Goodricke Group Faces Significant Stock Volatility Amid Broader Market Trends

2025-03-10 18:00:24Goodricke Group, a microcap player in the tea and coffee industry, has experienced notable fluctuations in its stock performance today. The company, with a market capitalization of Rs 401.00 crore, currently holds a price-to-earnings (P/E) ratio of -20.47, significantly lower than the industry average of 76.31. In terms of recent performance, Goodricke Group's stock has shown a year-to-date decline of 37.22%, contrasting with the Sensex's drop of 5.15%. Over the past month, the stock has decreased by 29.64%, while the Sensex has only fallen by 4.13%. On a weekly basis, Goodricke's performance is slightly better, with a 0.28% increase compared to the Sensex's 1.41% rise. Technical indicators suggest a bearish trend in the weekly and monthly MACD and Bollinger Bands, while the weekly Relative Strength Index (RSI) indicates a bullish signal. Overall, Goodricke Group's stock activity reflects a challenging en...

Read More

Goodricke Group Reports Strong Sales Growth Amid Ongoing Financial Challenges

2025-03-03 18:33:51Goodricke Group, a microcap in the tea and coffee sector, recently adjusted its evaluation amid positive third-quarter financial results, including a 22.2% rise in net sales. However, the company faces challenges such as operating losses and a low return on equity, leading to a cautious outlook.

Read More

Goodricke Group Reports Strong Sales Growth Amid Ongoing Financial Challenges

2025-02-24 18:15:40Goodricke Group, a microcap in the Tea/Coffee sector, recently adjusted its evaluation amid positive third-quarter results for FY24-25, reporting a 22.2% increase in net sales. However, the company faces challenges, including operating losses and a low return on equity, raising concerns about its long-term financial stability.

Read More

Goodricke Group Faces Financial Challenges Despite Positive Sales Growth and Rising Profits

2025-02-18 18:28:19Goodricke Group, a microcap in the Tea/Coffee sector, has recently experienced a change in evaluation amid mixed financial signals. While the company reported a 22.2% increase in net sales for Q3 FY24-25, challenges persist with operating losses and a low return on equity, raising concerns about its financial stability.

Read More

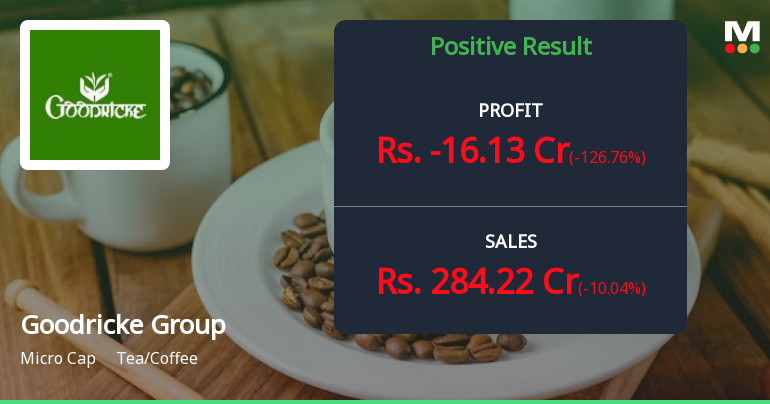

Goodricke Group Reports Mixed Financial Results Amid Sales Growth in December 2024

2025-02-12 11:48:50Goodricke Group has announced its financial results for the quarter ending December 2024, showing a 22.2% increase in net sales to Rs 284.22 crore. However, the company faced challenges with a profit before tax of Rs -20.06 crore and a profit after tax of Rs -16.13 crore, indicating mixed performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliance Certificate received from Registrar and Share Transfer Agent of the Company for the period from 1st January 2025 to 31st March 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window of the Company from Tuesday 1st April 2025 till the expiry of 48 hours after the declaration of the Audited Financial Results of the Company for the quarter and financial year ending on 31st March 2025.

Update On Sale Of Estates & Bearer Plants And Specified Assets Comprised In Chulsa Tea Estate

12-Mar-2025 | Source : BSEUpdate on Sale of Estates & Bearer Plants and Specified Assets comprised in Chulsa Tea Estate.

Corporate Actions

No Upcoming Board Meetings

Goodricke Group Ltd has declared 30% dividend, ex-date: 19 Jul 22

No Splits history available

No Bonus history available

No Rights history available