Gulf Oil Lubricants Shows Mixed Technical Trends Amidst Market Fluctuations

2025-04-02 08:08:01Gulf Oil Lubricants India, a midcap player in the lubricants industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 1,098.00, down from a previous close of 1,141.80. Over the past year, Gulf Oil has shown a notable return of 14.36%, significantly outperforming the Sensex, which recorded a return of 2.72% during the same period. In terms of technical metrics, the MACD indicates a mildly bullish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) remains neutral for both weekly and monthly evaluations. Bollinger Bands present a bearish outlook weekly, contrasting with a mildly bullish monthly trend. Daily moving averages indicate a bearish sentiment, while the KST reflects a mildly bullish weekly trend but a bearish monthly outlook. The company's per...

Read MoreGulf Oil Lubricants Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-26 08:03:58Gulf Oil Lubricants India, a midcap player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1209.05, down from a previous close of 1255.65, with a 52-week high of 1510.00 and a low of 849.55. Today's trading saw a high of 1251.10 and a low of 1192.85. In terms of technical indicators, the MACD shows a bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands indicate a mildly bullish stance weekly and bullish monthly, suggesting some positive momentum. However, moving averages present a mildly bearish outlook on a daily basis, indicating mixed signals in the short term. When comparing Gulf Oil's performance to the Sensex, the company has shown notable returns over various periods. Over the past year, Gulf Oil has delivered a return of 28.49%, significantly outper...

Read More

Gulf Oil Lubricants Adjusts Evaluation Amid Strong Financial Performance and Market Stability

2025-03-25 08:21:02Gulf Oil Lubricants India has recently adjusted its evaluation, reflecting current market dynamics. The company reported its highest net sales and cash equivalents in the latest quarter, maintaining a strong market position as the second-largest player in the lubricants sector, with a significant market cap and robust financial metrics.

Read MoreGulf Oil Lubricants Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:04:53Gulf Oil Lubricants India, a midcap player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,255.65, slightly down from the previous close of 1,258.10. Over the past year, Gulf Oil has demonstrated a notable performance with a return of 33.44%, significantly outpacing the Sensex's return of 7.07% during the same period. The technical summary indicates a mixed outlook, with the MACD showing bullish signals on a weekly basis while leaning mildly bearish on a monthly scale. The Bollinger Bands reflect a mildly bullish trend weekly and bullish monthly, suggesting some volatility in price movements. Meanwhile, the moving averages present a mildly bearish stance on a daily basis, indicating short-term challenges. In terms of returns, Gulf Oil has shown resilience, particularly over the last three years, with a rem...

Read More

Gulf Oil Lubricants India Reports Strong Financial Performance and Market Positioning

2025-03-19 08:09:46Gulf Oil Lubricants India has recently adjusted its evaluation, reflecting strong market performance and operational metrics. The company reported impressive financial results for Q3 FY24-25, with a notable return on equity of 23.37%, low debt-to-equity ratio, and significant cash reserves, solidifying its position as a leading player in the industry.

Read MoreGulf Oil Lubricants Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-19 08:04:01Gulf Oil Lubricants India, a midcap player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,256.60, showing a notable increase from the previous close of 1,202.50. Over the past year, Gulf Oil has demonstrated a strong performance with a return of 38.99%, significantly outpacing the Sensex, which recorded a return of 3.51% during the same period. The technical summary indicates a mixed outlook, with the MACD showing bullish signals on a weekly basis while remaining mildly bearish on a monthly scale. Bollinger Bands reflect bullish trends in both weekly and monthly assessments, suggesting potential volatility in price movements. The KST and Dow Theory metrics also indicate a mildly bullish stance on a weekly basis, while the daily moving averages present a mildly bearish perspective. In terms of stock perfor...

