Gujarat State Fertilizers Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-04-01 08:00:28Gujarat State Fertilizers & Chemicals (GSFC), a midcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting current market dynamics. The stock is currently priced at 177.30, down from a previous close of 181.90, with a 52-week high of 274.50 and a low of 158.30. Today's trading saw a high of 185.15 and a low of 176.25. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective remains mildly bearish. Similarly, Bollinger Bands and KST also reflect bearish tendencies in the weekly analysis. The moving averages are bearish on a daily basis, suggesting a cautious outlook. In terms of performance, GSFC's stock return over the past week has been negative at -2.15%, contrasting with a slight gain in the Sensex of 0.66%. However, over the longer term, the company has shown resil...

Read MoreGujarat State Fertilizers Faces Mixed Technical Signals Amid Market Evaluation Revision

2025-03-28 08:00:21Gujarat State Fertilizers & Chemicals (GSFC), a midcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 181.90, showing a notable increase from the previous close of 176.55. Over the past year, GSFC has experienced a decline of 7.71%, contrasting with a 6.32% gain in the Sensex, highlighting the stock's underperformance relative to the broader market. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands and KST also reflect a mildly bearish stance on a monthly basis, while the Dow Theory presents a mildly bullish view weekly, suggesting mixed signals in the short term. GSFC's performance over various time...

Read MoreGujarat State Fertilizers Faces Bearish Technical Trends Amid Market Challenges

2025-03-27 08:00:17Gujarat State Fertilizers & Chemicals (GSFC), a midcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 176.55, down from a previous close of 181.25, with a notable 52-week high of 274.50 and a low of 158.30. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious outlook. The KST aligns with this sentiment, indicating bearish trends on a weekly basis and mildly bearish on a monthly basis. In terms of performance, GSFC's returns have lagged behind the Sensex across multiple time frames. Over the past week, the stock has seen a decline of 0.31%, while the Sensex has gained 2.44%. ...

Read MoreGujarat State Fertilizers Faces Technical Trend Shifts Amid Market Challenges

2025-03-26 08:00:29Gujarat State Fertilizers & Chemicals (GSFC), a midcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 181.25, slightly down from its previous close of 183.60. Over the past year, GSFC has faced challenges, with a return of -9.58%, contrasting with a 7.12% gain in the Sensex during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands and KST also reflect a mildly bearish trend monthly, while the Dow Theory presents a mildly bullish signal on a weekly basis. Despite recent fluctuations, GSFC has demonstrated resilience over longer periods, with a notable 446.76%...

Read MoreGujarat State Fertilizers Faces Technical Trend Challenges Amid Market Dynamics

2025-03-25 08:00:42Gujarat State Fertilizers & Chemicals (GSFC), a midcap player in the fertilizers industry, has recently undergone an evaluation adjustment reflecting its current market dynamics. The stock is currently priced at 183.60, showing a slight increase from the previous close of 181.20. Over the past year, GSFC has faced challenges, with a return of -8.41%, contrasting with a 7.07% gain in the Sensex during the same period. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands and KST also reflect a similar pattern, suggesting a cautious outlook. Notably, the stock's performance over the last five years has been remarkable, with a return of 461.47%, significantly outpacing the Sensex's 192.36% return. In terms of recent performance, GSFC has shown resilience with a weekly return of 9.06%, outperfor...

Read MoreGujarat State Fertilizers Faces Mixed Technical Trends Amid Market Challenges

2025-03-19 08:00:33Gujarat State Fertilizers & Chemicals (GSFC), a midcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 173.15, showing a slight increase from the previous close of 168.35. Over the past year, GSFC has faced challenges, with a return of -14.85%, contrasting with a positive return of 3.51% for the Sensex during the same period. The technical summary indicates a mixed outlook, with various indicators showing bearish to mildly bearish trends. The MACD and KST metrics suggest a bearish stance on a weekly basis, while the monthly indicators reflect a mildly bearish sentiment. The Bollinger Bands also align with this assessment, indicating a cautious market environment. Despite these trends, the On-Balance Volume (OBV) remains bullish on both weekly and monthly scales, suggesting some underlying strength. I...

