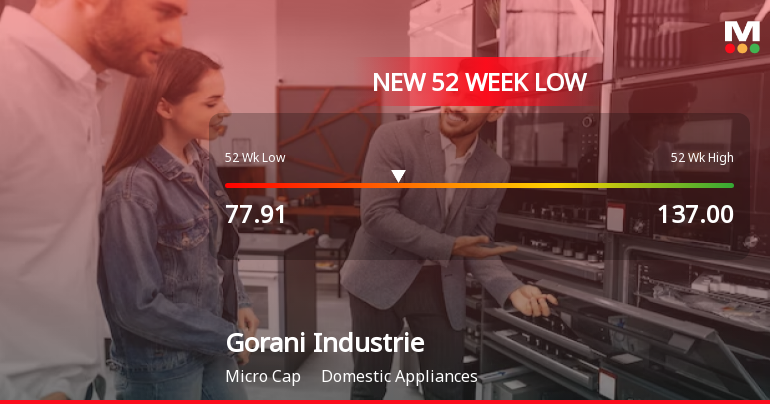

Gorani Industries Faces Significant Volatility Amid Weak Financial Fundamentals and Bearish Sentiment

2025-03-17 10:38:52Gorani Industries, a microcap in the domestic appliances sector, has faced significant volatility, reaching a new 52-week low. The stock has declined consecutively over two days, reflecting bearish sentiment and trading below key moving averages. Financially, the company shows weak fundamentals despite a profit increase over the past year.

Read More

Gorani Industries Faces Financial Struggles Amidst Market Volatility and High Debt Concerns

2025-03-10 09:42:53Gorani Industries, a microcap in the domestic appliances sector, has hit a new 52-week low, reflecting significant volatility and underperformance. The company faces financial challenges, including a high Debt to EBITDA ratio and weak long-term operating profit growth, while trading below key moving averages.

Read More

Gorani Industries Faces Financial Struggles Amid Significant Stock Volatility and Decline

2025-03-10 09:42:36Gorani Industries, a microcap in the domestic appliances sector, has hit a new 52-week low, reflecting significant volatility. The company faces financial challenges, including a high Debt to EBITDA ratio and dwindling cash reserves. Despite a profit increase, the stock's performance and market indicators suggest ongoing struggles.

Read More

Gorani Industries Faces Investor Confidence Challenges Amid Significant Stock Volatility

2025-03-04 10:47:38Gorani Industries, a microcap in the domestic appliances sector, hit a new 52-week low today after a volatile trading session. Despite a brief intraday gain, the company has underperformed over the past year, facing financial health concerns and bearish technical indicators amid a cautious market sentiment.

Read More

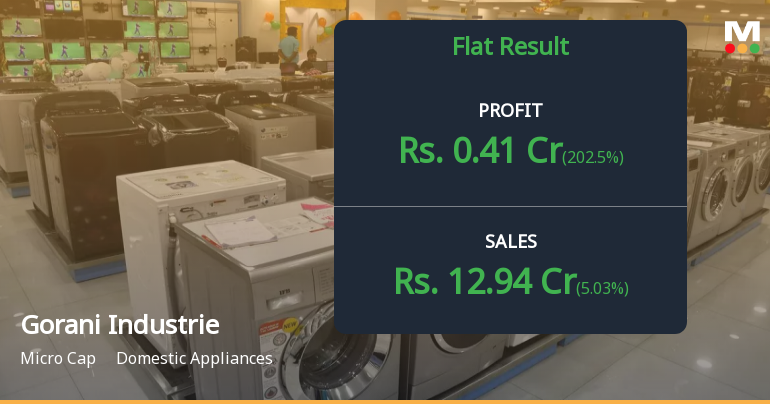

Gorani Industries Reports Mixed Q3 FY24-25 Results Amid Sales Growth and Liquidity Concerns

2025-02-08 10:08:30Gorani Industries has reported stable financial results for Q3 FY24-25, achieving its highest quarterly net sales in five quarters at Rs 12.94 crore. However, the company faces liquidity challenges, with cash and cash equivalents at a six-period low and a declining debtors turnover ratio, indicating slower debt settlement.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

07-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Gorani Industries Ltd |

| 2 | CIN NO. | L28121MP1995PLC009170 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.20 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: gorani.industries@yahoo.com

Designation: Chief Financial Officer

EmailId: gorani.industries@yahoo.com

Date: 07/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEGorani Industries Limited hereby submits Certificate received from MUFG Intime India Private Limited (formerly known as Link Intime India Private Limited) Registrar & Share Transfer Agent (RTA) of the Company as per Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Narendra Kumar Gorani & PACs

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available