Read More

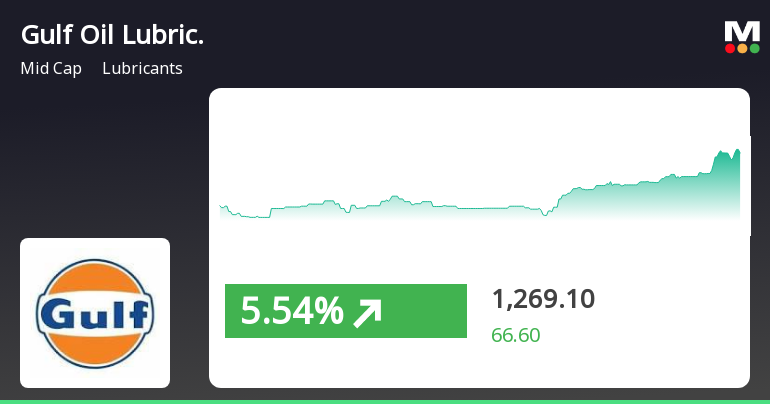

Gulf Oil Lubricants India Outperforms Sector Amid Positive Market Trends

2025-03-18 14:05:27Gulf Oil Lubricants India has exhibited strong performance, gaining 5.54% on March 18, 2025, and outperforming its sector. The stock has shown a positive trend with a total return of 5.95% over two days and is trading above key moving averages, indicating a solid market position.

Read More

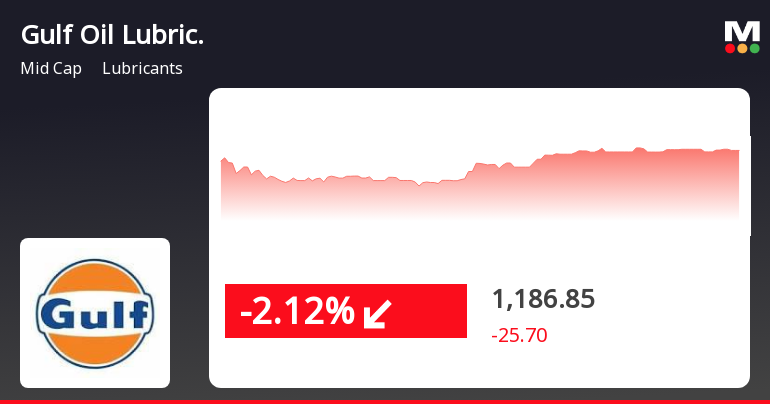

Gulf Oil Lubricants Faces Decline Amid Broader Market Weakness and Sector Underperformance

2025-03-11 10:05:22Gulf Oil Lubricants India has seen a significant decline in its stock today, coinciding with a broader market downturn. Despite recent losses, the company has demonstrated strong long-term performance, significantly outperforming the Sensex over the past year and three years, while maintaining a competitive dividend yield.

Read MoreGulf Oil Lubricants Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-07 08:03:01Gulf Oil Lubricants India, a midcap player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,220.70, showing a notable increase from the previous close of 1,187.05. Over the past week, Gulf Oil has demonstrated a strong performance, achieving a return of 8.51%, while the Sensex experienced a slight decline of 0.37%. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish trends on both weekly and monthly charts, suggesting potential volatility. Moving averages present a mildly bearish stance on a daily basis, contrasting with the overall bullish signals from the Dow Theory. When examining the company's performance over various time frames, Gulf Oil has outperformed the Sen...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find enclosed herewith the Certificates received from M/s KFin Technologies Limited Registrar and Share Transfer Agent (RTA) of the Company under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

07-Apr-2025 | Source : BSEWe hereby inform you that an interaction with the Analyst/Institutional Investors is scheduled to be held on Friday April 11 2025.

Intimation/Disclosures Under SEBI (Prohibition Of Insider Trading) Regulations 2015 - Trading In Securities By Designated Person

31-Mar-2025 | Source : BSEPursuant to Regulation 7(2) read with Regulation 6(2) of SEBI (Prohibition of Insider Trading) Regulation 2015 we enclose herewith disclosure received from a Designated Person in respect of shares traded by him.

Corporate Actions

No Upcoming Board Meetings

Gulf Oil Lubricants India Ltd has declared 1000% dividend, ex-date: 14 Feb 25

No Splits history available

No Bonus history available

No Rights history available