GPT Healthcare's Surge Highlights Sector Outperformance Amid Broader Market Volatility

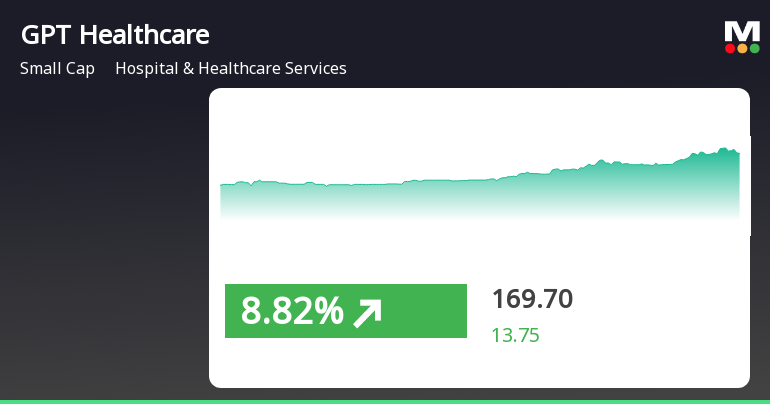

2025-04-03 12:20:25GPT Healthcare experienced notable trading activity, with a significant rise in stock value and a strong upward trend over the past week. The stock is currently above multiple moving averages, indicating a positive short-term outlook, despite a year-over-year decline compared to broader market performance.

Read More

GPT Healthcare's Evaluation Score Adjusted Amidst Market Dynamics and Investor Trends

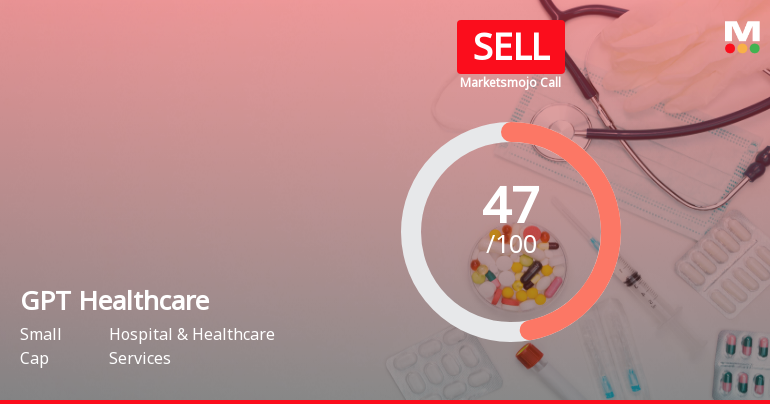

2025-04-03 08:14:48GPT Healthcare has recently adjusted its evaluation score, reflecting various market dynamics and technical indicators. The company showcases strong management efficiency with a high Return on Capital Employed and a low Debt to EBITDA ratio. However, it has faced challenges, including decreased institutional investor participation and underperformance relative to the BSE 500 index.

Read MoreGPT Healthcare Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-04-03 08:06:44GPT Healthcare, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 155.95, showing a notable increase from the previous close of 148.45. Over the past week, the stock has demonstrated a strong performance, with a return of 14.84%, contrasting with a slight decline of 0.87% in the Sensex. In terms of technical indicators, the weekly MACD remains bearish, while the daily moving averages indicate a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish sentiment on a weekly basis. Notably, the On-Balance Volume (OBV) shows a mildly bullish trend weekly, suggesting some positive trading activity despite the overall bearish indicators. Looking at the company's performance over various periods, GPT Healthcare has faced challenges, with a year-to-date return of -14...

Read MoreGPT Healthcare Opens Strong with 5.74% Gain Amid Mixed Long-Term Outlook

2025-03-07 10:30:58GPT Healthcare, a small-cap player in the Hospital & Healthcare Services sector, has shown significant activity today, opening with a gain of 5.74%. The stock's performance has outpaced its sector by 1.87%, marking a notable trend as it has gained for three consecutive days, accumulating a total return of 6.01% during this period. Today, GPT Healthcare reached an intraday high of Rs 139.9, reflecting its upward momentum. However, despite this recent surge, the stock's performance over the past month has been less favorable, with a decline of 17.71%, compared to a 4.37% drop in the Sensex. In terms of technical indicators, GPT Healthcare's moving averages indicate a mixed outlook, being higher than the 5-day moving average but lower than the 20, 50, 100, and 200-day averages. The stock is classified as high beta, with a beta of 1.35, suggesting it tends to experience larger fluctuations compared to the br...

