Havells India Shows Shift in Technical Outlook Amid Strong Market Position

2025-04-03 08:07:25Havells India has recently experienced a change in its technical outlook, shifting to a mildly bearish stance. The company maintains a strong market position with a significant market capitalization and robust long-term fundamentals, despite a flat performance in the recent quarter and a decline in profits.

Read MoreHavells India Faces Mixed Technical Trends Amid Market Evaluation Revision

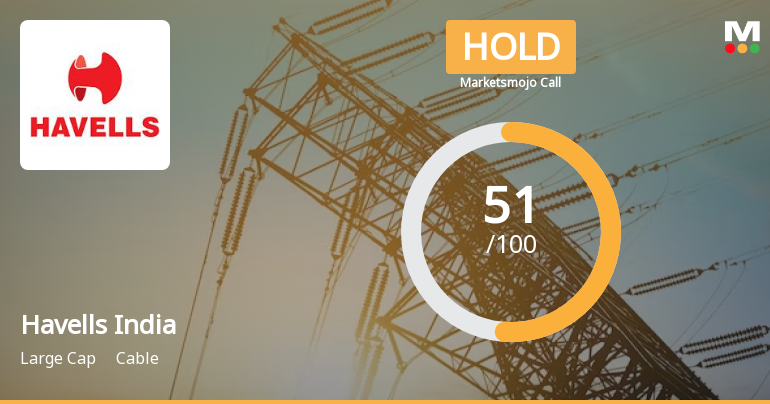

2025-04-03 08:01:45Havells India, a prominent player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1514.65, showing a slight increase from the previous close of 1502.35. Over the past year, Havells has experienced a 1.89% decline, contrasting with a 3.67% gain in the Sensex, indicating a challenging performance relative to the broader market. In terms of technical indicators, the MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments, suggesting a lack of strong momentum. Bollinger Bands and moving averages indicate bearish signals, reflecting potential headwinds for the stock. Despite these mixed signals, Havells has demonstrated resilience over longer periods, with a notable 212.23% return ...

Read MoreHavells India Faces Bearish Technical Trends Amid Market Volatility

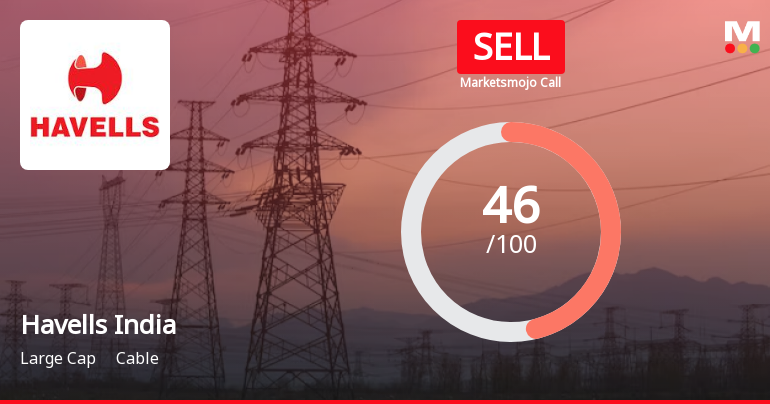

2025-04-02 08:02:59Havells India, a prominent player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1502.35, down from a previous close of 1527.65, with a 52-week high of 2,104.95 and a low of 1,380.55. Today's trading saw a high of 1527.90 and a low of 1488.20, indicating some volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. The KST indicator aligns with this sentiment, indicating bearish trends on a weekly basis and mildly bearish on a monthly basis. In terms of performance, Havells India has shown mixed results compared to the Sensex. Over the past week, the stock returned 1.96%, contra...

Read MoreHavells India Faces Technical Trend Shifts Amidst Market Evaluation Adjustments

2025-04-01 08:01:00Havells India, a prominent player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1527.65, showing a slight increase from the previous close of 1515.60. Over the past year, Havells has experienced a stock return of 0.84%, while the Sensex has returned 5.11% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis and a mildly bearish trend monthly. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands and Moving Averages also reflect a mildly bearish sentiment, while the KST and Dow Theory suggest a bearish outlook on a weekly basis and a mildly bearish stance monthly. Havells has demonstrated resilience over longer periods, with a remarkable 198.17% return over the past five years, compared to the Sensex's 159....

