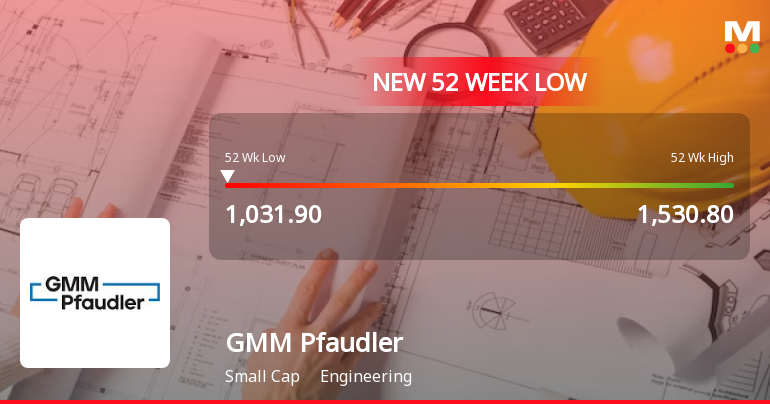

GMM Pfaudler Faces Volatility Amid Declining Profitability and Sector Underperformance

2025-03-17 09:38:52GMM Pfaudler has faced notable volatility, hitting a new 52-week low after a four-day decline. The company has reported negative financial results for four consecutive quarters, with significant drops in profitability. Despite strong management efficiency and growth potential, its overall performance lags behind the market.

Read More

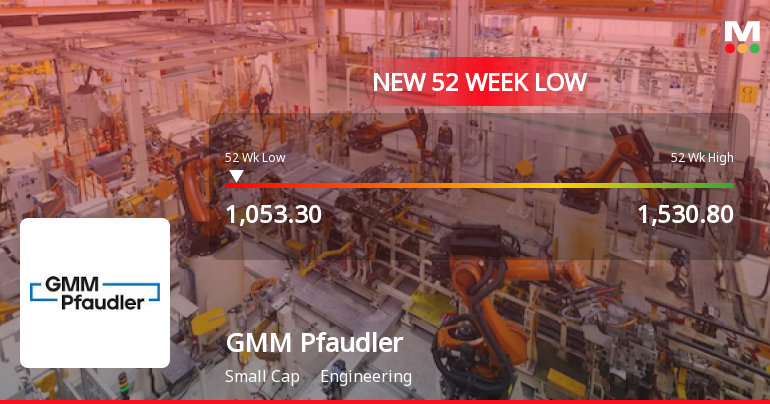

GMM Pfaudler Faces Declining Profitability Amid Increased Institutional Interest

2025-03-13 12:05:14GMM Pfaudler, a small-cap engineering firm, has reached a 52-week low amid a challenging performance trend, with a 5.4% decline over three days. The company has reported negative financial results for four consecutive quarters, yet maintains strong management efficiency and increased institutional holdings, reflecting some investor confidence.

Read MoreGMM Pfaudler Adjusts Valuation Grade Amidst Mixed Stock Performance and Market Positioning

2025-03-13 08:00:07GMM Pfaudler, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company currently has a price-to-earnings (P/E) ratio of 42.08 and a price-to-book value of 4.62, indicating a premium valuation relative to its book value. Its enterprise value to EBITDA stands at 14.35, while the EV to EBIT is recorded at 23.04, suggesting a robust operational performance. Despite these metrics, GMM Pfaudler has faced challenges in stock performance, with a year-to-date return of -10.65%, underperforming the Sensex, which has returned -5.26% over the same period. Over the past year, the stock has declined by 16.85%, contrasting with the Sensex's modest gain of 0.49%. However, the company has shown resilience over a longer horizon, with a remarkable 10-year return of 974.68%, significantly outpacing the Sensex's 155.89%. I...

Read MoreGMM Pfaudler Adjusts Valuation Grade Amidst Mixed Stock Performance and Market Positioning

2025-03-13 08:00:07GMM Pfaudler, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company currently has a price-to-earnings (P/E) ratio of 42.08 and a price-to-book value of 4.62, indicating a premium valuation relative to its book value. Its enterprise value to EBITDA stands at 14.35, while the EV to EBIT is recorded at 23.04, suggesting a robust operational performance. Despite these metrics, GMM Pfaudler has faced challenges in stock performance, with a year-to-date return of -10.65%, underperforming the Sensex, which has returned -5.26% over the same period. Over the past year, the stock has declined by 16.85%, contrasting with the Sensex's modest gain of 0.49%. However, the company has shown resilience over a longer horizon, with a remarkable 10-year return of 974.68%, significantly outpacing the Sensex's 155.89%. I...

