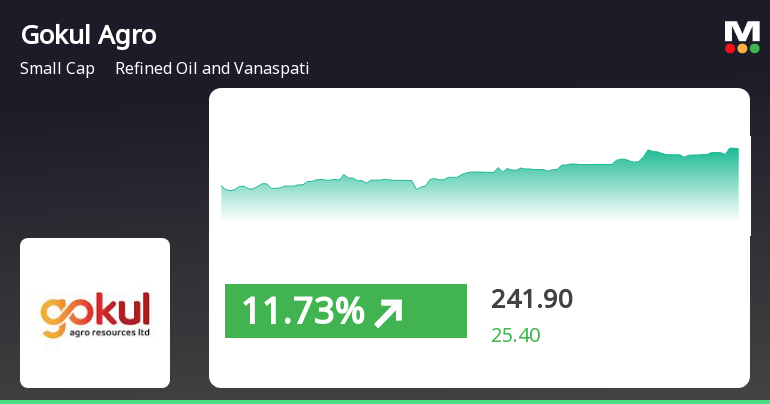

Gokul Agro Resources Adjusts Valuation Grade Amid Strong Financial Performance and Market Positioning

2025-04-02 08:02:35Gokul Agro Resources, a small-cap player in the refined oil and vanaspati industry, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company currently boasts a price-to-earnings (PE) ratio of 14.57 and an impressive return on capital employed (ROCE) of 45.76%. Additionally, its return on equity (ROE) stands at 22.16%, indicating robust profitability. In comparison to its peers, Gokul Agro's valuation metrics are noteworthy. For instance, while Gokul Agro's EV to EBITDA ratio is 6.89, other companies in the sector, such as BCL Industries, show a ratio of 7.11, highlighting Gokul's competitive edge. Furthermore, the company's PEG ratio of 0.17 suggests a favorable growth outlook relative to its earnings. Despite recent fluctuations in stock price, with a current price of 238.10, Gokul Agro has demonstrated significant long-term performance, achi...

Read More

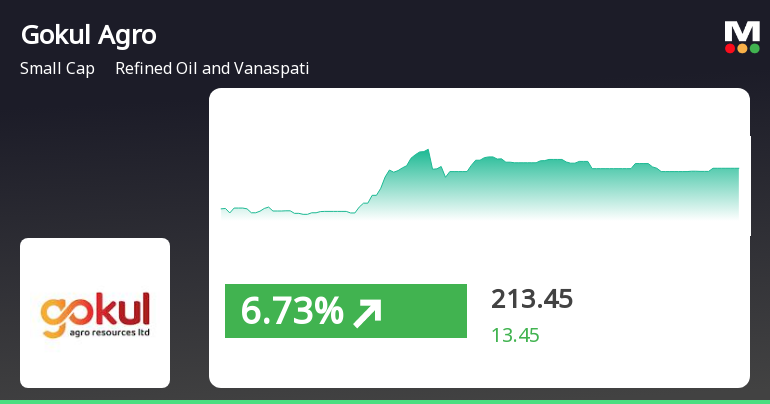

Gokul Agro Resources Demonstrates Strong Resilience Amid Broader Market Challenges

2025-03-19 10:50:28Gokul Agro Resources, a small-cap company in the refined oil and vanaspati sector, has demonstrated significant stock activity, gaining 9.01% on March 19, 2025. The stock has outperformed its sector and has shown notable volatility, marking its second consecutive day of gains and a substantial increase over the past year.

Read More

Gokul Agro Resources Shows Strong Rebound Amidst Broader Market Gains

2025-03-18 10:01:04Gokul Agro Resources, a small-cap company in the refined oil and vanaspati sector, experienced a notable performance on March 18, 2025, reversing a seven-day decline. The stock outperformed its sector and has delivered a substantial return over the past year, despite currently trading below key moving averages.

Read More

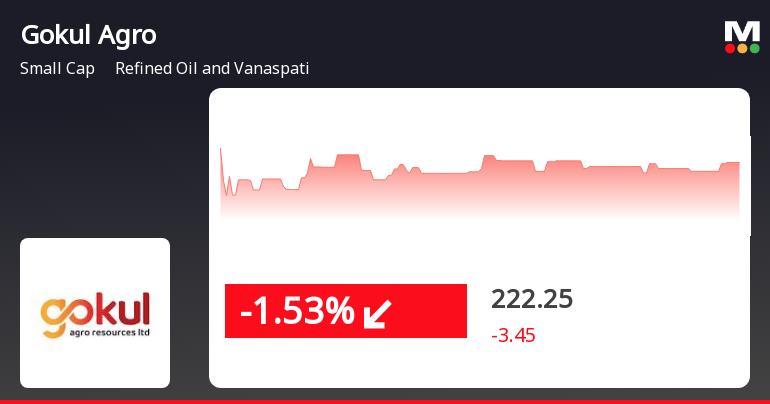

Gokul Agro Resources Faces Significant Stock Volatility Amid Market Fluctuations

2025-03-10 15:30:38Gokul Agro Resources, a small-cap company in the refined oil sector, experienced significant stock volatility today, with a notable decline following earlier gains. Over the past month, the stock has decreased substantially, although it has shown impressive growth over the past year, maintaining its status as a Reliable Performer.

