Goldiam International Adjusts Valuation Amid Strong Yearly Stock Performance and Competitive Landscape

2025-03-25 08:00:39Goldiam International, a small-cap player in the diamond and gold jewelry industry, has recently undergone a valuation adjustment. The company's current price stands at 407.90, reflecting a slight decline from the previous close of 411.20. Over the past year, Goldiam has demonstrated significant stock performance, achieving a remarkable return of 128.00%, which notably outpaces the Sensex's return of 7.07% during the same period. In terms of key financial metrics, Goldiam's price-to-earnings (PE) ratio is reported at 38.98, while its price-to-book value is 6.51. The company also shows a robust return on capital employed (ROCE) of 29.58% and a return on equity (ROE) of 14.12%. These figures indicate a strong operational efficiency relative to its peers. When compared to competitors, Goldiam's valuation metrics present a mixed picture. For instance, Senco Gold holds a more attractive valuation with a PE of ...

Read MoreGoldiam International Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-11 08:00:28Goldiam International, a small-cap player in the diamond and gold jewelry industry, has recently undergone a valuation adjustment. The company's financial metrics reflect a PE ratio of 38.67 and an EV to EBITDA ratio of 27.54, indicating a robust market position. Additionally, Goldiam's return on capital employed (ROCE) stands at 29.58%, showcasing its efficiency in generating profits from its capital. In comparison to its peers, Goldiam's valuation metrics present a mixed picture. For instance, Senco Gold, with a PE ratio of 36.76, is positioned attractively, while Rajesh Exports shows a significantly higher PE ratio of 122.95, indicating a different market perception. Other competitors like Renaiss. Global and Asian Star Co. exhibit lower valuation ratios, suggesting varying levels of market confidence within the industry. Goldiam's stock performance has been notable, with a one-year return of 124.43%, ...

Read More

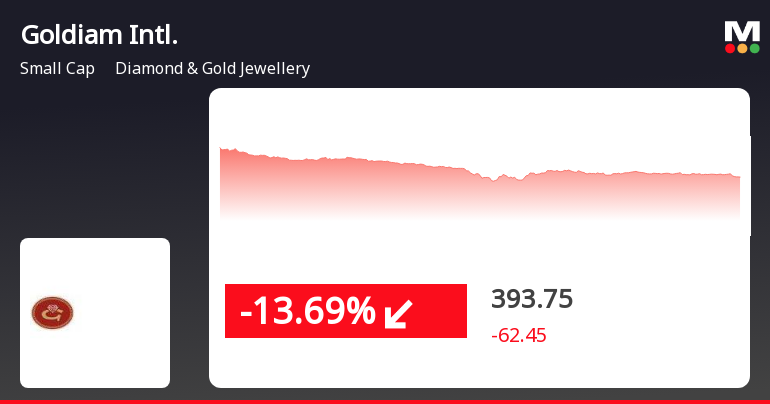

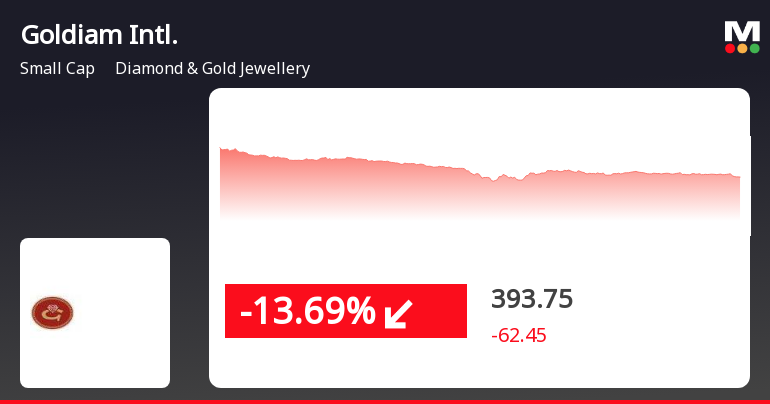

Goldiam International Shows Significant Stock Volatility Amid Market Dynamics Shift

