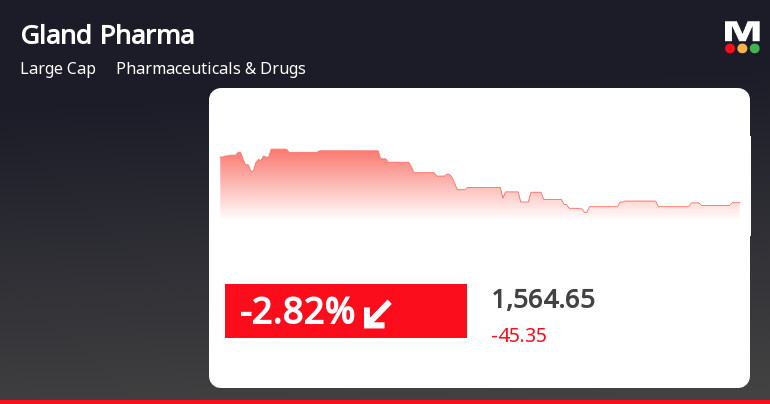

2025-04-02 08:09:42Gland Pharma, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1555.05, down from a previous close of 1610.00, with a notable 52-week high of 2,220.95 and a low of 1,412.00. Today's trading saw a high of 1607.35 and a low of 1549.60, indicating some volatility. The technical summary for Gland Pharma reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly periods. Bollinger Bands and Moving Averages suggest bearish tendencies, while the KST presents a bearish outlook weekly and mildly bearish monthly. In terms of performance, Gland Pharma's returns have lagged behind the Sensex across multip...

Read More

Gland Pharma Faces Significant Challenges Amid Broader Market Trends and Declining Stock Performance

2025-04-01 11:50:27Gland Pharma has faced challenges in its stock performance, experiencing a decline on April 1, 2025, that contrasts with broader market trends. While the stock is above its 50-day moving average, it has shown a notable decrease over the past three months and year, diverging from the Sensex's gains.

Read MoreGland Pharma Opens Strong with 4.53% Gain, Outperforming Sector and Sensex

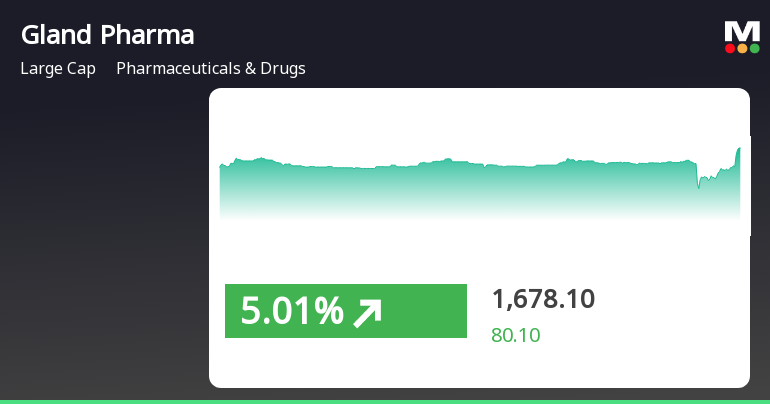

2025-03-24 10:40:17Gland Pharma, a prominent player in the Pharmaceuticals & Drugs industry, has shown significant activity today, opening with a gain of 4.53%. The stock reached an intraday high of Rs 1664.4, reflecting a 5.82% increase at its peak. In terms of performance metrics, Gland Pharma outperformed its sector by 2.82%, with a one-day performance of 3.58% compared to the Sensex's 0.99%. Over the past month, Gland Pharma has achieved a 7.06% increase, while the Sensex has risen by 4.31%. Analyzing the technical indicators, Gland Pharma's moving averages are currently higher than the 5-day, 20-day, and 50-day averages, but lower than the 100-day and 200-day averages. The MACD indicates a bearish trend on a weekly basis, while showing a mildly bullish stance monthly. The Bollinger Bands and KST also reflect a mildly bearish outlook on both weekly and monthly charts. Overall, Gland Pharma's stock activity today highligh...