Read More

Gokul Agro Resources Shows Strong Financial Growth Amid Market Challenges

2025-03-05 08:12:18Gokul Agro Resources, a small-cap player in the refined oil and vanaspati sector, has recently seen an evaluation adjustment due to its strong financial performance. The company reported significant growth in net sales and operating profit, alongside a low debt-to-equity ratio and a solid return on equity, reinforcing its market position.

Read MoreGokul Agro Resources Experiences Valuation Grade Change Amid Competitive Market Dynamics

2025-03-01 08:00:23Gokul Agro Resources, a small-cap player in the refined oil and vanaspati industry, has recently undergone a valuation adjustment. The company's current price stands at 261.15, reflecting a decline from its previous close of 268.35. Over the past year, Gokul Agro has demonstrated significant resilience, achieving a return of 126.59%, contrasting sharply with the Sensex's modest gain of 1.24% during the same period. Key financial metrics reveal a PE ratio of 15.98 and an EV to EBITDA ratio of 7.57, indicating a competitive position within its sector. The company's return on capital employed (ROCE) is notably high at 45.76%, while the return on equity (ROE) stands at 22.16%. These figures suggest a robust operational efficiency and profitability. In comparison to its peers, Gokul Agro's valuation metrics present a varied landscape. While it maintains a fair valuation, competitors like Guj. Ambuja and BCL In...

Read MoreGokul Agro Resources Faces Stock Volatility Amid Broader Market Challenges

2025-02-24 09:40:11Gokul Agro Resources, a small-cap player in the refined oil and vanaspati industry, has experienced notable volatility in its stock performance today. The stock opened with a significant loss of 5.38%, reflecting a broader trend as it has underperformed its sector by 1.47%. Over the past two days, Gokul Agro has seen a consecutive decline, accumulating a total drop of 4.41%. During today's trading session, the stock reached an intraday low of Rs 266.55. In terms of moving averages, Gokul Agro's stock is currently positioned higher than its 200-day moving average but falls below the 5-day, 20-day, 50-day, and 100-day moving averages, indicating mixed short-term performance. In the context of broader market performance, Gokul Agro Resources recorded a one-day decline of 2.73%, while the Sensex experienced a smaller drop of 0.68%. Over the past month, the stock has faced a more pronounced decline of 8.67%, c...

Read More

Gokul Agro Resources Reports Record Q3 FY24-25 Sales and Profit Growth

2025-02-11 20:06:11Gokul Agro Resources has reported strong financial results for Q3 FY24-25, with record net sales of Rs 4,988.22 crore and significant increases in Profit Before Tax and Profit After Tax. The Earnings per Share reached Rs 4.92, and the Debtors Turnover Ratio was notably high at 59.53 times.

Read MoreGokul Agro Resources Faces Increased Volatility Amid Broader Market Challenges

2025-02-10 11:50:15Gokul Agro Resources, a small-cap player in the refined oil and vanaspati industry, has experienced notable activity today amid a challenging market environment. The stock opened with a significant loss of 5.63%, reflecting a broader trend as it has underperformed its sector by 1.41%. Over the past three days, Gokul Agro has faced consecutive declines, resulting in a total drop of 3.89% during this period. Today's trading saw the stock reach an intraday low of Rs 290.9, contributing to a one-day performance decline of 3.10%, compared to the Sensex's decrease of 0.72%. Over the past month, Gokul Agro Resources has seen a more pronounced decline of 13.77%, while the Sensex has remained relatively stable with a minor drop of 0.10%. Despite these challenges, Gokul Agro Resources maintains a position above its 200-day moving average, although it is currently below its shorter-term moving averages, including th...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories Participants) Regulations 2018 for the quarter ended 31st March 2025

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Intimation Of Postponement Of Date Of Completion Of Solar Power Project

10-Mar-2025 | Source : BSEIntimation of Postponement of Date of Completion of Solar Power Project to further period of Nine Months i.e. 31st December 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Gokul Agro Resources Ltd has announced 1:32 rights issue, ex-date: 08 Mar 23