Goodluck India Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-04-02 08:00:42Goodluck India, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company currently boasts a price-to-earnings (PE) ratio of 15.08 and an EV to EBITDA ratio of 10.23, indicating a competitive standing within its sector. Additionally, Goodluck India has a return on capital employed (ROCE) of 13.68% and a return on equity (ROE) of 12.23%, showcasing its operational efficiency. In comparison to its peers, Goodluck India stands out with a more favorable valuation profile. For instance, while Sunflag Iron is positioned at a higher PE ratio of 26.09, and Kalyani Steels is categorized as very expensive, Goodluck India maintains a more attractive valuation. The company’s dividend yield is at 0.40%, further enhancing its appeal in the market. Despite recent fluctuations in stock performance,...

Read MoreGoodluck India Faces Bearish Technical Trends Amidst Market Volatility

2025-03-27 08:00:42Goodluck India, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 717.50, down from a previous close of 754.90, with a notable 52-week high of 1,345.00 and a low of 568.20. Today's trading saw a high of 763.10 and a low of 717.05. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, the Bollinger Bands and KST also reflect bearish tendencies in the weekly analysis. The daily moving averages align with this sentiment, indicating a consistent bearish trend. In terms of performance, Goodluck India's stock return over the past week stands at 0.86%, compared to a 2.44% return from the Sensex. Over the past month, the stock has outperformed the Sensex ...

Read MoreGoodluck India Faces Technical Trend Shifts Amidst Market Volatility and Performance Fluctuations

2025-03-25 08:01:29Goodluck India, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 763.50, showing a notable increase from the previous close of 736.40. Over the past year, Goodluck India has experienced a 52-week high of 1,345.00 and a low of 568.20, indicating significant volatility. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands and moving averages also reflect a mildly bearish trend, indicating a cautious market environment. The On-Balance Volume (OBV) shows no significant trend on a weekly basis, while the monthly perspective leans mildly bearish. When comparing the company's performance to the Sensex, Goodluck India has demonstrated impressive returns over longer periods. ...

Read More

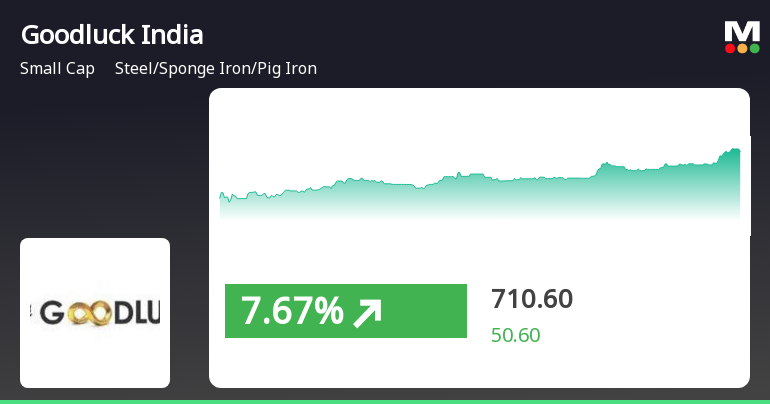

Goodluck India Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-19 14:45:21Goodluck India, a small-cap company in the steel industry, has experienced notable gains, outperforming its sector recently. The stock has shown consecutive gains over two days and reached an intraday high. Despite recent performance, its year-to-date and annual figures indicate a decline, though long-term returns remain strong.

Read More

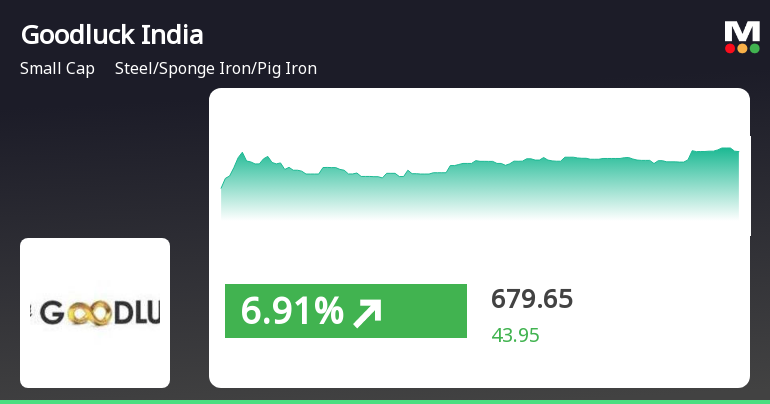

Goodluck India Surges Amid Broader Market Trends, Highlighting Small-Cap Resilience

2025-03-06 11:15:19Goodluck India, a small-cap company in the steel sector, experienced significant trading activity, outperforming its sector. While the stock showed a strong one-day performance, it has faced declines over the past month and year-to-date, though it boasts impressive gains over three and five years.

