Hatsun Agro Faces Significant Stock Volatility Amid Broader Market Decline

2025-04-01 11:40:26Hatsun Agro Product's stock has faced notable volatility, declining significantly today. It has underperformed against the broader market, with substantial decreases over various timeframes. The stock is currently trading below multiple moving averages, reflecting a bearish trend amid a generally negative market sentiment.

Read MoreHatsun Agro Product Shows Mixed Technical Trends Amid Market Evaluation Revision

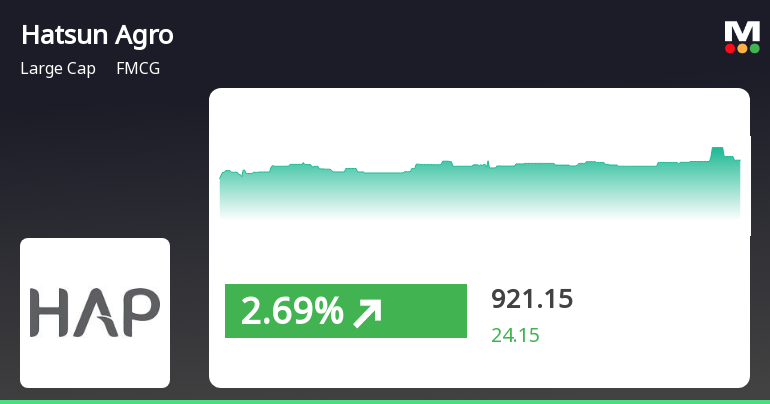

2025-04-01 08:00:12Hatsun Agro Product, a prominent player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 960.00, showing a slight increase from the previous close of 945.00. Over the past year, Hatsun Agro has faced challenges, with a stock return of -4.76%, contrasting with a 5.11% return from the Sensex during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook leans towards a mildly bearish stance. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate bearish trends on both weekly and monthly scales, and moving averages reflect a mildly bearish position on a daily basis. Despite these mixed signals, Hatsun Agro has demonstrated resilience over the long term, with a rema...

Read MoreHatsun Agro Product Faces Bearish Technical Trends Amid Market Volatility

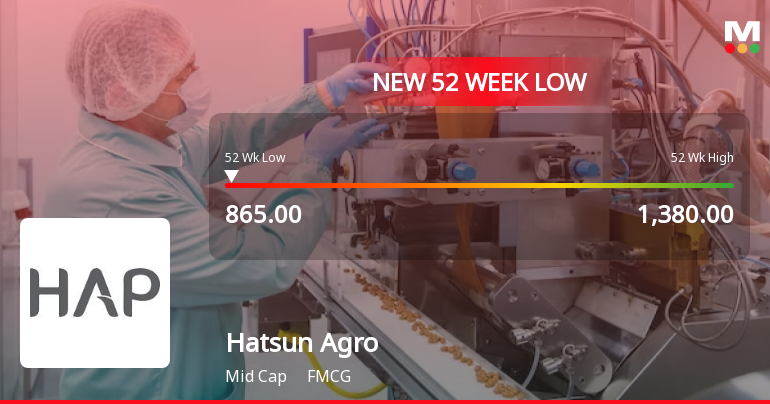

2025-03-28 08:00:09Hatsun Agro Product, a prominent player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 945.00, down from a previous close of 964.00, with a 52-week high of 1,380.00 and a low of 865.00. Today's trading saw a high of 964.00 and a low of 941.30, indicating some volatility in its performance. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish outlook for both weekly and monthly assessments. Moving averages indicate a bearish trend on a daily basis, suggesting a cautious market environment. In terms of returns, Hatsun Agro's performance has been mixed when compared to the Sensex. Over the past week, the stock returned 3.17%, outperforming the Sensex's 1.65%....

Read More

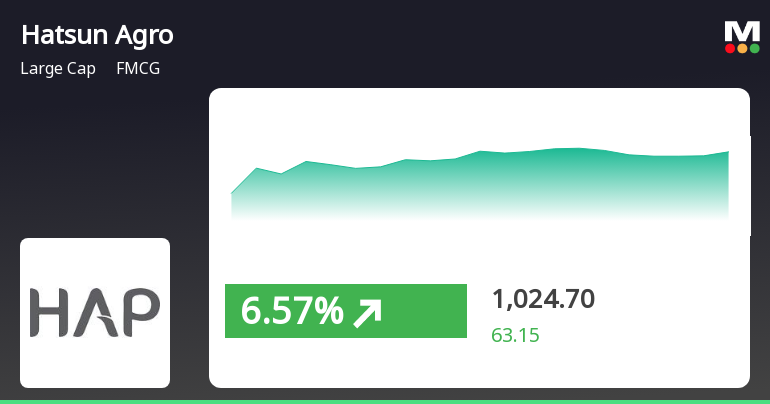

Hatsun Agro Product Shows Resilience Amidst Fluctuating Market Trends

2025-03-25 09:30:20Hatsun Agro Product has demonstrated notable performance, gaining 6.91% on March 25, 2025, and outperforming its sector. The stock has risen consistently over four days, achieving an 11.67% total return. Despite mixed moving average trends, it reflects resilience in the FMCG sector amid broader market fluctuations.

