Gujarat Alkalies & Chemicals Faces Mixed Technical Trends Amid Market Volatility

2025-04-03 08:04:57Gujarat Alkalies & Chemicals, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 664.35, showing a notable increase from the previous close of 566.35. Over the past year, the stock has experienced a high of 900.00 and a low of 484.00, indicating significant volatility. In terms of technical indicators, the MACD and KST metrics are bearish on both weekly and monthly scales, while the Bollinger Bands suggest a mildly bearish trend. The moving averages also reflect a mildly bearish sentiment, although the Dow Theory indicates a mildly bullish outlook on a weekly basis. The Relative Strength Index (RSI) shows no clear signal, and the On-Balance Volume (OBV) indicates no discernible trend. When comparing the stock's performance to the Sensex, Gujarat Alkalies has shown a strong return over the past...

Read More

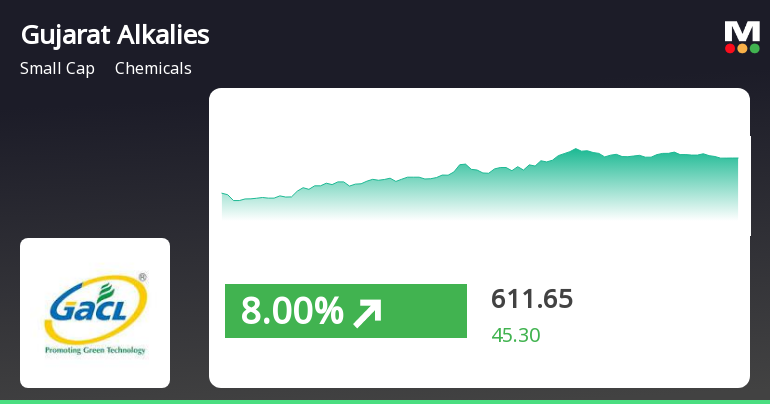

Gujarat Alkalies & Chemicals Experiences Notable Rebound Amid Broader Market Trends

2025-04-02 10:20:21Gujarat Alkalies & Chemicals experienced notable activity on April 2, 2025, rebounding after two days of decline. The stock outperformed its sector and has shown gains over the past week and month, despite longer-term declines. It is currently trading above several moving averages while remaining below others.

Read More

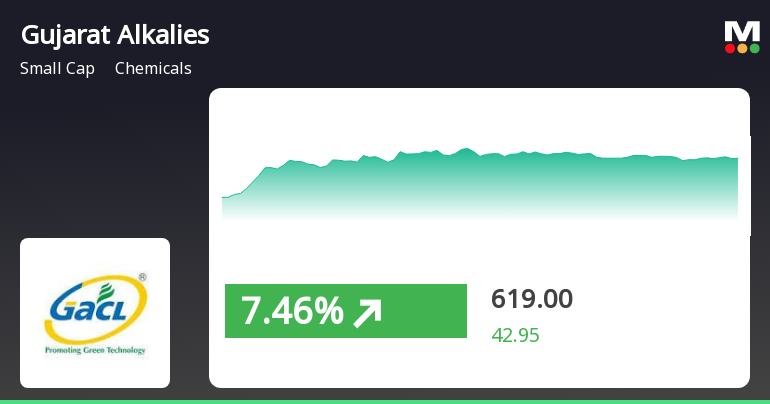

Gujarat Alkalies & Chemicals Experiences Notable Rebound Amid Market Volatility

2025-03-27 09:50:20Gujarat Alkalies & Chemicals experienced notable activity on March 27, 2025, reversing a two-day decline with a significant intraday high. The stock has outperformed its sector today and surged over the past week, although its three-month performance remains negative, indicating volatility in the small-cap chemicals sector.

Read MoreGujarat Alkalies & Chemicals Faces Mixed Technical Trends Amid Market Volatility

2025-03-25 08:04:23Gujarat Alkalies & Chemicals, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 603.45, showing a notable increase from the previous close of 551.00. Over the past week, the stock has reached a high of 622.60 and a low of 541.00, indicating some volatility in its trading activity. In terms of technical indicators, the weekly and monthly MACD readings are both bearish, while the moving averages on a daily basis also reflect a bearish sentiment. The Bollinger Bands and KST indicators suggest a mildly bearish trend on a weekly and monthly basis, respectively. The Dow Theory presents a mixed picture, with a mildly bullish signal on a weekly basis but bearish on a monthly scale. When comparing the stock's performance to the Sensex, Gujarat Alkalies has shown a strong return of 21.69% over the pas...

Read More

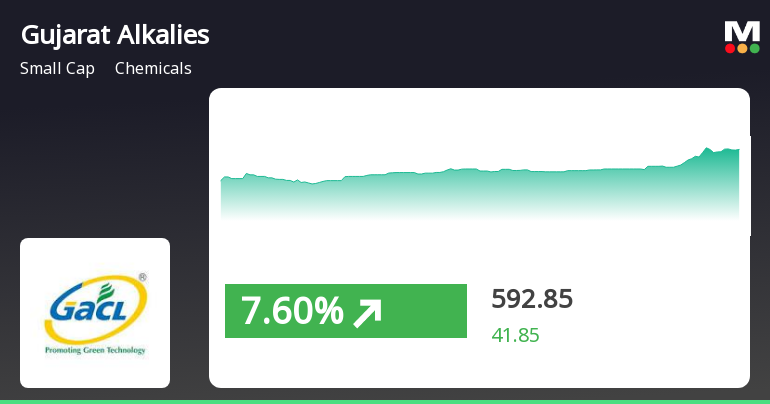

Gujarat Alkalies & Chemicals Experiences Notable Stock Surge Amid Market Uptrend

2025-03-24 11:35:21Gujarat Alkalies & Chemicals experienced notable activity on March 24, 2025, with a significant intraday high and strong five-day returns. While the stock outperformed its sector recently, it has struggled year-to-date compared to broader market indices, which have shown positive trends.

