GMR Airports Shows Resilience Amid Market Volatility and Sector Outperformance

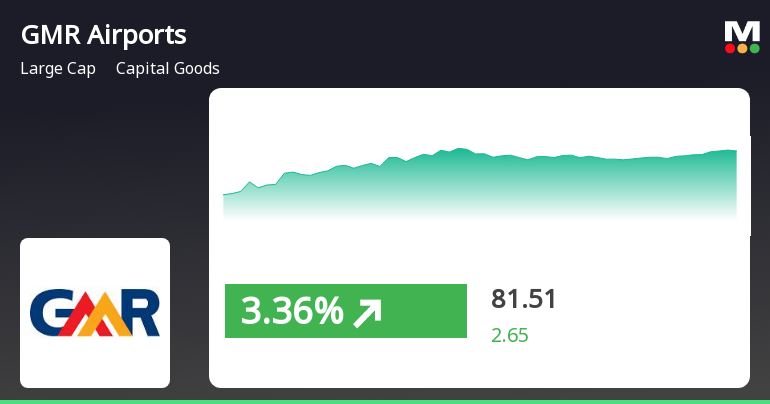

2025-04-03 09:45:16GMR Airports has demonstrated notable performance, gaining 3.47% on April 3, 2025, and achieving a total return of 7.23% over three days. The stock is positioned above several moving averages, reflecting resilience amid broader market volatility, where the Sensex has shown mixed signals.

Read MoreGMR Airports Ltd Shows Increased Investor Activity Amid Market Volatility

2025-04-01 11:00:03GMR Airports Ltd, a prominent player in the Capital Goods sector, has emerged as one of the most active equities today, with a total traded volume of 29,733,998 shares and a traded value of approximately Rs 22,630.55 lakhs. The stock opened at Rs 76.40 and has shown notable volatility, reaching a day high of Rs 77.45 and a day low of Rs 75.35. As of the latest update, the last traded price stands at Rs 75.50. Today’s performance indicates a positive trend reversal for GMR Airports, as the stock has gained after two consecutive days of decline. It has outperformed its sector by 2.82%, while the broader market, represented by the Sensex, has seen a decline of 1.16%. The stock's one-day return is recorded at 1.41%. In terms of moving averages, GMR Airports is currently above the 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. Additionally, the deliver...

Read MoreGMR Airports Sees Surge in Trading Activity Amid Mixed Performance Indicators

2025-03-27 14:00:04GMR Airports Ltd, a prominent player in the capital goods sector, has emerged as one of the most active equities today, with a total traded volume of 19,055,534 shares and a total traded value of approximately Rs 143.53 crore. The stock opened at Rs 75.90 and reached a day high of Rs 76.74, while the day low was recorded at Rs 74.96. As of the latest update, the last traded price stands at Rs 75.19. Despite its active trading, GMR Airports has underperformed relative to its sector, showing a decline of 1.26% compared to a sector return of 0.53% and a Sensex return of 0.49%. The stock's performance today indicates that it is currently above its 20-day and 50-day moving averages, but below its 5-day, 100-day, and 200-day moving averages. Notably, there has been a significant increase in investor participation, with delivery volume rising by 567.47% against the 5-day average, reaching 3.12 crore shares on Ma...

Read MoreGMR Airports Sees Significant Open Interest Surge Amid Increased Trading Activity

2025-03-26 15:00:04GMR Airports Ltd, a prominent player in the Capital Goods sector, has experienced a significant increase in open interest today. The latest open interest stands at 64,353 contracts, reflecting a rise of 6,985 contracts or 12.18% from the previous open interest of 57,368. This surge in open interest comes alongside a trading volume of 27,211 contracts, indicating heightened activity in the stock. In terms of performance, GMR Airports has outperformed its sector, recording a 1D return of 0.82%, compared to the sector's return of 0.52%. The stock's underlying value is noted at Rs 76, while its total futures value is approximately Rs 75,442.21 lakhs. Despite this positive performance, the stock has shown a decline in delivery volume, which fell by 50.31% against the 5-day average, with a delivery volume of 24.95 lakhs on March 25. GMR Airports is currently positioned as a large-cap company with a market capit...

Read MoreGMR Airports Sees Significant Open Interest Surge Amidst Market Activity Shift

2025-03-25 15:00:06GMR Airports Ltd, a prominent player in the Capital Goods sector, has experienced a significant increase in open interest today. The latest open interest stands at 64,977 contracts, reflecting a rise of 7,513 contracts or 13.07% from the previous open interest of 57,464. This uptick comes alongside a trading volume of 27,993 contracts, indicating heightened activity in the derivatives market. In terms of price performance, GMR Airports has underperformed its sector by 1.52%, with the stock falling 2.30% today. It reached an intraday low of Rs 76.05, marking a decline of 2.4%. The stock's weighted average price suggests that more volume was traded closer to this low price point. While the stock remains above its 5-day, 20-day, and 50-day moving averages, it is currently below its 100-day and 200-day moving averages. Additionally, there has been a noted decrease in investor participation, with delivery volu...

