GVK Power & Infrastructure Shows Strong Market Resilience Amid Broader Decline

2025-04-03 10:00:40GVK Power & Infrastructure Ltd, a microcap player in the Power Generation and Distribution industry, has shown significant activity today as it hit its upper circuit limit. The stock reached a high price of Rs 3.22, reflecting a change of Rs 0.06, or a 1.9% increase. The stock's performance today outpaced its sector, which recorded a 1D return of 0.66%, while the Sensex declined by 0.34%. In terms of trading volume, GVK Power saw a total traded volume of approximately 3.06546 lakh shares, resulting in a turnover of Rs 0.0984 crore. The stock has been on a positive trajectory, gaining for the last three consecutive days and achieving a total return of 5.81% during this period. The stock's price band is set at 2%, and it has demonstrated liquidity sufficient for trades of Rs 0.01 crore, with delivery volume increasing by 32.88% compared to the five-day average. Overall, GVK Power & Infrastructure's perform...

Read MoreGVK Power & Infrastructure Sees Strong Buying Momentum Amid Market Decline

2025-04-03 09:40:10GVK Power & Infrastructure Ltd is currently witnessing significant buying activity, marking a notable performance in the market. The stock has gained 1.84% today, contrasting sharply with the Sensex, which has declined by 0.38%. Over the past week, GVK Power has shown a cumulative increase of 3.75%, while the Sensex has dropped 1.64%. This trend indicates a strong buying momentum, as the stock has recorded consecutive gains for the last three days, accumulating a total return of 5.73% during this period. Despite its recent positive performance, GVK Power's longer-term metrics reveal challenges. Over the past month, the stock has decreased by 13.32%, and its year-to-date performance shows a decline of 31.69%. In comparison, the Sensex has maintained a positive trajectory in the same timeframe. Today's trading session opened with a gap up, and the stock reached an intraday high, further reflecting the buyin...

Read MoreGVK Power & Infrastructure Sees Surge in Investor Activity Amid Market Engagement

2025-04-02 11:00:11GVK Power & Infrastructure Ltd, a microcap player in the Power Generation and Distribution industry, has shown significant activity today, hitting its upper circuit limit with a high price of Rs 3.22. The stock experienced a positive change of Rs 0.06, translating to a 1.9% increase, outperforming its sector by 2.66%. The stock's performance has been notable over the last two days, with a cumulative return of 3.87%. Today's trading saw a total volume of approximately 2.44 lakh shares, resulting in a turnover of Rs 0.078 crore. The stock's low price for the day was Rs 3.20, indicating a tight trading range within the established price band of 2%. Despite trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, GVK Power & Infrastructure has seen a rise in investor participation, with delivery volume increasing by 79.73% compared to the 5-day average. In summary, GVK Power & Infrast...

Read MoreGVK Power & Infrastructure Sees Increased Buying Activity Amid Ongoing Price Challenges

2025-04-02 10:40:04GVK Power & Infrastructure Ltd is currently witnessing strong buying activity, with the stock gaining 1.87% today, significantly outperforming the Sensex, which rose by 0.52%. This marks the second consecutive day of gains for GVK Power, with a total increase of 3.82% over this period. Despite this recent uptick, the stock has faced challenges over the longer term, with a notable decline of 69.76% over the past year, while the Sensex has appreciated by 3.41% in the same timeframe. In the last month, GVK Power's performance has been particularly weak, down 16.41%, contrasting sharply with the Sensex's gain of 4.40%. The stock opened with a gap up today, indicating initial positive sentiment among buyers. However, it continues to trade below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a struggle to regain upward momentum. The buying pressure may be attributed to short-term ...

Read MoreGVK Power & Infrastructure Sees Notable Buying Activity Amidst Market Volatility