Read More

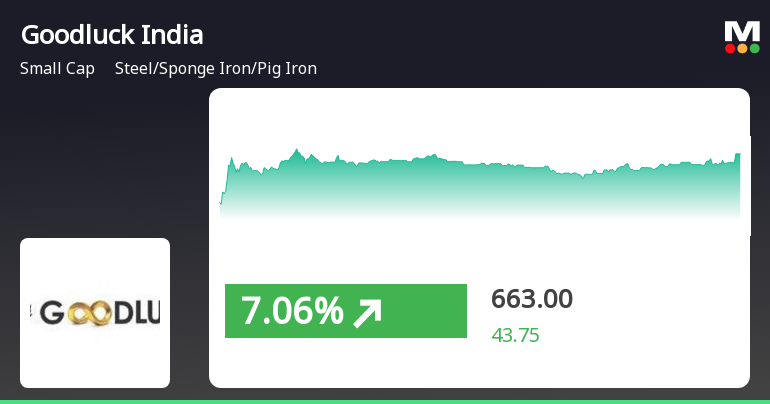

Goodluck India's Stock Surge Signals Potential Trend Reversal Amid Market Volatility

2025-02-19 15:45:17Goodluck India, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, experienced a notable gain on February 19, 2025, after three days of decline. Despite this uptick, the stock remains below key moving averages and has faced significant challenges over the past month compared to the broader market.

Read More

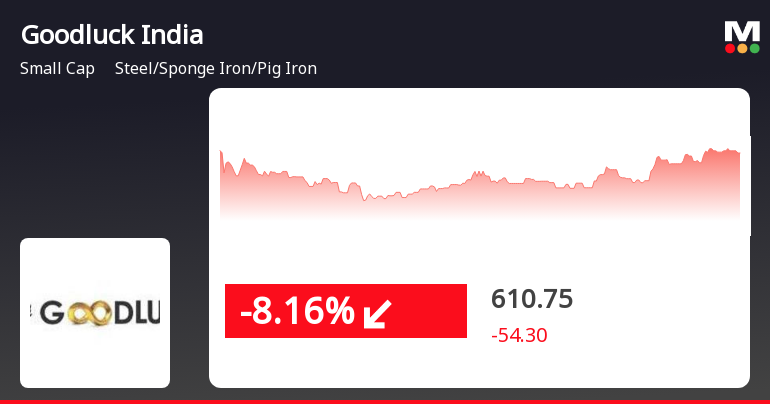

Goodluck India Faces Significant Stock Volatility Amid Broader Market Trends

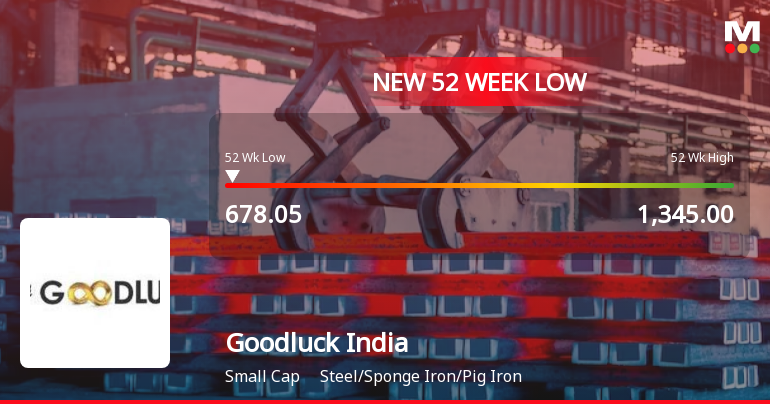

2025-02-18 11:56:56Goodluck India, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has faced notable stock volatility on February 18, 2025, hitting a 52-week low. The stock has underperformed its sector significantly, with a three-day decline totaling over 22%, amidst high intraday volatility and trading below key moving averages.

Read More

Goodluck India Faces Significant Volatility Amidst Persistent Downward Trend in Steel Sector

2025-02-18 11:53:18Goodluck India, a small-cap company in the steel sector, has faced significant trading volatility, hitting a new 52-week low. The stock has dropped 22% over three days and is underperforming its sector. It has also declined 40.39% over the past year, contrasting with the Sensex's gains.

Read More

Goodluck India Shows Resilience Amidst Broader Market Challenges and Declining Performance

2025-02-17 09:36:31Goodluck India, a small-cap company in the steel sector, has seen notable trading activity, opening higher and reaching an intraday peak. Despite this, the stock has faced a significant decline over the past year, underperforming compared to the broader market, yet showing some resilience against its sector today.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulation 74(5)of SEBI (DP) Regulations 2018 for the quarter ended March 2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window pursuant to SEBI (Prohibition of Insider Trading Regulations) 2015 for declaration of Audited Finical Statement for the quarter and year ended 31.03.2025

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

13-Feb-2025 | Source : BSETranscript of the Analysts/Investors conference call held on Monday February 10 2025 to discuss Q3 and 9M FY2025 results of the Company

Corporate Actions

No Upcoming Board Meetings

Goodluck India Ltd has declared 50% dividend, ex-date: 20 Sep 24

Goodluck India Ltd has announced 2:10 stock split, ex-date: 12 Jun 09

No Bonus history available

No Rights history available