Read More

Hatsun Agro Product Faces Evaluation Adjustment Amid Mixed Market Signals and Performance Trends

2025-03-25 08:10:47Hatsun Agro Product has recently adjusted its evaluation score, reflecting changes in technical indicators and market trends. The company has faced fluctuations in financial performance, including a decline in profit after tax and cash reserves, while still showing long-term growth in operating profit.

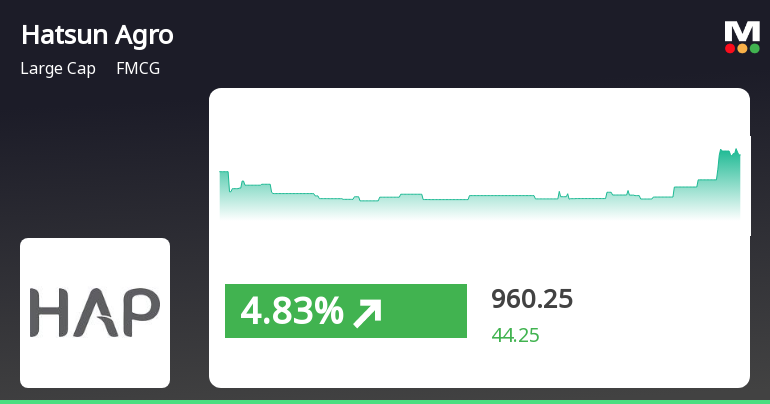

Read MoreHatsun Agro Product Shows Mixed Technical Trends Amid Market Challenges

2025-03-25 08:00:23Hatsun Agro Product, a prominent player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 961.55, showing a slight increase from the previous close of 960.25. Over the past year, Hatsun Agro has faced challenges, with a return of -11.22%, contrasting with a 7.07% gain in the Sensex during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook leans towards a mildly bearish stance. The Bollinger Bands indicate a bearish trend on a monthly basis, and moving averages also reflect a mildly bearish position. The KST shows a mixed signal, with weekly data indicating mild bullishness, while the monthly data aligns with a bearish trend. Despite these mixed technical signals, Hatsun Agro has demonstrated resilience over the longer term, with a remarkab...

Read More

Hatsun Agro Product Shows Positive Short-Term Trend Amid Broader Market Rebound

2025-03-21 15:30:20Hatsun Agro Product has experienced notable activity, gaining 5.12% on March 21, 2025, and outperforming its sector. The stock has shown a positive short-term trend with a total increase of 6.1% over two days. However, its year-to-date performance remains negative, contrasting with broader market gains.

Read More

Hatsun Agro Product's Recent Gains Reflect Volatility in FMCG Sector Amid Market Fluctuations

2025-03-18 15:15:51Hatsun Agro Product has demonstrated significant activity, achieving a notable gain and outperforming its sector. The stock has seen consecutive gains over two days, reaching an intraday high. Its price trends indicate mixed signals, reflecting volatility within the FMCG sector amid broader market fluctuations.

Read More

Hatsun Agro Product Faces Continued Volatility Amid Broader Market Decline

2025-03-11 10:06:05Hatsun Agro Product has faced notable volatility, hitting a new 52-week low amid a broader market decline. The stock has underperformed its sector and recorded a significant drop over recent days. Financial results indicate a decrease in profit and cash reserves, contributing to a bearish outlook.

Read MoreClosure of Trading Window

25-Mar-2025 | Source : BSENotice of Trading Window Closure Period

Announcement under Regulation 30 (LODR)-Updates on Acquisition

25-Mar-2025 | Source : BSEAcquisition of entire Shares of Milk Mantra Dairy Private Limited and declaring Milk Mantra Dairy Private Limited has a Wholly-Owned Subsidiary

Announcement under Regulation 30 (LODR)-Press Release / Media Release

19-Mar-2025 | Source : BSEPress Release for the launch of 4000th HAP daily Outlet

Corporate Actions

No Upcoming Board Meetings

Hatsun Agro Product Ltd has declared 600% dividend, ex-date: 24 Jul 24

Hatsun Agro Product Ltd has announced 1:2 stock split, ex-date: 03 Oct 11

Hatsun Agro Product Ltd has announced 1:3 bonus issue, ex-date: 09 Dec 20

Hatsun Agro Product Ltd has announced 1:30 rights issue, ex-date: 07 Dec 22