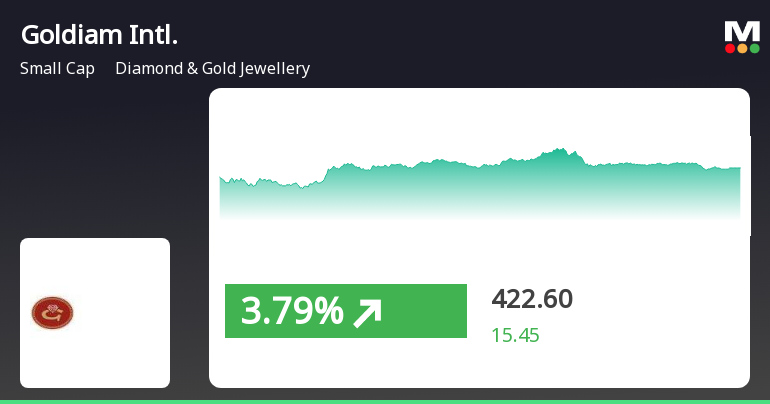

2025-02-19 09:50:23Goldiam International, a small-cap player in the diamond and gold jewelry sector, saw significant trading activity on February 19, 2025, with notable intraday volatility. The stock is currently positioned above its 200-day moving average but below several shorter-term averages, reflecting mixed performance amid recent challenges.

Read More

Goldiam International Faces Significant Stock Volatility Amid Broader Market Challenges

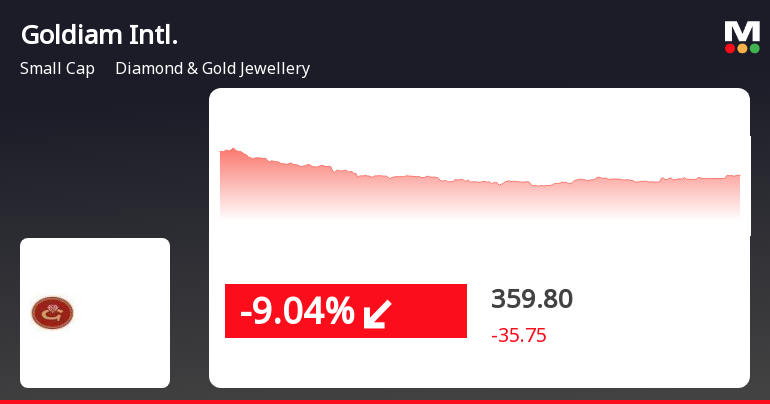

2025-02-18 11:57:03Goldiam International, a small-cap in the diamond and gold jewelry sector, faced significant stock volatility on February 18, 2025, with a notable decline. The stock's performance over the past month shows a sharp drop, highlighting the company's struggles amid broader market challenges.

Read More

Goldiam International Faces Ongoing Challenges Amid Significant Stock Volatility in February 2025

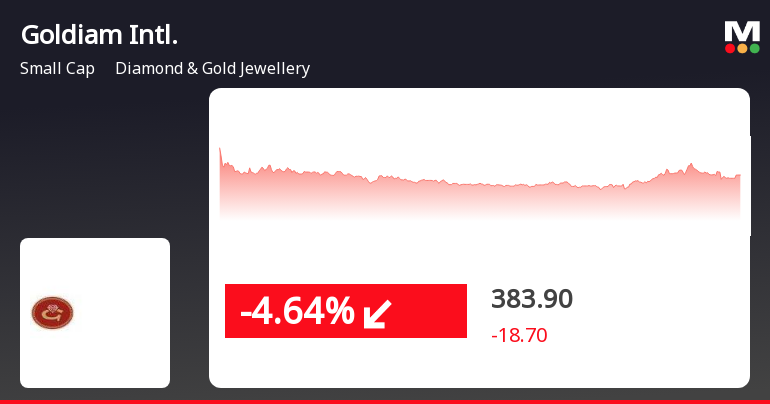

2025-02-14 14:15:48Goldiam International, a small-cap in the diamond and gold jewelry sector, faced notable stock volatility, declining 7.18% on February 14, 2025. Over two days, it lost 11.65%, underperforming its sector. The stock has dropped 27.98% in the past month, indicating significant challenges in the market.

