GMDC Faces Technical Trend Challenges Amidst Recent Market Resilience

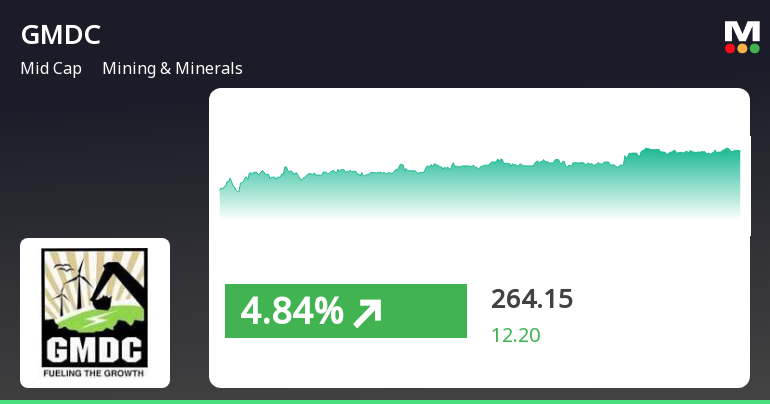

2025-04-03 08:03:18Gujarat Mineral Development Corporation (GMDC), a midcap player in the Mining & Minerals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 278.55, showing a slight increase from the previous close of 274.35. Over the past week, GMDC has demonstrated a notable performance with a return of 6.85%, contrasting with a decline of 0.87% in the Sensex. In terms of technical indicators, the MACD suggests a bearish stance on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands and Moving Averages also indicate a mildly bearish trend, aligning with the overall technical summary. Despite some challenges reflected in the year-to-date return of -13.47%, GMDC has shown resilience over longer periods, with a remarkable 7...

Read MoreGujarat Mineral Development Corporation Adjusts Valuation Amid Competitive Market Landscape

2025-04-02 08:01:16Gujarat Mineral Development Corporation (GMDC), a midcap player in the mining and minerals sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 13.09 and a price-to-book value of 1.41. Its enterprise value to EBITDA stands at 12.46, while the EV to EBIT is recorded at 14.45. GMDC also offers a dividend yield of 3.48%, with a return on capital employed (ROCE) of 10.69% and a return on equity (ROE) of 10.26%. In comparison to its peers, GMDC's valuation metrics indicate a relatively higher position. For instance, Sandur Manganese has a PE ratio of 14.75, while MOIL's PE ratio is significantly higher at 18.64. KIOCL, on the other hand, is currently loss-making, which affects its valuation metrics. Over the past week, GMDC has shown a stock return of 3.26%, contrasting with a decline in the Sensex by 2.55%. However, the company's year-to-date...

Read MoreGMDC's Technical Indicators Reflect Mixed Sentiment Amid Market Volatility

2025-03-25 08:02:48Gujarat Mineral Development Corporation (GMDC), a midcap player in the Mining & Minerals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 274.90, showing a slight increase from the previous close of 271.80. Over the past year, GMDC has experienced significant volatility, with a 52-week high of 452.95 and a low of 226.20. The technical summary indicates a bearish sentiment in the weekly MACD and KST indicators, while the monthly metrics show a mildly bearish trend. The Bollinger Bands and moving averages also reflect a bearish outlook on a daily basis. Notably, the On-Balance Volume (OBV) presents a bullish signal on a monthly basis, suggesting some underlying strength despite the overall bearish indicators. In terms of performance, GMDC has shown a strong return over the long term, particularly over the past five years, where ...

Read MoreGujarat Mineral Development Corporation Adjusts Valuation Amidst Market Challenges

2025-03-21 08:00:21Gujarat Mineral Development Corporation (GMDC), a midcap player in the Mining & Minerals sector, has recently undergone a valuation adjustment. The company's current price stands at 267.50, reflecting a slight increase from the previous close of 263.45. Over the past year, GMDC has experienced a stock return of -22.20%, contrasting with a 5.89% return from the Sensex, indicating a challenging performance relative to the broader market. Key financial metrics for GMDC include a PE ratio of 12.76 and an EV to EBITDA ratio of 12.13, which position the company within a competitive landscape. The dividend yield is noted at 3.57%, and the latest return on capital employed (ROCE) is 10.69%, while the return on equity (ROE) stands at 10.26%. In comparison to its peers, GMDC's valuation metrics suggest a more favorable position than KIOCL, which is currently loss-making, and Sandur Manganese and MOIL, both of whic...

