GNFC Adjusts Valuation Grade Amid Mixed Industry Performance Metrics

2025-04-02 08:02:09Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) has recently undergone a valuation adjustment, reflecting its current standing within the fertilizers industry. The company’s price-to-earnings ratio stands at 14.07, while its price-to-book value is recorded at 0.87. Key metrics such as the EV to EBITDA ratio are at 9.72, and the EV to sales ratio is notably low at 0.64. Additionally, GNFC offers a dividend yield of 3.34%, with a return on capital employed (ROCE) of 2.66% and a return on equity (ROE) of 5.38%. In comparison to its peers, GNFC's valuation metrics present a mixed picture. For instance, Deepak Fertilizers shows a higher PE ratio of 15.94 and a more favorable EV to EBITDA of 9.12, while Paradeep Phosphates has a significantly higher EV to EBITDA ratio of 11.47. GSFC and RCF also present competitive metrics, with GSFC having a lower PE ratio of 13.32 and RCF showing a much higher PEG ratio ...

Read MoreGNFC Adjusts Valuation Grade Amidst Competitive Fertilizers Market Dynamics

2025-03-24 08:00:46Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) has recently undergone a valuation adjustment, reflecting shifts in its financial metrics and market positioning within the fertilizers industry. The company's current price stands at 492.00, with a previous close of 494.00. Over the past year, GNFC has experienced a stock return of -20.86%, contrasting with a 5.87% return from the Sensex, indicating a notable underperformance relative to the broader market. Key financial indicators for GNFC include a price-to-earnings (PE) ratio of 14.01 and an EV to EBITDA ratio of 9.65. The company's dividend yield is reported at 3.35%, while its return on capital employed (ROCE) and return on equity (ROE) are at 2.66% and 5.38%, respectively. In comparison to its peers, GNFC's valuation metrics present a mixed picture. For instance, Deepak Fertilizers and Paradeep Phosphates are positioned more favorably in terms ...

Read MoreGujarat Narmada Valley Fertilizers Adjusts Valuation Amidst Mixed Market Metrics

2025-03-17 08:00:43Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position within the fertilizers industry. The company's current price stands at 482.50, with a 52-week range between 448.90 and 776.60. Key financial indicators include a price-to-earnings (PE) ratio of 13.74 and a price-to-book value of 0.85, which provide insights into its valuation relative to its assets and earnings. In comparison to its peers, GNFC's valuation metrics present a mixed picture. For instance, Deepak Fertilizers and Paradeep Phosphates show higher PE ratios of 16.3 and 18.27, respectively, indicating a different market perception. Additionally, GNFC's EV to EBITDA ratio of 9.39 is competitive, yet lower than some peers, suggesting varying levels of operational efficiency. Despite recent stock performance showing a decline over various...

Read More

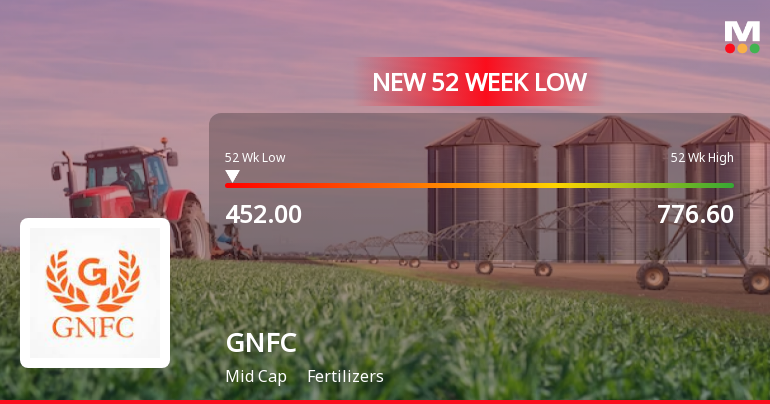

GNFC Hits 52-Week Low Amid Broader Fertilizer Sector Decline and Consecutive Losses

2025-03-03 09:37:24Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) has hit a new 52-week low, reflecting a challenging market position with consecutive losses over the past six days. The stock has underperformed its sector significantly, while the broader fertilizers sector has also declined. GNFC offers a high dividend yield despite its struggles.

Read MoreGujarat Narmada Valley Fertilizers Adjusts Valuation Amidst Competitive Market Dynamics

2025-03-01 08:00:19Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position within the fertilizers industry. The company's current price stands at 469.00, with a notable 52-week range between 465.80 and 776.60. Key financial indicators reveal a price-to-earnings (PE) ratio of 13.36 and a price-to-book value of 0.82. The enterprise value to EBITDA ratio is recorded at 9.00, while the dividend yield is at 3.52%. Return on capital employed (ROCE) and return on equity (ROE) are at 2.66% and 5.38%, respectively. In comparison to its peers, GNFC's valuation metrics present a mixed picture. While its PE ratio is competitive, other companies in the sector, such as Deepak Fertilizers and Paradeep Phosphates, exhibit different valuation characteristics. Notably, GNFC's stock performance has lagged behind the Sensex over variou...

