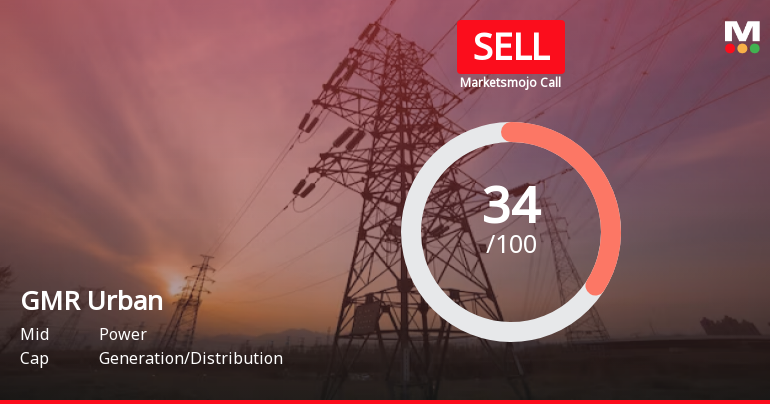

GMR Power & Urban Infra Faces Mixed Signals Amidst Evaluation Adjustment and Financial Challenges

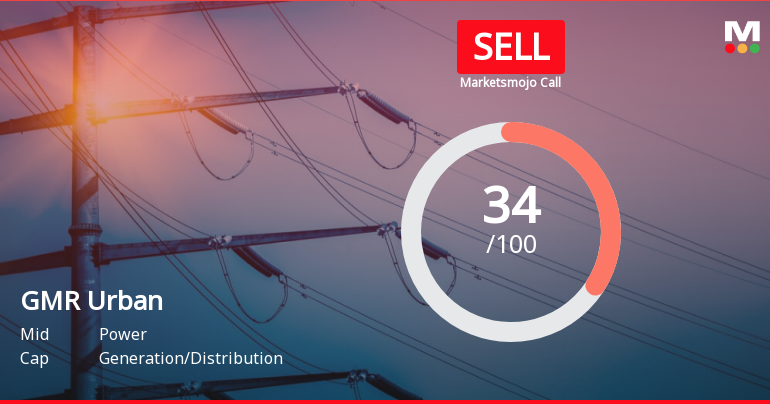

2025-04-03 08:14:01GMR Power & Urban Infra has experienced a recent evaluation adjustment, indicating a shift in its technical trends. The company, a midcap player in power generation and distribution, shows mixed signals in key indicators while maintaining strong performance metrics over the past year, despite facing financial challenges.

Read MoreGMR Power & Urban Infra Shows Mixed Technical Trends Amid Strong Performance Growth

2025-04-03 08:06:30GMR Power & Urban Infra, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 116.55, showing a slight increase from the previous close of 115.20. Over the past year, GMR Power has demonstrated significant performance, with a remarkable return of 150.7%, far surpassing the Sensex's return of 3.67% during the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD signals a mildly bearish trend on both weekly and monthly charts, while the Bollinger Bands indicate a bullish stance on the same timeframes. The moving averages present a mildly bearish signal on a daily basis, contrasting with the mildly bullish indicators from the Dow Theory and On-Balance Volume metrics. GMR Power's performance over various timeframes highlights its resilience...

Read More

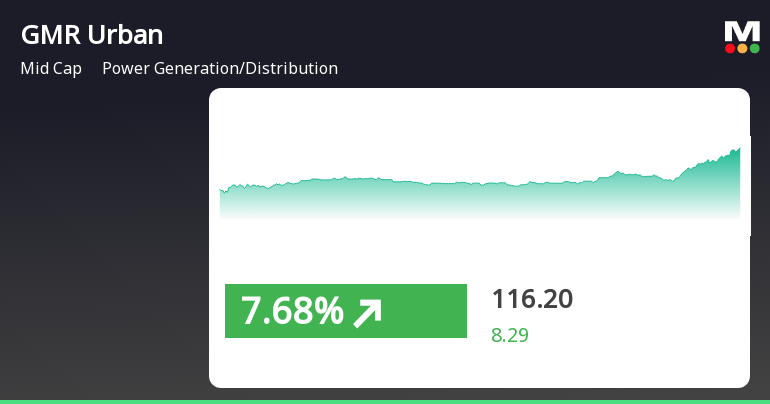

GMR Power & Urban Infra Shows Strong Recovery Amid Broader Market Resilience

2025-03-27 14:50:31GMR Power & Urban Infra has experienced notable gains, reversing a two-day decline and reaching an intraday high. The company has outperformed its sector and the broader market over various time frames, demonstrating strong momentum and significant annual growth compared to the Sensex's modest increase.