Read More

GPT Healthcare Faces Market Challenges Despite Strong Financial Metrics and Stability

2025-03-03 19:03:40GPT Healthcare has recently experienced a change in evaluation, reflecting a stable financial outlook despite flat performance for Q3 FY24-25. The company shows strong management efficiency with a high ROCE, but has underperformed against the BSE 500 index. Institutional investor stakes have slightly decreased, indicating cautious sentiment.

Read More

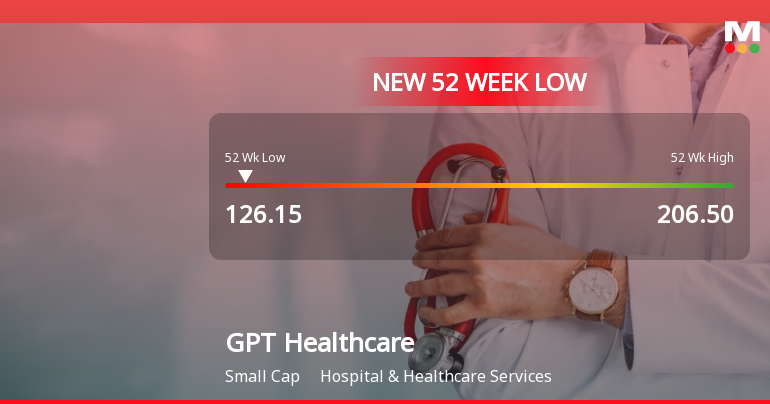

GPT Healthcare Hits 52-Week Low Amid Ongoing Market Challenges in Healthcare Sector

2025-03-03 09:38:00GPT Healthcare has reached a new 52-week low, reflecting a significant decline of 31.68% over the past year, contrasting with the Sensex's minor drop. The stock has faced three consecutive days of losses and continues to trade below key moving averages, highlighting ongoing market challenges.

Read MoreGPT Healthcare Shows Resilience Amid Broader Market Decline, Faces Long-Term Challenges

2025-02-24 10:44:45GPT Healthcare, a small-cap player in the Hospital & Healthcare Services sector, has shown notable activity today, with its stock rising by 0.57%. This performance stands in contrast to the broader market, as the Sensex has declined by 1.02%. Over the past week, GPT Healthcare has maintained the same percentage increase, while the Sensex has dropped by 1.91%. However, a longer-term view reveals challenges for GPT Healthcare. The stock has decreased by 18.07% over the past month and 14.99% over the last three months. Year-to-date, the stock has faced a significant decline of 23.36%, while the Sensex has only fallen by 4.60% during the same period. In terms of financial metrics, GPT Healthcare has a price-to-earnings (P/E) ratio of 22.93, which is notably lower than the industry average of 51.06. Technical indicators suggest a bearish trend in the short term, with moving averages and MACD signaling caution....

Read More

GPT Healthcare Reports Steady Q3 Performance Amid Score Evaluation Shift

2025-02-11 15:59:29GPT Healthcare has announced its financial results for the quarter ending February 2025, showing stable performance in the Hospital & Healthcare Services sector. The company's stock evaluation has notably changed, prompting stakeholders to consider the factors influencing this shift as they monitor future developments.

Read MoreAnnouncement Under Regulation 30 Of SEBI (LODR) Regulations 2015

28-Mar-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (LODR) Regulations 2015

Closure of Trading Window

27-Mar-2025 | Source : BSEPlease find enclosed herewith the intimation for Closure of Trading Window.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

21-Mar-2025 | Source : BSEPlease find enclosed intimation for investor meet on March 27 2025.

Corporate Actions

No Upcoming Board Meetings

GPT Healthcare Ltd has declared 10% dividend, ex-date: 28 Nov 24

No Splits history available

No Bonus history available

No Rights history available