Read MoreHavells India Sees Significant Open Interest Surge Amid Active Market Participation

2025-03-25 15:00:23Havells India Ltd., a prominent player in the cable industry, has experienced a significant increase in open interest today. The latest open interest stands at 34,404 contracts, reflecting a rise of 3,277 contracts or 10.53% from the previous open interest of 31,127. This uptick in open interest comes alongside a trading volume of 20,404 contracts, indicating active market participation. In terms of financial metrics, Havells India is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a bearish trend in the short to medium term. The stock's performance today aligns closely with its sector, showing a 1D return of -0.24%, compared to a sector return of -0.63%. The broader market, represented by the Sensex, recorded a slight gain of 0.23%. Additionally, the stock has seen a decline in delivery volume, with 9.77 lakh shares delivered on March 24, down by 0.13% ...

Read More

Havells India Faces Market Sentiment Shift Amid Declining Profit Metrics

2025-03-25 08:14:14Havells India has recently experienced a change in its evaluation, influenced by shifts in technical indicators and market sentiment. Despite a decline in quarterly profits, the company retains a strong market presence with a significant sector share and robust long-term fundamentals, including a low debt-to-equity ratio.

Read MoreHavells India Sees Significant Surge in Open Interest Amid Increased Trading Activity

2025-03-24 15:00:18Havells India Ltd. has experienced a notable increase in open interest today, signaling heightened activity in its trading. The latest open interest stands at 34,253 contracts, reflecting a rise of 4,228 contracts or 14.08% from the previous open interest of 30,025. The trading volume for the day reached 25,616 contracts, contributing to a futures value of approximately Rs 72.27 crore. In terms of price performance, Havells India has underperformed its sector by 1.41%, although it has shown signs of recovery after two consecutive days of decline. The stock is currently trading above its 20-day moving averages but remains below its 5-day, 50-day, 100-day, and 200-day moving averages. Notably, the delivery volume surged to 15.39 lakh shares on March 21, marking a significant increase of 91.55% compared to the 5-day average delivery volume. With a market capitalization of Rs 93,138 crore, Havells India opera...

Read MoreHavells India Sees Significant Surge in Open Interest Amid Increased Trading Activity

2025-03-24 14:00:12Havells India Ltd. has experienced a notable increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 33,404 contracts, up from the previous figure of 30,025, marking a change of 3,379 contracts or an 11.25% increase. The trading volume for the day reached 23,444 contracts, contributing to a futures value of approximately Rs 62,569.74 lakhs. In terms of price performance, Havells India has underperformed its sector by 1.39%, although it has shown signs of recovery after two consecutive days of decline. The stock is currently trading above its 20-day moving average but below its 5-day, 50-day, 100-day, and 200-day moving averages. Notably, the delivery volume on March 21 surged to 15.39 lakh shares, reflecting a significant increase of 91.55% compared to the 5-day average delivery volume. With a market capitalization of Rs 93,094.58 crore, Havells I...

Read MoreHavells India Faces Technical Trend Shifts Amid Market Volatility and Mixed Signals

2025-03-21 08:00:54Havells India, a prominent player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1502.70, down from a previous close of 1557.40, with a notable 52-week high of 2,104.95 and a low of 1,380.55. Today's trading saw a high of 1528.60 and a low of 1470.80, indicating some volatility. The technical summary for Havells India reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands and KST also reflect similar trends, suggesting caution in the current market environment. The Dow Theory presents a mildly bullish outlook on a weekly basis but shifts to a mildly bearish stance monthly, indicating mixed signals. In terms of performance, Havells India has shown varied returns compared to the Sensex. Over the past ...

Read MoreBoard Meeting Intimation for Audited Financial Results And Recommending Dividend

09-Apr-2025 | Source : BSEHavells India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 22/04/2025 inter alia to consider and approve Board Meeting is scheduled inter alia for the following agenda:- 1.to consider and approve the Standalone & Consolidated Audited Financial Results of the Company for Q4 and FY ended 31st March 2025. and 2.to recommend Final Dividend for FY 2024-25

Announcement under Regulation 30 (LODR)-Press Release / Media Release

07-Apr-2025 | Source : BSEHavells India Limited furnishes copy of Press Release titled Lloyd Unveils Luxuria Collection Expands Manufacturing to Meet rising Demand.

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

03-Apr-2025 | Source : BSEIntimation under sub-para 20 of Para A of Part A of Schedule III.

Corporate Actions

No Upcoming Board Meetings

Havells India Ltd. has declared 400% dividend, ex-date: 22 Jan 25

Havells India Ltd. has announced 1:5 stock split, ex-date: 26 Aug 14

Havells India Ltd. has announced 1:1 bonus issue, ex-date: 08 Oct 10

No Rights history available