Read More

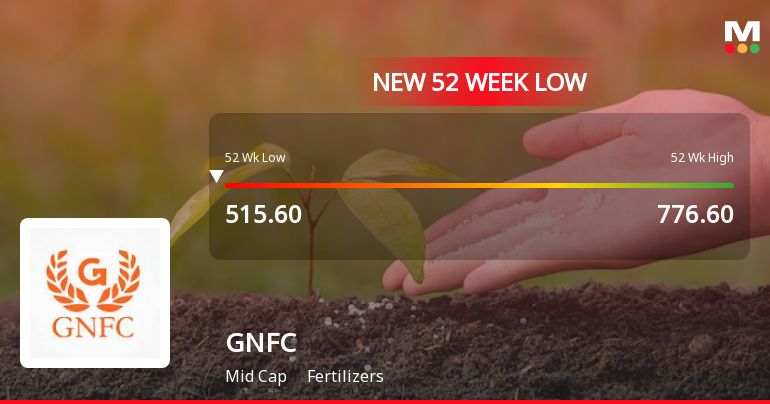

GNFC Hits 52-Week Low Amidst Broader Sector Decline and Consecutive Losses

2025-02-28 09:38:51Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) has reached a new 52-week low, reflecting a significant decline over the past five days. The stock is trading below multiple moving averages and has seen a notable annual decrease, contrasting with the overall market performance. The company offers a high dividend yield.

Read More

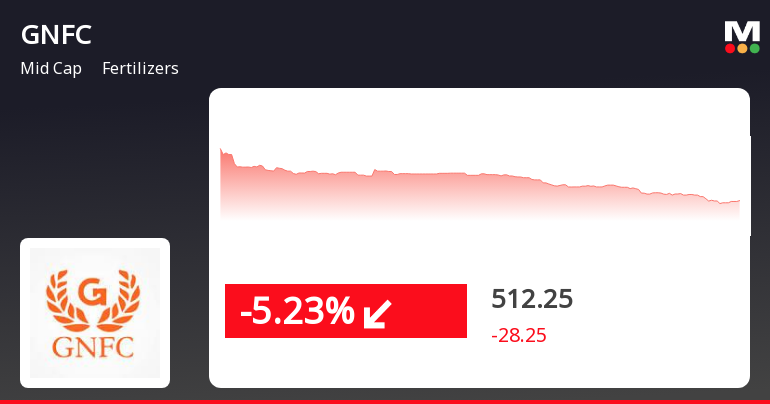

GNFC Faces Significant Stock Decline Amidst Fertilizer Industry Challenges

2025-02-27 12:20:22Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) has faced a notable decline in its stock price, reaching a new 52-week low. The company has underperformed in the fertilizers sector and is trading below key moving averages, reflecting ongoing challenges. Despite this, it maintains a high dividend yield.

Read More

GNFC Faces Market Challenges Amid Persistent Bearish Trend and Declining Stock Performance

2025-02-27 12:05:24Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) is facing significant market challenges, trading near its 52-week low and underperforming its sector. The stock has declined for four consecutive days, with a notable drop in value. GNFC's performance contrasts sharply with the broader market, reflecting ongoing volatility in the fertilizers industry.

Read More

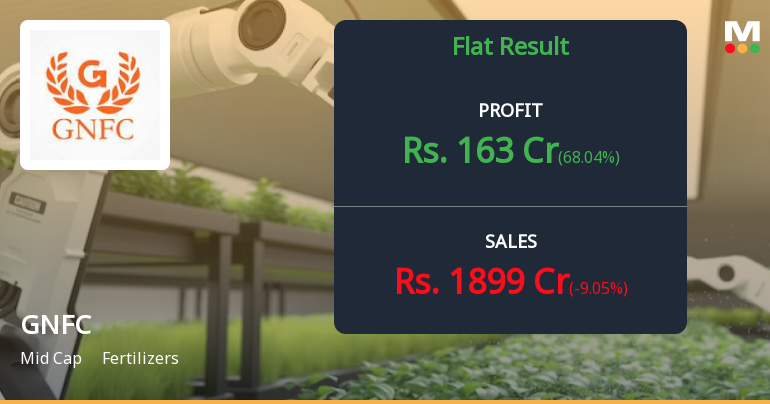

GNFC Reports December 2024 Results: Profit Growth Amid Sales Decline Concerns

2025-02-14 21:22:29Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) reported its financial results for the quarter ending December 2024, showing significant growth in profitability metrics, including a notable increase in Profit Before Tax and Profit After Tax. However, the company faced challenges with its lowest net sales in five quarters.

Read MoreVoting Results Of Postal Ballot Along With ScrutinizerS Report

05-Apr-2025 | Source : BSEPlease find enclosed results of remote e-voting conducted on postal ballot process along with scrutinizers report thereon.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

05-Apr-2025 | Source : BSEPlease find enclosed Scrutinizers Report on postal ballot Process

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

05-Apr-2025 | Source : BSEPlease find enclosed Outcome of Postal Ballot.

Corporate Actions

No Upcoming Board Meetings

Gujarat Narmada Valley Fertilizers & Chemicals Ltd. has declared 165% dividend, ex-date: 06 Sep 24

No Splits history available

No Bonus history available

No Rights history available