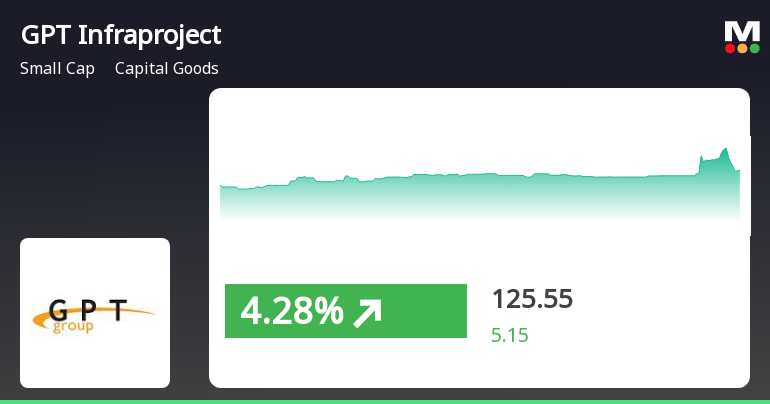

GPT Infraprojects Outperforms Sector Amid High Volatility and Strong Market Trends

2025-04-02 13:00:15GPT Infraprojects has demonstrated notable trading activity, achieving a significant rise and outperforming its sector. The stock has shown consecutive gains over two days and reached an intraday high, amid high volatility. In the broader market, mid-cap stocks are leading, with the Sensex also experiencing positive movement.

Read More

GPT Infraprojects Adjusts Valuation Metrics Amidst Financial Strengths and Challenges

2025-04-02 08:02:01GPT Infraprojects, a small-cap company in the capital goods sector, has experienced a valuation grade change reflecting an improved assessment of its financial health. Key metrics indicate strong operational efficiency and profitability, although challenges such as modest growth and pledged promoter shares remain.

Read MoreGPT Infraprojects Adjusts Valuation Grade Amid Strong Financial Performance and Market Positioning

2025-04-02 08:00:18GPT Infraprojects, a small-cap player in the capital goods sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market positioning. The company currently boasts a price-to-earnings (P/E) ratio of 21.12 and a price-to-book value of 3.03. Its enterprise value to EBITDA stands at 12.14, while the enterprise value to EBIT is recorded at 13.87. Additionally, GPT Infraprojects has a PEG ratio of 0.77 and a dividend yield of 2.04%. The company's return on capital employed (ROCE) is notably high at 19.36%, and its return on equity (ROE) is 13.04%, indicating effective management and operational efficiency. In comparison to its peers, GPT Infraprojects demonstrates a competitive edge, particularly against companies like Hindustan Construction, which is currently loss-making, and Bharat Bijlee, which has a higher P/E ratio. Over the past year, GPT Infraprojects has ou...

Read More

GPT Infraprojects Shows Mixed Performance Amid Broader Market Resilience

2025-03-27 11:45:15GPT Infraprojects saw a notable increase today, though it has underperformed its sector recently. The stock has experienced consecutive declines over the past three days. In the broader market, the Sensex has shown resilience, with significant gains over the past three weeks, while GPT Infraprojects has delivered strong long-term returns.

Read More

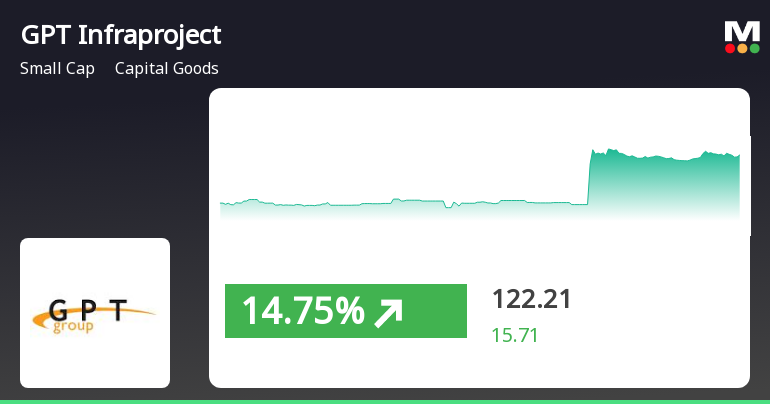

GPT Infraprojects Outperforms Sector Amidst Broader Market Recovery and Small-Cap Gains

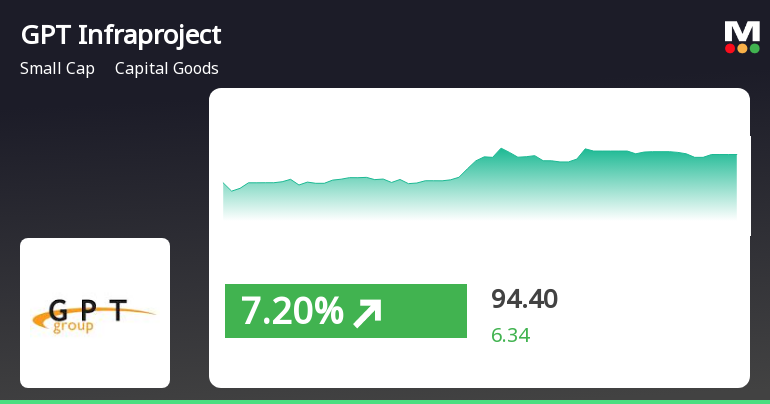

2025-03-21 10:15:14GPT Infraprojects has demonstrated strong performance, gaining 7.79% on March 21, 2025, and outperforming its sector. The stock has seen consecutive gains over three days, totaling 15.91%. In the broader market, small-cap stocks are leading, with the BSE Small Cap index up 1.55%.

