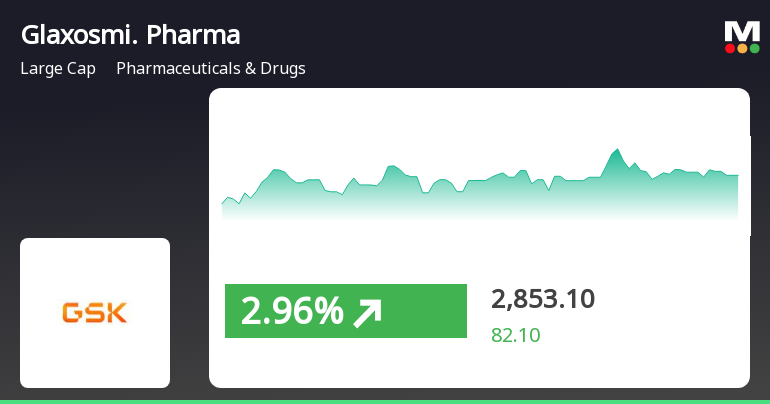

Glaxosmithkline Pharmaceuticals Shows Strong Reversal Amid Broader Market Gains

2025-04-03 10:35:23Glaxosmithkline Pharmaceuticals has rebounded today, reversing a two-day decline and outperforming the broader pharmaceuticals sector. The stock has shown strong performance across various time frames, with significant gains over the past month and year, indicating a robust market position and positive investor sentiment.

Read MoreGlaxoSmithKline Faces Mixed Technical Trends Amid Strong Yearly Performance

2025-04-02 08:07:00GlaxoSmithKline Pharmaceuticals, a prominent player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,790.95, with a previous close of 2,872.95. Over the past year, the stock has demonstrated a notable performance, achieving a return of 40.43%, significantly outpacing the Sensex's return of 2.72% during the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates a bearish stance on a weekly basis, with no signal on a monthly scale. Bollinger Bands suggest a mildly bullish trend in both weekly and monthly assessments, while moving averages indicate a mildly bearish position on a daily basis. The company's performance over various time frames reveals resilience, particularly ...

Read More

Glaxosmithkline Pharmaceuticals Adjusts Evaluation Amidst Stable Market Position and Strong Returns

2025-03-25 08:16:32Glaxosmithkline Pharmaceuticals has recently adjusted its evaluation, reflecting changes in technical indicators and market position. The stock shows a sideways trend, indicating stability. Despite strong historical returns and a low debt-to-equity ratio, the company faces flat financial performance and a premium valuation compared to peers.

Read MoreGlaxoSmithKline Experiences Mixed Technical Trends Amid Strong Stock Performance

2025-03-25 08:04:13GlaxoSmithKline Pharmaceuticals, a prominent player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,882.90, showing a notable range with a 52-week high of 3,087.95 and a low of 1,825.05. In terms of technical indicators, the weekly MACD remains bullish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates a bearish sentiment on a weekly basis, with no significant signal on a monthly scale. Bollinger Bands present a mildly bullish trend weekly and bullish monthly, suggesting some volatility in price movements. Moving averages indicate a mildly bearish trend daily, while the KST shows a bullish weekly trend but a mildly bearish monthly perspective. When comparing the stock's performance to the Sensex, GlaxoSmithKline Pharmaceuticals has demonstrat...

Read More

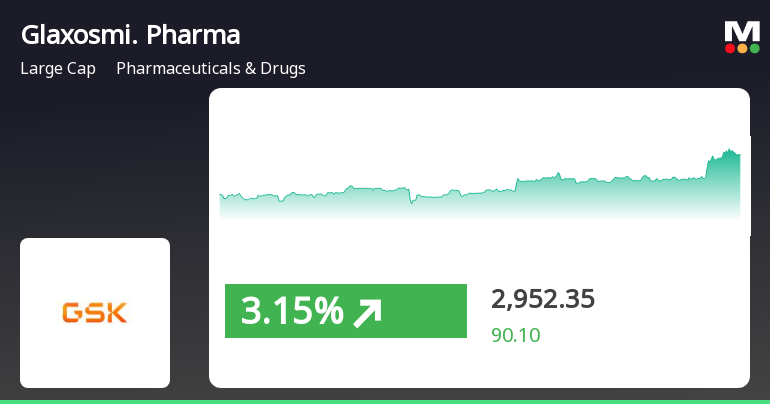

Glaxosmithkline's Strong Performance Highlights Resilience in Pharmaceuticals Sector Amid Mixed Market Signals

2025-03-21 15:35:24Glaxosmithkline Pharmaceuticals has demonstrated strong performance, gaining 3.32% and trading close to its 52-week high. The stock has outperformed its sector recently, with a notable 11.51% return over the past five days. In contrast, the broader market shows mixed signals despite a rebound in the Sensex.