Read More

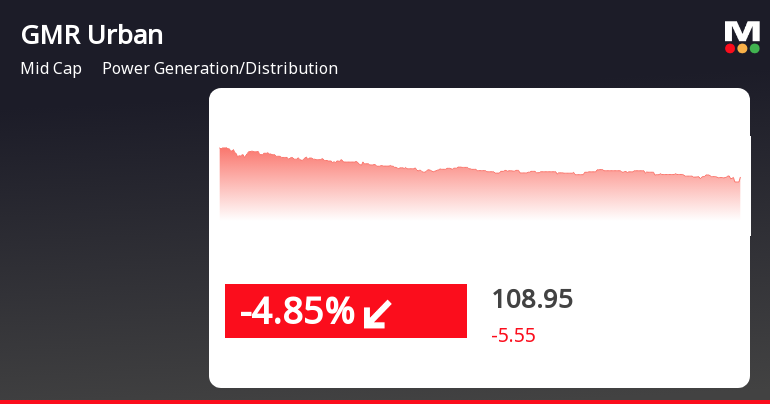

GMR Power & Urban Infra Faces Setback Amid Broader Market Resilience

2025-03-25 15:50:26GMR Power & Urban Infra saw a decline on March 25, 2025, after two days of gains, underperforming its sector. Despite this, the stock remains above several moving averages. In contrast, the broader market, represented by the Sensex, has shown resilience and positive performance over recent weeks.

Read MoreGMR Power & Urban Infra Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-19 08:05:10GMR Power & Urban Infra, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 103.61, showing a notable increase from the previous close of 100.34. Over the past year, GMR Power has demonstrated significant resilience, with a return of 123.39%, contrasting sharply with the Sensex's modest gain of 3.51% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal on both weekly and monthly charts, indicating a neutral momentum. Bollinger Bands suggest a mildly bearish trend on the weekly scale, while the monthly perspective appears bullish. Daily moving averages indicate a bearish stance, and the KST shows a bullish trend on a weekly basis. The company's ...

Read More

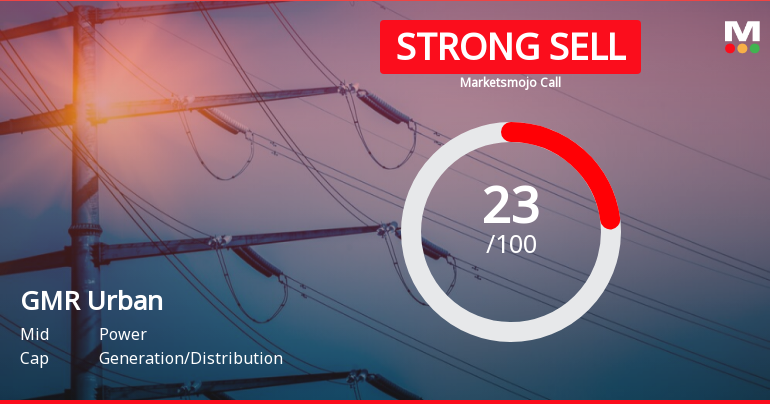

GMR Power & Urban Infra Faces Financial Challenges Amid Market Reassessment

2025-03-17 10:37:42GMR Power & Urban Infra has recently experienced an evaluation adjustment, highlighting a reassessment of its financial position amid challenges such as a high debt burden and flat quarterly performance. Despite these issues, the company shows attractive valuation metrics and has outperformed the broader market over the past year.

Read MoreGMR Power Shows Mixed Technical Trends Amid Strong Yearly Performance Resilience

2025-03-12 08:03:28GMR Power & Urban Infra, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 103.45, showing a slight increase from the previous close of 102.90. Over the past year, GMR Power has demonstrated significant resilience, with a remarkable return of 111.68%, contrasting sharply with the Sensex's modest gain of 0.82% during the same period. In terms of technical indicators, the weekly MACD suggests a bearish sentiment, while the monthly outlook remains mildly bearish. The Bollinger Bands indicate a bearish trend on a weekly basis, although they show bullish tendencies monthly. Moving averages also reflect a bearish stance, aligning with the overall technical summary that indicates mixed signals across various timeframes. Despite recent fluctuations, GMR Power's performance over the...

Read MoreGMR Power & Urban Infra Demonstrates Resilience Amid Broader Market Challenges

2025-03-11 18:00:27GMR Power & Urban Infra Ltd, a mid-cap player in the power generation and distribution sector, has shown notable activity today, with its stock price increasing by 0.53%. This performance stands in contrast to the broader market, as the Sensex experienced a slight decline of 0.02%. Over the past year, GMR Power & Urban Infra has delivered an impressive return of 111.68%, significantly outperforming the Sensex, which gained only 0.82% during the same period. In terms of market capitalization, GMR Power & Urban Infra is valued at Rs 7,203.00 crore, with a price-to-earnings (P/E) ratio of -21.66, compared to the industry average of 20.71. While the stock has faced challenges in the short term, including a year-to-date decline of 14.47%, it has shown resilience with an 8.67% increase over the past week. Technical indicators present a mixed picture, with weekly MACD showing bearish signals, while monthly Bolli...

Read More

GMR Power & Urban Infra Faces Financial Challenges Amid Market Reassessment

2025-03-10 08:08:39GMR Power & Urban Infra has recently experienced an evaluation adjustment, highlighting a reassessment of its financial health amid market dynamics. The company faces challenges, including a high debt-equity ratio and stagnant operating profit, while a significant portion of promoter shares is pledged, impacting stock performance.

Read MoreDisclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received the Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011 on March 28 2025 for GMR Enterprises Pvt Ltd

Intimation Under SEBI (LODR) 2015

31-Mar-2025 | Source : BSEUpdate on One time settlement of GMR Rajahmundry Energy Limited (GREL) an associate Company with its lenders

Closure of Trading Window

29-Mar-2025 | Source : BSEIntimation under SEBI (PIT) Regulation 2015-Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available