Read More

Gland Pharma Experiences Short-Term Recovery Amid Long-Term Underperformance Challenges

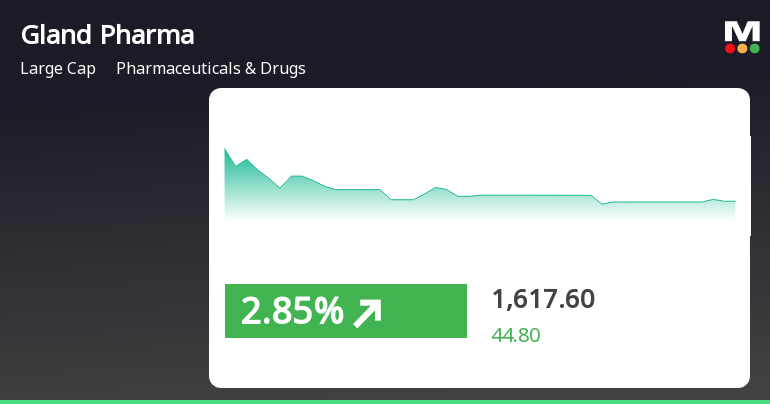

2025-03-24 09:35:35Gland Pharma experienced significant activity on March 24, 2025, with a notable intraday high and outperforming its sector. While the stock has shown short-term recovery, it faces challenges with declines over the past three months and year, indicating complexities within the pharmaceutical market.

Read More

Gland Pharma Experiences Increased Volatility Amid Positive Short-Term Performance Trends

2025-03-21 15:35:30Gland Pharma has demonstrated significant activity, gaining 3.32% on March 21, 2025, and outperforming its sector. The stock reached an intraday high of Rs 1680, with notable volatility. While it has shown positive returns over the past week, its three-month and year-to-date performance reflects declines.

Read MoreGland Pharma Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-19 08:05:03Gland Pharma, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1581.25, showing a notable change from the previous close of 1548.60. Over the past year, Gland Pharma has faced challenges, with a return of -11.61%, contrasting with a positive return of 3.51% for the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective leans mildly bullish. The Relative Strength Index (RSI) presents no clear signals, and Bollinger Bands are categorized as mildly bearish for both weekly and monthly assessments. Moving averages also reflect a mildly bearish stance on a daily basis, while the KST indicates a bearish trend weekly and mildly bearish monthly. In terms o...

Read MoreGland Pharma Experiences Valuation Grade Change Amidst Competitive Pharmaceutical Landscape

2025-03-17 08:01:01Gland Pharma, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 1554.15, reflecting a decline from its previous close of 1581.95. Over the past year, Gland Pharma has experienced a stock return of -8.07%, contrasting with a modest gain of 1.47% in the Sensex. Key financial metrics for Gland Pharma include a PE ratio of 36.35 and an EV to EBITDA ratio of 18.06, indicating its market positioning within the industry. The company's return on capital employed (ROCE) is reported at 14.18%, while the return on equity (ROE) is at 7.87%. In comparison to its peers, Gland Pharma's valuation metrics present a mixed picture. For instance, Sun Pharma is noted for its higher PE ratio of 34.25, while Divi's Laboratories stands out with a significantly elevated PEG ratio of 72.07. Other competitors like Cipla and Dr. Reddy's Lab...

Read MoreGland Pharma Experiences Technical Trend Adjustments Amid Mixed Performance Indicators

2025-03-13 08:02:44Gland Pharma, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 1581.95, reflecting a slight decline from the previous close of 1605.00. Over the past year, Gland Pharma has experienced a stock return of -8.73%, contrasting with a modest gain of 0.49% in the Sensex during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands signal bearish trends, while the monthly MACD shows a mildly bullish stance. The Relative Strength Index (RSI) currently indicates no signal for both weekly and monthly assessments. Moving averages also reflect a bearish sentiment on a daily basis, with the KST and Dow Theory showing bearish and mildly bearish trends, respectively. Gland Pharma's performance over various time frames reveals a mixed picture. In the last month, the stock returned 7.9%...

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

03-Apr-2025 | Source : BSEGland Pharma receives approval for Acetaminophen Injection

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

31-Mar-2025 | Source : BSEPostal Ballot Voting Results

Shareholder Meeting / Postal Ballot-Scrutinizers Report

31-Mar-2025 | Source : BSEPostal Ballot Results - Scrutinizer Report

Corporate Actions

No Upcoming Board Meetings

Gland Pharma Ltd has declared 2000% dividend, ex-date: 16 Aug 24

No Splits history available

No Bonus history available

No Rights history available