Read MoreGlaxoSmithKline Pharmaceuticals Shows Mixed Technical Trends Amid Market Volatility

2025-03-20 08:02:37GlaxoSmithKline Pharmaceuticals, a prominent player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,840.00, showing a notable increase from the previous close of 2,792.00. Over the past year, the stock has reached a high of 3,087.95 and a low of 1,825.05, indicating significant volatility. In terms of technical indicators, the weekly MACD is bullish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) presents a bearish signal on a weekly basis, with no signal on a monthly basis. Bollinger Bands indicate bullish trends for both weekly and monthly evaluations. Moving averages reflect a mildly bearish stance on a daily basis, while the KST shows a mildly bullish trend weekly and a mildly bearish trend monthly. The On-Balance Volume (OBV) is bullish for both week...

Read MoreGlaxoSmithKline Experiences Technical Trend Shifts Amid Market Volatility

2025-03-19 08:03:21GlaxoSmithKline Pharmaceuticals, a prominent player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,792.00, showing a notable increase from the previous close of 2,692.50. Over the past year, the stock has reached a high of 3,087.95 and a low of 1,825.05, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bullish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates a bearish sentiment on a weekly basis, with no signal on a monthly scale. Bollinger Bands suggest a bullish trend in both weekly and monthly assessments, while moving averages present a mildly bearish stance on a daily basis. The KST reflects a mildly bullish trend weekly but is mildly bearish monthly, and the Dow Theory indicates a mildly bulli...

Read More

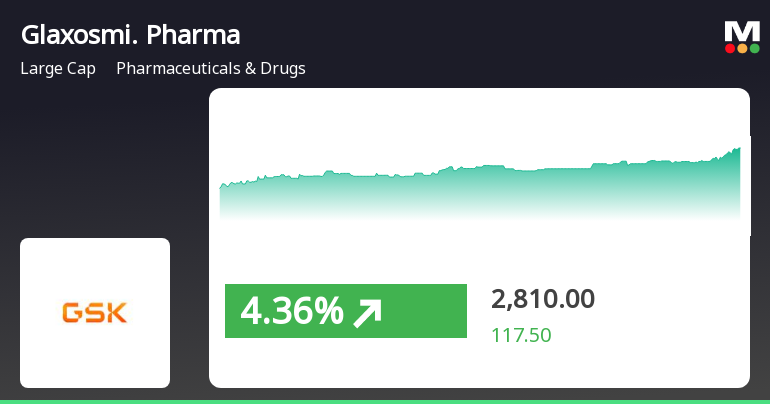

Glaxosmithkline Pharmaceuticals Shows Strong Performance Amid Broader Market Gains

2025-03-18 15:15:58Glaxosmithkline Pharmaceuticals has shown strong performance, gaining 3.85% on March 18, 2025, and outperforming its sector. The stock has achieved consecutive gains over two days, trading above all key moving averages. In the broader market, the Sensex has risen significantly, with small-cap stocks leading the gains.

Read More

Glaxosmithkline Adjusts Evaluation Amid Flat Performance and Strong Management Efficiency

2025-03-18 08:14:19Glaxosmithkline Pharmaceuticals has recently adjusted its evaluation, reflecting a nuanced perspective on its market position. The company reported flat financial performance in Q3 FY24-25, despite showcasing high management efficiency and a conservative debt-to-equity ratio. Its stock has outperformed the market over the past year.

Read MoreDisclosure Under Regulation 30

09-Apr-2025 | Source : BSEAs per attachment

Announcement under Regulation 30 (LODR)-Change in Management

04-Apr-2025 | Source : BSEAs per attachment

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEAs per attachment

Corporate Actions

No Upcoming Board Meetings

Glaxosmithkline Pharmaceuticals Ltd has declared 120% dividend, ex-date: 07 Nov 24

No Splits history available

Glaxosmithkline Pharmaceuticals Ltd has announced 1:1 bonus issue, ex-date: 11 Sep 18

No Rights history available