H P Cotton Textile Mills Experiences Valuation Grade Change Amid Industry Challenges

2025-04-03 08:00:37H P Cotton Textile Mills has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the textile industry. The company currently reports a PE ratio of -36.82, indicating challenges in profitability. Its price-to-book value stands at 2.45, while the EV to EBITDA ratio is noted at 9.50, suggesting a moderate valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of performance metrics, H P Cotton's return on capital employed (ROCE) is recorded at 6.17%, and the return on equity (ROE) is at -14.75%, highlighting areas of concern regarding efficiency and shareholder returns. When compared to its peers, H P Cotton's valuation metrics present a mixed picture. For instance, Indo Rama Synthetic is currently loss-making, while Mafatlal Industries shows a more attractive valuation profile with a PE ratio of 7.88. Other competitors like...

Read MoreH P Cotton Textile Mills Experiences Valuation Grade Change Amid Industry Challenges

2025-03-21 08:00:33H P Cotton Textile Mills has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the textile industry. The company's current price stands at 89.90, down from a previous close of 94.78, with a 52-week range between 82.00 and 193.95. Key financial metrics reveal a PE ratio of -35.26 and a price-to-book value of 2.34, indicating challenges in profitability. The company's return on capital employed (ROCE) is reported at 6.17%, while the return on equity (ROE) is notably negative at -14.75%. In comparison to its peers, H P Cotton's valuation metrics present a mixed picture. For instance, Mafatlal Industries holds a more favorable position with an attractive valuation, while Indo Rama Synthetic and Faze Three also maintain fair valuations. Notably, Nahar Spinning stands out with a very attractive valuation despite being loss-making. Overall, H P Cotton's performanc...

Read More

H P Cotton Textile Mills Faces Challenges Amid Broader Market Resilience

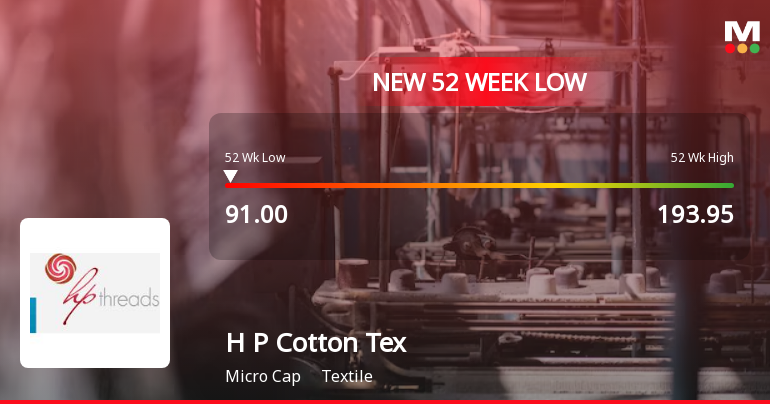

2025-03-18 10:39:09H P Cotton Textile Mills has faced notable volatility, hitting a 52-week low and underperforming its sector. The company has seen a significant decline over the past year, grappling with high debt and disappointing financial results, while the broader market, including small-cap stocks, shows resilience.

Read More

H P Cotton Textile Mills Faces Ongoing Challenges Amid Significant Stock Volatility

2025-03-17 15:41:03H P Cotton Textile Mills has faced notable volatility, hitting a 52-week low and underperforming its sector. The company has seen a significant decline in profit after tax and struggles with high debt levels. Its technical outlook remains bearish, reflecting ongoing challenges in the textile industry.

Read More

H P Cotton Textile Mills Faces Persistent Decline Amid Financial Struggles and High Debt Levels

2025-03-17 15:41:01H P Cotton Textile Mills has faced notable volatility, hitting a 52-week low and experiencing a significant decline over the past year. The company struggles with high debt, negative return on equity, and a substantial drop in profit after tax, indicating ongoing financial challenges and a bearish market trend.

Read More

H P Cotton Textile Mills Faces Ongoing Challenges Amid Significant Stock Volatility

2025-03-04 11:06:55H P Cotton Textile Mills has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over four consecutive days. The stock is trading below all major moving averages and has reported a substantial year-on-year drop in profit, raising concerns about its financial health and market position.

Read More

H P Cotton Textile Mills Faces Persistent Decline Amid Market Volatility

2025-03-03 14:20:54H P Cotton Textile Mills has faced notable volatility, hitting a new 52-week low and experiencing a three-day losing streak. The stock is trading below multiple moving averages, reflecting a bearish trend. Over the past year, its performance has significantly lagged behind the broader market.

Read More

H P Cotton Textile Mills Hits 52-Week Low Amid Broader Sector Challenges

2025-02-28 10:35:33H P Cotton Textile Mills has reached a new 52-week low, reflecting ongoing challenges in the textile sector. The company's stock has declined significantly over the past two days and is trading below key moving averages, indicating a persistent downward trend amid broader sector struggles.

Read More

H P Cotton Textile Mills Hits 52-Week Low Amid Broader Sector Challenges

2025-02-18 14:35:22H P Cotton Textile Mills has hit a new 52-week low, reflecting a significant decline after a brief period of gains. The stock is trading below all major moving averages and has dropped 28.60% over the past year, contrasting with the overall market's positive performance. The textile sector is also facing challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEPlease find attached herewith certificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window.

Announcement under Regulation 30 (LODR)-Acquisition

24-Mar-2025 | Source : BSESubscribe to the equity shares of HP MMF Textiles Limited a wholly owned subsidiary company offered by way of right issue.

Corporate Actions

No Upcoming Board Meetings

H P Cotton Textile Mills Ltd has declared 10% dividend, ex-date: 20 Sep 22

No Splits history available

No Bonus history available

No Rights history available