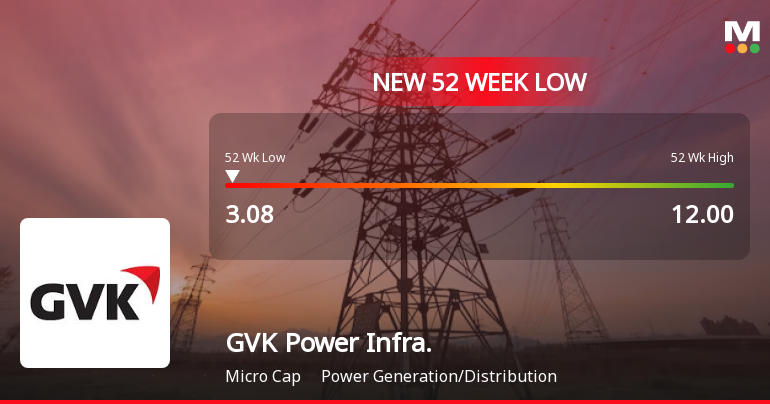

2025-04-01 14:15:08GVK Power & Infrastructure Ltd is witnessing significant buying activity today, marking a notable performance against the broader market. The stock has gained 1.91% in a single day, contrasting sharply with the Sensex, which has declined by 1.78%. This uptick comes after a challenging period, as GVK Power has experienced seven consecutive days of decline prior to today’s performance. Despite the positive movement today, the stock's longer-term performance remains concerning. Over the past month, GVK Power has dropped 17.95%, and its year-to-date performance shows a decline of 34.16%. The stock has also reached a new 52-week low of Rs. 3.08 today, indicating ongoing volatility. The buying pressure may be attributed to a potential trend reversal after a prolonged period of losses, as the stock has outperformed its sector by 2.65% today. However, it continues to trade below key moving averages, including the...

Read More

GVK Power & Infrastructure Hits 52-Week Low Amid Ongoing Financial Struggles

2025-04-01 11:44:57GVK Power & Infrastructure has reached a new 52-week low, reflecting a 69.04% decline over the past year. The company, operating in the power sector, faces significant financial challenges, including negative book value and high debt. Recent quarterly results show a sharp drop in net sales and profits.

Read MoreGVK Power Faces Persistent Bearish Sentiment Amid Declining Investor Participation

2025-03-28 10:00:32GVK Power & Infrastructure Ltd, a microcap player in the Power Generation and Distribution industry, has experienced significant trading activity today, hitting its lower circuit limit at a low price of Rs. 3.17. The stock recorded a change of -0.07, reflecting a decline of 2.16% from the previous trading session. Today's trading saw a total volume of approximately 4.84 lakh shares, resulting in a turnover of Rs. 0.15 crore. The stock's performance has notably underperformed its sector, with a 1D return of -2.21%, while the sector itself saw a slight gain of 0.12%. GVK Power has been on a downward trend, with a consecutive fall over the past seven days, accumulating a total decline of 14.13% during this period. Additionally, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a persistent bearish sentiment. Investor participation appears to be ...

Read More

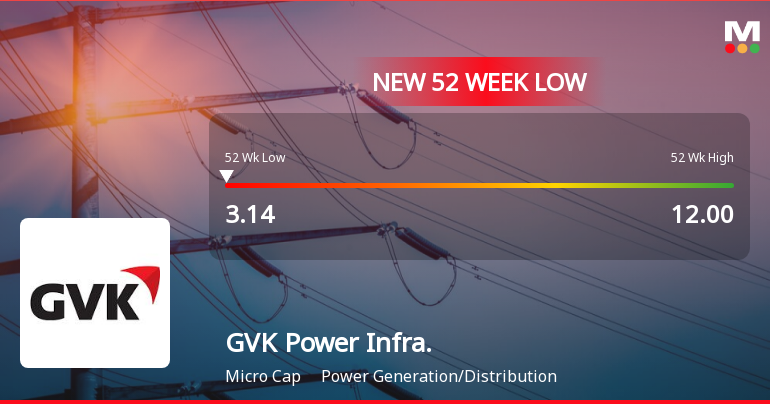

GVK Power Faces Ongoing Challenges Amid Broader Market Volatility and Declining Fundamentals

2025-03-28 09:42:29GVK Power & Infrastructure has hit a new 52-week low, reflecting ongoing volatility and a significant decline in stock price over the past week. The company faces challenges with negative financial indicators, including a high debt-to-equity ratio and declining sales, amidst a broader market downturn.

Read More

GVK Power Faces Severe Financial Struggles Amidst Market Volatility and Declining Performance

2025-03-28 09:42:22GVK Power & Infrastructure has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over the past week. The company's recent financial performance shows a sharp drop in net sales and profits, alongside weak long-term fundamentals and a substantial decrease in stock value over the past year.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation for closure of trading window

Corporate Insolvency Resolution Process (CIRP)-Updates - Corporate Insolvency Resolution Process (CIRP)

10-Mar-2025 | Source : BSETwelfth meeting of the Committee of Creditors of GVK Power & Infrastructure Limited -undergoing Corporate Insolvency Resolution Process (CIRP)

Corporate Actions

No Upcoming Board Meetings

GVK Power & Infrastructure Ltd has declared 25% dividend, ex-date: 06 Nov 06

GVK Power & Infrastructure Ltd has announced 1:10 stock split, ex-date: 08 Feb 08

No Bonus history available

No Rights history available