Read More

Gujarat Mineral Development Corporation Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-19 15:05:21Gujarat Mineral Development Corporation has experienced notable activity, outperforming its sector and achieving consecutive gains over two days. While the stock shows a slight decline over the past month and year-to-date, it has demonstrated significant growth over the past five years. The broader market remains positive.

Read MoreGMDC's Technical Indicators Reflect Mixed Trends Amid Market Dynamics

2025-03-19 08:02:28Gujarat Mineral Development Corporation (GMDC), a midcap player in the mining and minerals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD showing bearish trends on a weekly basis and mildly bearish on a monthly basis. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands and KST also suggest a mildly bearish stance on both weekly and monthly charts, while moving averages indicate a bearish trend on a daily basis. Interestingly, the Dow Theory presents a mildly bullish outlook weekly, contrasting with the monthly mildly bearish trend. The On-Balance Volume (OBV) shows a mildly bullish trend weekly and bullish on a monthly basis, suggesting some underlying strength. In terms of performance, GMDC has faced challenges comp...

Read More

GMDC Faces Continued Stock Decline Amid Broader Mining Sector Challenges

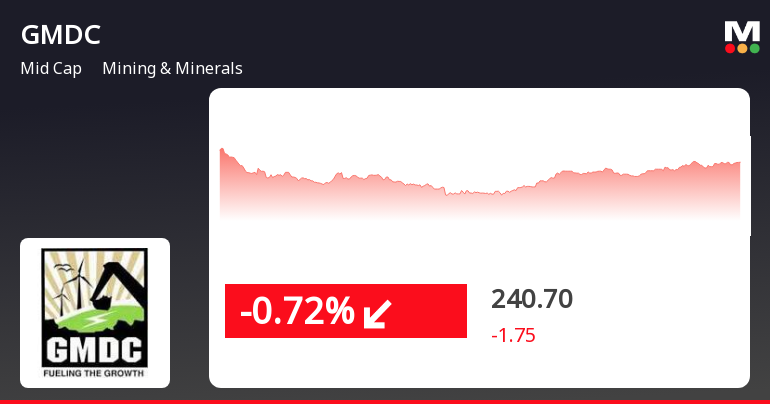

2025-03-03 11:50:30Gujarat Mineral Development Corporation (GMDC) has seen a notable decline in its stock price, reaching a new 52-week low. The company has faced consecutive losses over the past six days and is trading below key moving averages, reflecting a bearish trend amid broader sector challenges.

Read More

Gujarat Mineral Development Corporation Hits 52-Week Low Amid Sector Challenges

2025-03-03 10:06:43Gujarat Mineral Development Corporation (GMDC) has reached a new 52-week low, reflecting a significant decline over the past six days. The company's performance has lagged behind its sector, and it is currently trading below key moving averages. Over the past year, GMDC has experienced a notable drop, contrasting with the broader market.

Read More

Gujarat Mineral Development Corporation Hits 52-Week Low Amid Ongoing Market Challenges

2025-02-28 09:37:12Gujarat Mineral Development Corporation (GMDC) has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has faced consecutive losses over the past week and is trading below key moving averages. Its one-year performance shows a notable drop, contrasting with the broader market's gains.

Read MoreClosure of Trading Window

01-Apr-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Change in Directorate

12-Feb-2025 | Source : BSEAppointment of additional Independent Director

Integrated Filing (Financial)

11-Feb-2025 | Source : BSEIntegrated Filing (Financial)

Corporate Actions

No Upcoming Board Meetings

Gujarat Mineral Development Corporation Ltd. has declared 477% dividend, ex-date: 20 Sep 24

Gujarat Mineral Development Corporation Ltd. has announced 2:10 stock split, ex-date: 08 Nov 07

Gujarat Mineral Development Corporation Ltd. has announced 1:1 bonus issue, ex-date: 16 Oct 08

No Rights history available