Read MoreGMR Airports Faces Technical Trend Shifts Amid Market Evaluation Revision

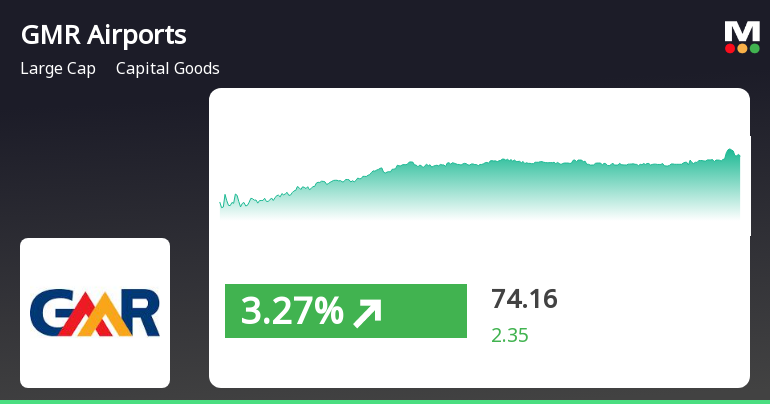

2025-03-12 08:00:05GMR Airports, a prominent player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 74.16, showing a notable increase from the previous close of 71.81. Over the past year, GMR Airports has experienced a decline of 10.33%, contrasting with a slight gain of 0.82% in the Sensex during the same period. In terms of technical indicators, the MACD and KST metrics indicate a bearish sentiment on a weekly basis, while the monthly outlook shows a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish stance for both weekly and monthly assessments. Notably, the stock's performance over the last three years has been impressive, with a return of 88.22%, significantly outpacing the Sensex's 33.40% return in the same timeframe. The company's ability to navigate market fluctuations is evident, particularly ...

Read More

GMR Airports Shows Trend Reversal Amid Broader Market Resilience and Mid-Cap Gains

2025-03-11 14:15:15GMR Airports experienced a notable uptick on March 11, 2025, reversing a three-day decline. The stock surpassed its short-term moving averages, while still trailing behind longer-term ones. Despite recent gains, it has faced challenges over the past three months and year. The broader market showed resilience, with mid-cap stocks leading.

Read MoreGMR Airports Faces Bearish Technical Trends Amidst Market Evaluation Revision

2025-03-10 08:00:07GMR Airports, a prominent player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 72.70, slightly down from the previous close of 73.71. Over the past year, GMR Airports has experienced a decline of 13.94%, contrasting with a modest gain of 0.29% in the Sensex during the same period. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the monthly metrics indicate a mildly bearish trend. The moving averages on a daily basis also reflect a bearish sentiment. The Bollinger Bands and the On-Balance Volume (OBV) metrics further support this cautious outlook, with both weekly and monthly readings suggesting a mildly bearish stance. Despite the recent challenges, GMR Airports has demonstrated resilience over longer time frames, achieving a remarkable 318.65% return over the...

Read MoreGMR Airports Faces Technical Trend Challenges Amid Market Evaluation Revision

2025-03-06 08:00:07GMR Airports, a prominent player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 74.18, showing a notable increase from the previous close of 71.19. Over the past year, GMR Airports has experienced a decline of 14.43%, contrasting with a slight gain of 0.07% in the Sensex during the same period. In terms of technical indicators, the weekly MACD and KST are positioned in a bearish trend, while the monthly metrics indicate a mildly bearish stance. The Bollinger Bands also reflect a mildly bearish trend on both weekly and monthly scales. Moving averages on a daily basis suggest a similar mildly bearish outlook. Despite the recent challenges, GMR Airports has demonstrated resilience over longer time frames, with a remarkable 327.17% return over the past decade, significantly outperforming the Sensex's 150.37%...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Acquisition

06-Apr-2025 | Source : BSERegulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 (Listing Regulations)

Announcement under Regulation 30 (LODR)-Allotment

03-Apr-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 - Allotment of Non-Convertible Bonds

Corporate Actions

No Upcoming Board Meetings

GMR Airports Ltd has declared 10% dividend, ex-date: 09 Sep 14

GMR Airports Ltd has announced 1:2 stock split, ex-date: 01 Oct 09

No Bonus history available

GMR Airports Ltd has announced 3:14 rights issue, ex-date: 11 Mar 15