Read More

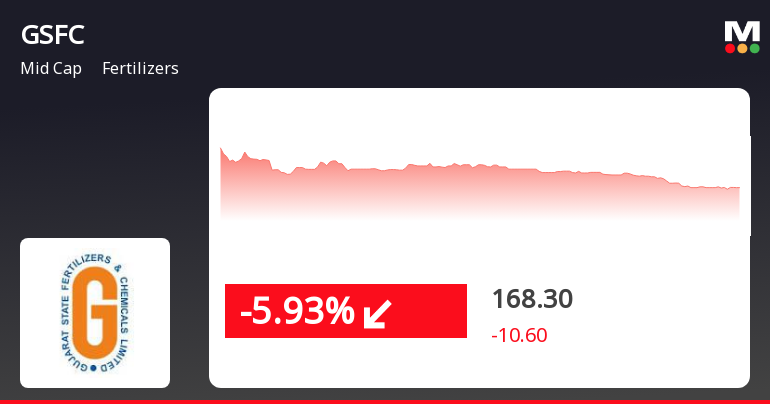

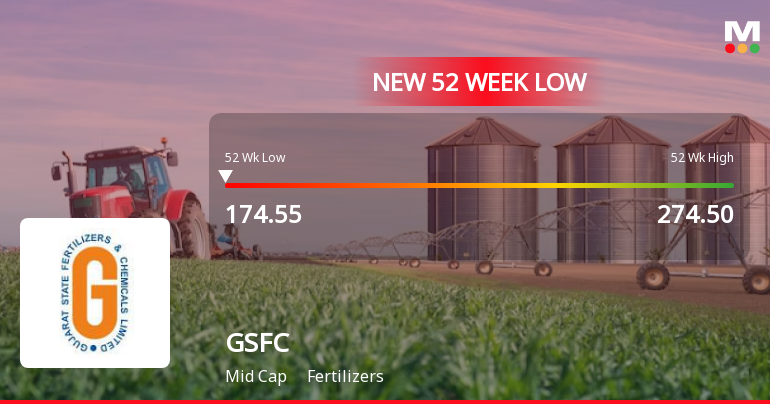

Gujarat State Fertilizers Faces Significant Volatility Amidst Market Challenges

2025-03-03 10:05:25Gujarat State Fertilizers & Chemicals (GSFC) has reached a new 52-week low amid significant volatility, marking a six-day decline of 14.17%. The company has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges in the competitive fertilizers industry. Over the past year, GSFC's performance has dropped by 28.00%.

Read More

Gujarat State Fertilizers Faces Continued Decline Amid Broader Sector Challenges

2025-02-28 11:45:12Gujarat State Fertilizers & Chemicals (GSFC) shares have declined for five consecutive days, reaching a new 52-week low. The stock's performance is below key moving averages, reflecting a bearish trend, while the broader fertilizers sector has also faced challenges, contributing to GSFC's significant losses over the past month.

Read More

Gujarat State Fertilizers Faces Challenges Amid Broader Market Trends and Declining Performance

2025-02-28 09:35:25Gujarat State Fertilizers & Chemicals (GSFC) has reached a new 52-week low, continuing a downward trend over the past five days. Despite outperforming its sector slightly, GSFC has declined significantly over the past year, contrasting with the overall market performance, reflecting ongoing challenges in the midcap fertilizer sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI LODR for the Qtr. ended 31st March 2025

Letter Intimating Allotment Of Shares By GIPCL

29-Mar-2025 | Source : BSEpls find attached the letter.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

25-Mar-2025 | Source : BSEpls find the voting results along with scrutinizers report

Corporate Actions

No Upcoming Board Meetings

Gujarat State Fertilizers & Chemicals Ltd. has declared 200% dividend, ex-date: 09 Sep 24

Gujarat State Fertilizers & Chemicals Ltd. has announced 2:10 stock split, ex-date: 20 Sep 12

No Bonus history available

No Rights history available