Read MoreGujarat Alkalies & Chemicals Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-20 08:02:43Gujarat Alkalies & Chemicals, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 533.00, showing a slight increase from the previous close of 513.80. Over the past year, the stock has experienced a decline of 22.03%, contrasting with a 4.77% gain in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish signals on both weekly and monthly charts, while the RSI reflects bullish trends in the same time frames. Bollinger Bands and KST also present a mildly bearish outlook, suggesting caution in the current market environment. Notably, the stock's performance over the last week has outpaced the Sensex, with a return of 3.75% compared to the index's 1.92%. In terms of historical performance, Gujarat Alkalies has seen s...

Read More

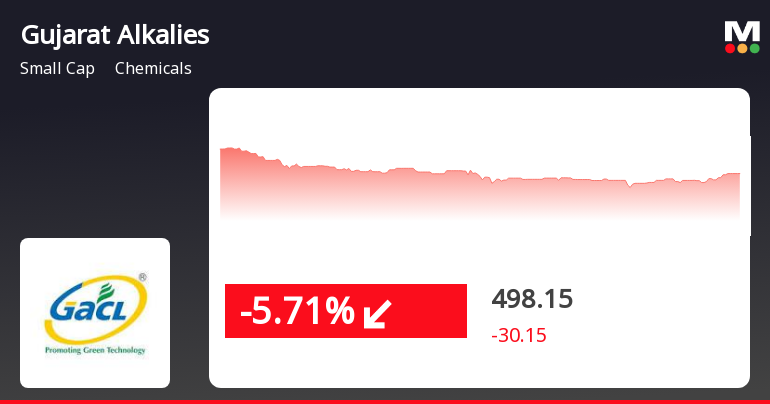

Gujarat Alkalies & Chemicals Faces Sustained Decline Amid Broader Market Challenges

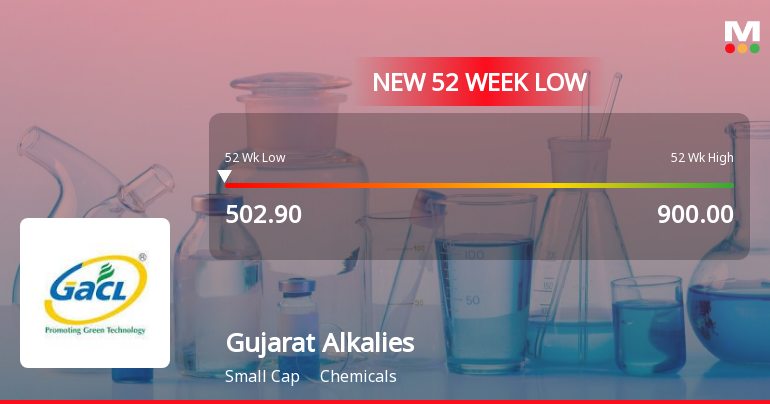

2025-03-03 11:15:46Gujarat Alkalies & Chemicals has faced a notable decline in its stock price, reaching a new 52-week low. The company has experienced three consecutive days of losses, significantly underperforming its sector and key market indices, indicating ongoing challenges in the current market environment.

Read More

Gujarat Alkalies & Chemicals Faces Persistent Downward Trend Amid Market Challenges

2025-03-03 09:36:45Gujarat Alkalies & Chemicals has faced notable volatility, hitting a 52-week low and underperforming against its sector. The stock has declined significantly over the past year, contrasting with the broader market. Its performance indicates ongoing challenges within the chemicals industry and persistent downward trends in moving averages.

Read More

Gujarat Alkalies & Chemicals Hits 52-Week Low Amid Ongoing Market Challenges

2025-02-28 09:37:44Gujarat Alkalies & Chemicals has reached a new 52-week low, continuing a downward trend over the past two days. The stock is trading below key moving averages and has declined significantly over the past year, contrasting with the overall market performance. The company's future remains a point of interest for investors.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (DP) Regulations 2018 for the Quarter ended 31.03.2025.

Disclosure Of Information Under Regulation 30(3) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

29-Mar-2025 | Source : BSEWe had vide our letters dated 07.02.201808.02.2018 and 25.05.2022 informed you about updates on 30000 TPA Chlorotoluene Plant at Dahej with an estimated project cost of Rs.350 Crores. We would now like to inform you that the Company has started production process of Chlorotoluene Plant at Dahej. For more details kindly refer attached file.

Disclosure In Terms Of Regulation 29(2) Of Securities And Exchange Board Of India (Substantial Acquisition Of Shares And Takeovers) Regulations 2011

29-Mar-2025 | Source : BSEWe enclose herewith disclosure under Regulation 29(2) of SEBI (SAST) Regulations 2011 of Target Company i.e. Gujarat Industries Power Company Limited. For more details kindly refer updated file.

Corporate Actions

No Upcoming Board Meetings

Gujarat Alkalies & Chemicals Ltd has declared 138% dividend, ex-date: 19 Sep 24

No Splits history available

No Bonus history available

No Rights history available