Read MoreGMM Pfaudler Adjusts Valuation Grade Amidst Mixed Stock Performance and Market Positioning

2025-03-13 08:00:07GMM Pfaudler, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company currently has a price-to-earnings (P/E) ratio of 42.08 and a price-to-book value of 4.62, indicating a premium valuation relative to its book value. Its enterprise value to EBITDA stands at 14.35, while the EV to EBIT is recorded at 23.04, suggesting a robust operational performance. Despite these metrics, GMM Pfaudler has faced challenges in stock performance, with a year-to-date return of -10.65%, underperforming the Sensex, which has returned -5.26% over the same period. Over the past year, the stock has declined by 16.85%, contrasting with the Sensex's modest gain of 0.49%. However, the company has shown resilience over a longer horizon, with a remarkable 10-year return of 974.68%, significantly outpacing the Sensex's 155.89%. I...

Read MoreGMM Pfaudler Adjusts Valuation Grade Amidst Mixed Stock Performance and Market Positioning

2025-03-13 08:00:07GMM Pfaudler, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company currently has a price-to-earnings (P/E) ratio of 42.08 and a price-to-book value of 4.62, indicating a premium valuation relative to its book value. Its enterprise value to EBITDA stands at 14.35, while the EV to EBIT is recorded at 23.04, suggesting a robust operational performance. Despite these metrics, GMM Pfaudler has faced challenges in stock performance, with a year-to-date return of -10.65%, underperforming the Sensex, which has returned -5.26% over the same period. Over the past year, the stock has declined by 16.85%, contrasting with the Sensex's modest gain of 0.49%. However, the company has shown resilience over a longer horizon, with a remarkable 10-year return of 974.68%, significantly outpacing the Sensex's 155.89%. I...

Read MoreGMM Pfaudler Adjusts Valuation Grade Amidst Mixed Stock Performance and Market Positioning

2025-03-13 08:00:07GMM Pfaudler, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company currently has a price-to-earnings (P/E) ratio of 42.08 and a price-to-book value of 4.62, indicating a premium valuation relative to its book value. Its enterprise value to EBITDA stands at 14.35, while the EV to EBIT is recorded at 23.04, suggesting a robust operational performance. Despite these metrics, GMM Pfaudler has faced challenges in stock performance, with a year-to-date return of -10.65%, underperforming the Sensex, which has returned -5.26% over the same period. Over the past year, the stock has declined by 16.85%, contrasting with the Sensex's modest gain of 0.49%. However, the company has shown resilience over a longer horizon, with a remarkable 10-year return of 974.68%, significantly outpacing the Sensex's 155.89%. I...

Read MoreGMM Pfaudler Adjusts Valuation Grade Amidst Mixed Stock Performance and Market Positioning

2025-03-13 08:00:07GMM Pfaudler, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company currently has a price-to-earnings (P/E) ratio of 42.08 and a price-to-book value of 4.62, indicating a premium valuation relative to its book value. Its enterprise value to EBITDA stands at 14.35, while the EV to EBIT is recorded at 23.04, suggesting a robust operational performance. Despite these metrics, GMM Pfaudler has faced challenges in stock performance, with a year-to-date return of -10.65%, underperforming the Sensex, which has returned -5.26% over the same period. Over the past year, the stock has declined by 16.85%, contrasting with the Sensex's modest gain of 0.49%. However, the company has shown resilience over a longer horizon, with a remarkable 10-year return of 974.68%, significantly outpacing the Sensex's 155.89%. I...

Read MoreGMM Pfaudler Adjusts Valuation Grade Amidst Mixed Stock Performance and Market Positioning

2025-03-13 08:00:07GMM Pfaudler, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company currently has a price-to-earnings (P/E) ratio of 42.08 and a price-to-book value of 4.62, indicating a premium valuation relative to its book value. Its enterprise value to EBITDA stands at 14.35, while the EV to EBIT is recorded at 23.04, suggesting a robust operational performance. Despite these metrics, GMM Pfaudler has faced challenges in stock performance, with a year-to-date return of -10.65%, underperforming the Sensex, which has returned -5.26% over the same period. Over the past year, the stock has declined by 16.85%, contrasting with the Sensex's modest gain of 0.49%. However, the company has shown resilience over a longer horizon, with a remarkable 10-year return of 974.68%, significantly outpacing the Sensex's 155.89%. I...

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEPlease find attached letter for closure of trading window for approval of Q4 FY25 financial results.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

17-Mar-2025 | Source : BSEIntimation of investor meeting to be held on March 21 2025.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

14-Mar-2025 | Source : BSEPlease find enclosed voting results for resolutions passed by the shareholders of the Company on March 13 2025 through postal ballot.

Corporate Actions

No Upcoming Board Meetings

GMM Pfaudler Ltd has declared 50% dividend, ex-date: 21 Nov 24

GMM Pfaudler Ltd has announced 2:10 stock split, ex-date: 20 Oct 06

GMM Pfaudler Ltd has announced 2:1 bonus issue, ex-date: 11 Jul 22

No Rights history available