Read More

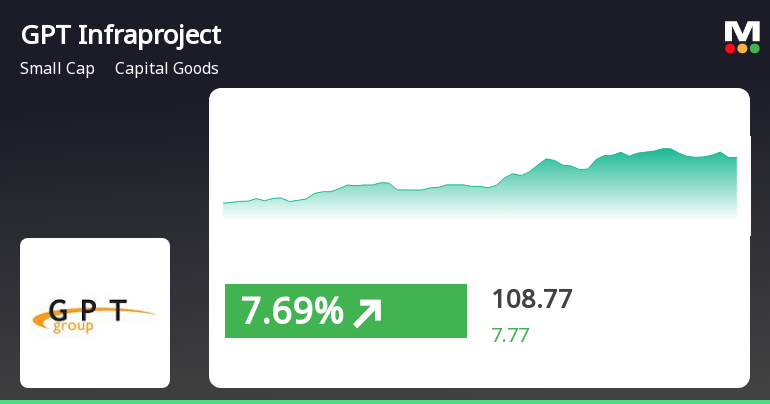

GPT Infraprojects Exhibits Strong Performance Amid Broader Market Trends

2025-03-20 11:15:14GPT Infraprojects has experienced notable stock performance, significantly outperforming the broader market. The company has shown strong returns over the past week and achieved consecutive gains recently. Despite a decline year-to-date, its long-term growth metrics indicate substantial increases over three and five years, highlighting its volatility and resilience.

Read MoreGPT Infraprojects Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:00:20GPT Infraprojects, a small-cap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 94.08, slightly down from the previous close of 95.16. Over the past year, GPT Infraprojects has shown a notable return of 26.49%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no clear signal on a monthly basis. Bollinger Bands and KST also reflect a mildly bearish trend, suggesting caution in the short term. Despite these technical indicators, the stock has demonstrated resilience over longer periods, with a remarkable 418.35% re...

Read More

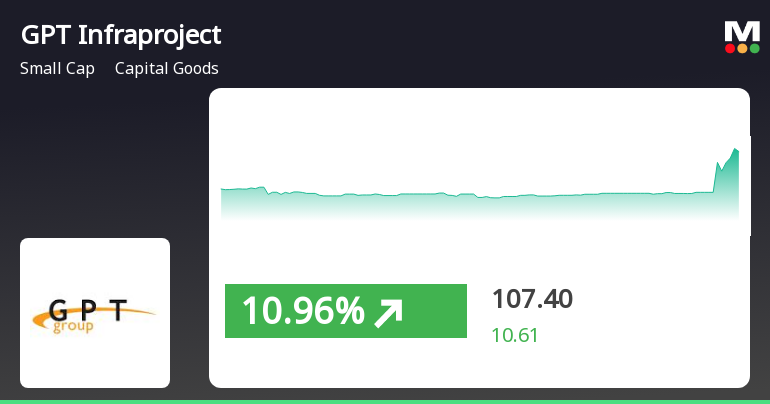

GPT Infraprojects Surges Amid Market Volatility, Small-Cap Stocks Outperform

2025-03-06 10:00:15GPT Infraprojects has demonstrated notable activity, outperforming the broader market and its sector. The stock opened higher and reached an intraday peak, despite experiencing significant volatility. Meanwhile, the overall market, represented by the Sensex, has faced a downturn, with small-cap stocks showing relative strength.

Read More

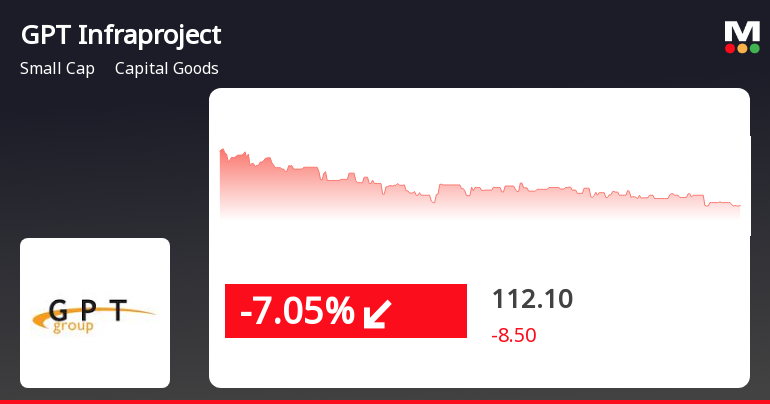

GPT Infraprojects Faces Significant Stock Decline Amid Challenging Market Conditions

2025-02-05 14:30:11GPT Infraprojects, a small-cap company in the capital goods sector, has faced a notable stock decline today, underperforming relative to its sector. The stock's performance is mixed against various moving averages, and it has experienced a significant drop over the past month, indicating ongoing market challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find enclosed herewith Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018.

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

02-Apr-2025 | Source : BSEPlease find enclosed herewith the Press Release on the order bagged worth Rs. 481.11 Crores

Closure of Trading Window

27-Mar-2025 | Source : BSEPlease find enclosed herewith the intimation of closure of Trading Window.

Corporate Actions

No Upcoming Board Meetings

GPT Infraprojects Ltd has declared 10% dividend, ex-date: 10 Feb 25

No Splits history available

GPT Infraprojects Ltd has announced 1:1 bonus issue, ex-date: 03 Jul 24

No Rights history available