Happiest Minds Technologies Approaches 52-Week Low Amidst Declining Stock Performance

2025-04-01 12:05:47Happiest Minds Technologies is nearing its 52-week low, with a notable decline of 10.24% over the past six days. The stock is underperforming the broader IT sector and trading below key moving averages. Despite challenges, the company shows strong management efficiency and increased institutional interest.

Read More

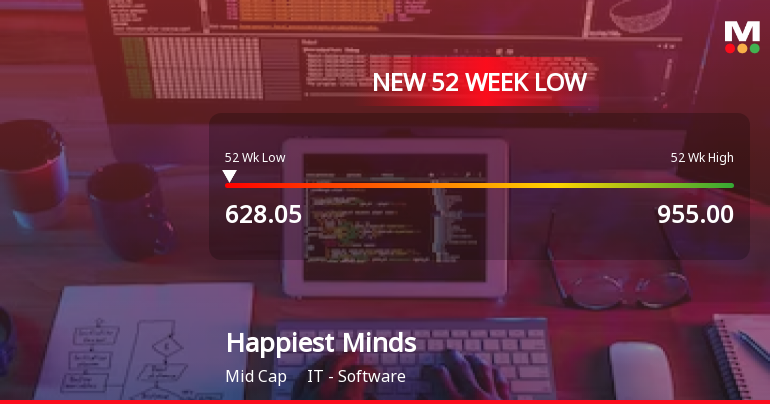

Happiest Minds Technologies Hits 52-Week Low Amid Ongoing Market Challenges

2025-03-28 10:16:41Happiest Minds Technologies has reached a new 52-week low, continuing a downward trend over five days with an 18.22% decline over the past year. Despite this, the company shows strong management efficiency and increased institutional interest, holding 11.42% of the company. The stock remains a key focus in the IT sector.

Read More

Happiest Minds Technologies Faces Continued Stock Decline Amid Strong Management Efficiency

2025-03-26 10:11:48Happiest Minds Technologies has reached a new 52-week low, continuing a downward trend with a notable decline over the past three days. The stock has underperformed compared to its sector and the broader market, despite strong management efficiency and increased institutional investor interest.

Read More

Happiest Minds Technologies Hits New Low Amidst Ongoing Downward Trend and Institutional Interest

2025-03-26 10:11:46Happiest Minds Technologies has reached a new 52-week low, continuing a downward trend with a notable decline over the past three days. The company has underperformed compared to the Sensex, with a one-year return of -17.62%. Despite this, it shows strong management efficiency and increased institutional interest.

Read More

Happiest Minds Technologies Faces Volatility Amidst Institutional Investor Interest

2025-03-25 13:06:15Happiest Minds Technologies has faced significant volatility, reaching a new 52-week low and continuing a downward trend. Over the past year, the company's performance has lagged behind the market. However, it shows strong management efficiency and increased institutional investor interest, indicating potential resilience amid challenges.

Read More

Happiest Minds Technologies Hits 52-Week Low Amid Broader Market Gains

2025-03-18 15:39:15Happiest Minds Technologies has hit a new 52-week low, continuing a six-day decline that has seen a total drop of 7.66%. Despite its struggles, the company maintains strong management efficiency with a return on equity of 24.91% and low debt levels, while institutional investors have increased their stake.

Read MoreHappiest Minds Technologies Adjusts Valuation Amidst Challenging Market Conditions and Peer Comparison

2025-03-18 08:01:07Happiest Minds Technologies, a midcap player in the IT software industry, has recently undergone a valuation adjustment. The company's current price stands at 644.65, reflecting a decline from its previous close of 668.85. Over the past year, Happiest Minds has experienced a stock return of -18.74%, contrasting with a modest gain of 2.10% in the Sensex. Key financial metrics for Happiest Minds include a PE ratio of 46.10 and an EV to EBITDA ratio of 27.19. The company also boasts a return on capital employed (ROCE) of 20.10% and a return on equity (ROE) of 14.54%. In comparison to its peers, Happiest Minds maintains a relatively high valuation in terms of PE ratio, with competitors like Zensar Technologies and Cyient showing significantly lower ratios. While Happiest Minds has faced challenges reflected in its stock performance, its financial metrics indicate a solid operational foundation. The evaluatio...

Read More

Happiest Minds Technologies Faces Continued Volatility Amid Broader Market Resilience

2025-03-17 10:13:05Happiest Minds Technologies has faced significant volatility, reaching a new 52-week low and continuing a downward trend. The stock has underperformed its sector and recorded a notable decline over the past year. Despite this, institutional investors have increased their stake, indicating a complex market environment for the company.

Read MoreHappiest Minds Technologies Faces Mixed Technical Trends Amid Market Evaluation Changes

2025-03-13 08:02:42Happiest Minds Technologies, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 685.05, down from a previous close of 695.05, with a 52-week high of 955.00 and a low of 655.00. Today's trading saw a high of 698.90 and a low of 682.85. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signals for both weekly and monthly assessments. Bollinger Bands indicate a bearish stance weekly and mildly bearish monthly, while moving averages reflect a bearish trend on a daily basis. The KST shows a mildly bullish trend weekly but is bearish monthly, and the On-Balance Volume (OBV) is mildly bearish across both time frames. In term...

Read MoreCommunication To The Shareholders Pursuant To Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

08-Apr-2025 | Source : BSECommunication to the shareholders purusant to Regulation 30 of SEBI (LODR) Regulations 2015

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECompliance Certificate pursuant to Regulation 74(5) of SEBI (DP) Regulations 2018

Receipt Of Certified True Copy Of First Motion Order By Honble NCLT Bengaluru Bench

01-Apr-2025 | Source : BSEReceipt of Certified True Copy of First Motion Order by Honble NCLT Bengaluru Bench in the matter of Scheme of Amalgamation of Happiest Minds Edutech Private Limited and Happiest Minds Technologies Limited and their respective Shareholders and Creditors

Corporate Actions

No Upcoming Board Meetings

Happiest Minds Technologies Ltd has declared 125% dividend, ex-date: 27 Nov 24

No Splits history available

No Bonus history available

No Rights history available