Read More

Goldiam International Shows Significant Recovery Amidst Market Volatility in February 2025

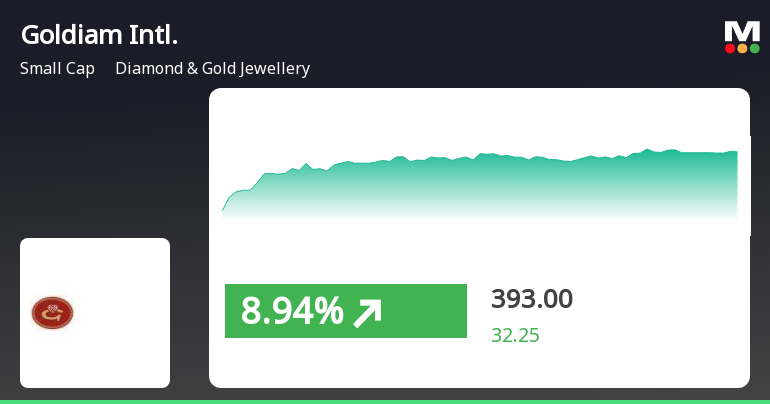

2025-02-12 13:20:19Goldiam International, a small-cap in the diamond and gold jewelry sector, experienced a notable rebound on February 12, 2025, after six days of decline. The stock demonstrated high volatility and outperformed its sector, indicating a significant shift in momentum amid a challenging market environment.

Read More

Goldiam International Reports Strong Q3 Growth Amid Mixed Stock Evaluation and Stakeholder Changes

2025-02-11 18:00:26Goldiam International, a small-cap company in the diamond and gold jewelry sector, reported impressive third-quarter financial results for FY24-25, with a significant increase in operating profit and cash reserves. However, the stock's evaluation has been adjusted, reflecting a mixed outlook amid slight changes in promoter confidence.

Read More

Goldiam International Faces Stock Volatility Amid Mixed Performance Indicators

2025-02-11 11:05:19Goldiam International, a small-cap company in the diamond and gold jewelry sector, has faced notable stock volatility, with a significant decline over three consecutive days. Despite recent losses, the stock remains above longer-term moving averages, indicating a mixed short-term performance while still being recognized in the jewelry industry.

Read More

Goldiam International Faces Stock Volatility Amid Mixed Performance Indicators

2025-02-11 11:05:19Goldiam International, a small-cap company in the diamond and gold jewelry sector, has faced notable stock volatility, with a significant decline over three consecutive days. Despite recent losses, the stock remains above longer-term moving averages, indicating a mixed short-term performance while still being recognized in the jewelry industry.

Read MoreIntimation For Opening Of Sixth Store For Lab-Grown Diamond Jewellery Retail At Golden Chambers Andheri Link Road Andheri West Mumbai-400053 Under The Brand Name ORIGEM.

09-Apr-2025 | Source : BSEIntimation of opening of sixth store

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Reg.74(5) of SEBI DP Regulations

Intimation For Opening Of Fifth Store For Lab-Grown Diamond Jewellery Retail At Fairmont Hotel 2-Upper Ground Floor Next To T2 Terminal Chhatrapati Shivaji Maharaj International Airport Road Mumbai- 400099 Under The Brand Name ORIGEM

01-Apr-2025 | Source : BSEIntimation for opening of fifth store

Corporate Actions

No Upcoming Board Meetings

Goldiam International Ltd has declared 50% dividend, ex-date: 14 Feb 25

Goldiam International Ltd has announced 2:10 stock split, ex-date: 28 Mar 22

No Bonus history available

No Rights history available