Godrej Agrovet Shows Bullish Technical Trends Amid Strong Market Performance

2025-04-03 08:05:59Godrej Agrovet, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 784.00, showing a notable increase from the previous close of 750.35. Over the past year, Godrej Agrovet has demonstrated strong performance, with a return of 53.56%, significantly outpacing the Sensex's return of 3.67% during the same period. The technical summary indicates a bullish sentiment in several key indicators. The MACD and Bollinger Bands are both signaling bullish trends on a weekly and monthly basis, while the KST also reflects a bullish outlook. However, the daily moving averages present a mildly bearish stance, suggesting some short-term volatility. In terms of market performance, Godrej Agrovet has shown resilience, particularly over the last month with an 8.41% return compared to the Sensex's 4.67%. The stock's performan...

Read MoreGodrej Agrovet Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-04-02 08:09:11Godrej Agrovet, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 750.35, slightly down from its previous close of 754.15. Over the past year, Godrej Agrovet has demonstrated significant resilience, achieving a return of 49.4%, which notably outperforms the Sensex's return of 2.72% during the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal on a weekly basis but leans bearish monthly. Bollinger Bands suggest a mildly bullish outlook on both weekly and monthly charts, while moving averages present a mildly bearish stance daily. The company's performance over various time frames highlights its ability to navigate market fluctuations, with a notable 63.44% retu...

Read MoreGodrej Agrovet Adjusts Valuation Grade Amid Strong Financial Performance and Market Position

2025-04-02 08:02:49Godrej Agrovet, a midcap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company currently boasts a PE ratio of 34.67 and an EV to EBITDA ratio of 19.97, indicating robust earnings relative to its valuation. Additionally, Godrej Agrovet's PEG ratio stands at 1.40, suggesting a favorable growth outlook compared to its price. In terms of returns, Godrej Agrovet has shown resilience, with a one-year return of 49.4%, significantly outperforming the Sensex, which recorded a 2.72% return over the same period. Over three years, the company's return of 63.44% also surpasses the Sensex's 28.25%, highlighting its competitive edge in the market. When compared to its peers, Godrej Agrovet's valuation metrics appear favorable. For instance, while companies like Bikaji Foods and Mrs. Bectors are positioned at higher valuation lev...

Read MoreGodrej Agrovet Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-24 08:02:47Godrej Agrovet, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 770.00, showing a slight increase from the previous close of 760.95. Over the past year, Godrej Agrovet has demonstrated a robust performance with a return of 53.36%, significantly outpacing the Sensex's return of 5.87% during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands are signaling bullish trends, while the monthly metrics present a mixed picture with some bearish signals in the RSI. The stock's moving averages indicate a mildly bearish stance on a daily basis, contrasting with the overall bullish sentiment observed in longer-term indicators. The company's performance over various time frames highlights its resilience, particularly in the last three years, where it achieved a return of 63.08%,...

Read MoreGodrej Agrovet Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-20 08:03:39Godrej Agrovet, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 761.95, slightly down from the previous close of 766.75. Over the past year, Godrej Agrovet has demonstrated a robust performance with a return of 52.27%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. The technical summary indicates a mixed outlook, with various indicators showing differing trends. The MACD suggests a mildly bearish stance on a weekly basis while remaining bullish on a monthly scale. The Relative Strength Index (RSI) shows no signal weekly but leans bearish monthly. Bollinger Bands and On-Balance Volume (OBV) present a bullish trend on a monthly basis, indicating potential strength in the stock's performance. In terms of returns, Godrej Agrovet has outperformed the Sensex ov...

Read More

Godrej Agrovet Faces Mixed Financial Signals Amid Stakeholder Confidence Decline

2025-03-19 08:10:04Godrej Agrovet has recently experienced an evaluation adjustment, reflecting its market position amid flat financial performance for Q3 FY24-25. Despite a notable annual return and profit increase, concerns arise from a decline in promoter confidence and the stock's trading discount compared to peers, indicating a complex financial landscape.

Read MoreGodrej Agrovet Shows Mixed Technical Trends Amid Strong Yearly Performance

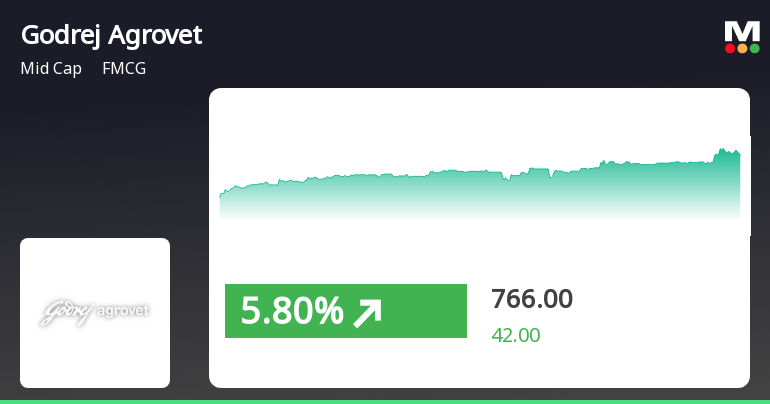

2025-03-19 08:04:45Godrej Agrovet, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 766.75, showing a notable increase from the previous close of 724.00. Over the past year, Godrej Agrovet has demonstrated a strong performance with a return of 53.04%, significantly outpacing the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands are signaling bullish trends, while the monthly metrics present a mixed picture, with the RSI indicating bearish conditions. The daily moving averages suggest a mildly bearish stance, contrasting with the overall bullish sentiment observed in the weekly and monthly KST readings. The company's performance over various time frames highlights its resilience, particularly in the one-month and three-year periods, wher...

Read More

Godrej Agrovet Outperforms Sector Amid Broader Market Gains and Positive Trends

2025-03-18 15:16:05Godrej Agrovet has demonstrated strong performance, gaining 6.22% on March 18, 2025, and outperforming its sector. The stock has seen consecutive gains over two days, reaching an intraday high of Rs 774.5. It is trading above all key moving averages, indicating a positive trend in its price performance.

Read MoreGodrej Agrovet Experiences Mixed Technical Trends Amid Market Fluctuations

2025-03-17 08:01:26Godrej Agrovet, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 721.00, down from a previous close of 736.00, with a notable 52-week high of 877.85 and a low of 475.70. Today's trading saw fluctuations, reaching a high of 757.95 and a low of 715.35. The technical summary indicates a mixed outlook, with the MACD showing a mildly bearish trend on a weekly basis while remaining bullish on a monthly scale. The Relative Strength Index (RSI) presents no signal weekly but leans bearish monthly. Bollinger Bands reflect a bearish stance weekly, contrasting with a mildly bullish monthly perspective. Daily moving averages are bearish, while the KST shows a bearish trend weekly and bullish monthly. The On-Balance Volume (OBV) remains bullish on both weekly and monthly assessments. In terms of performance, Godrej...

Read MoreAnnouncement Under Regulation 30- Updates

01-Apr-2025 | Source : BSEPlease find enclosed intimation under Regulation 30 of SEBI (LODR) Regulation 2015

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

31-Mar-2025 | Source : BSEThe Nomination and Remuneration Committee has allotted 4942 Equity Shares to an eligible employee of the Company under Godrej Agrovet Limited - Employees Stock Grant Scheme 2018

Closure of Trading Window

28-Mar-2025 | Source : BSEPlease find enclosed intimation of closure of Trading Window for the Quarter ended March 31 2025

Corporate Actions

No Upcoming Board Meetings

Godrej Agrovet Ltd. has declared 100% dividend, ex-date: 26 Jul 24

No Splits history available

No Bonus history available

No Rights history available